Martin Lewis issues payslip warning to workers

TV money-saving expert reminds viewers it is their responsibility, not their employer’s or HMRC’s, to check they are assigned the correct tax code

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

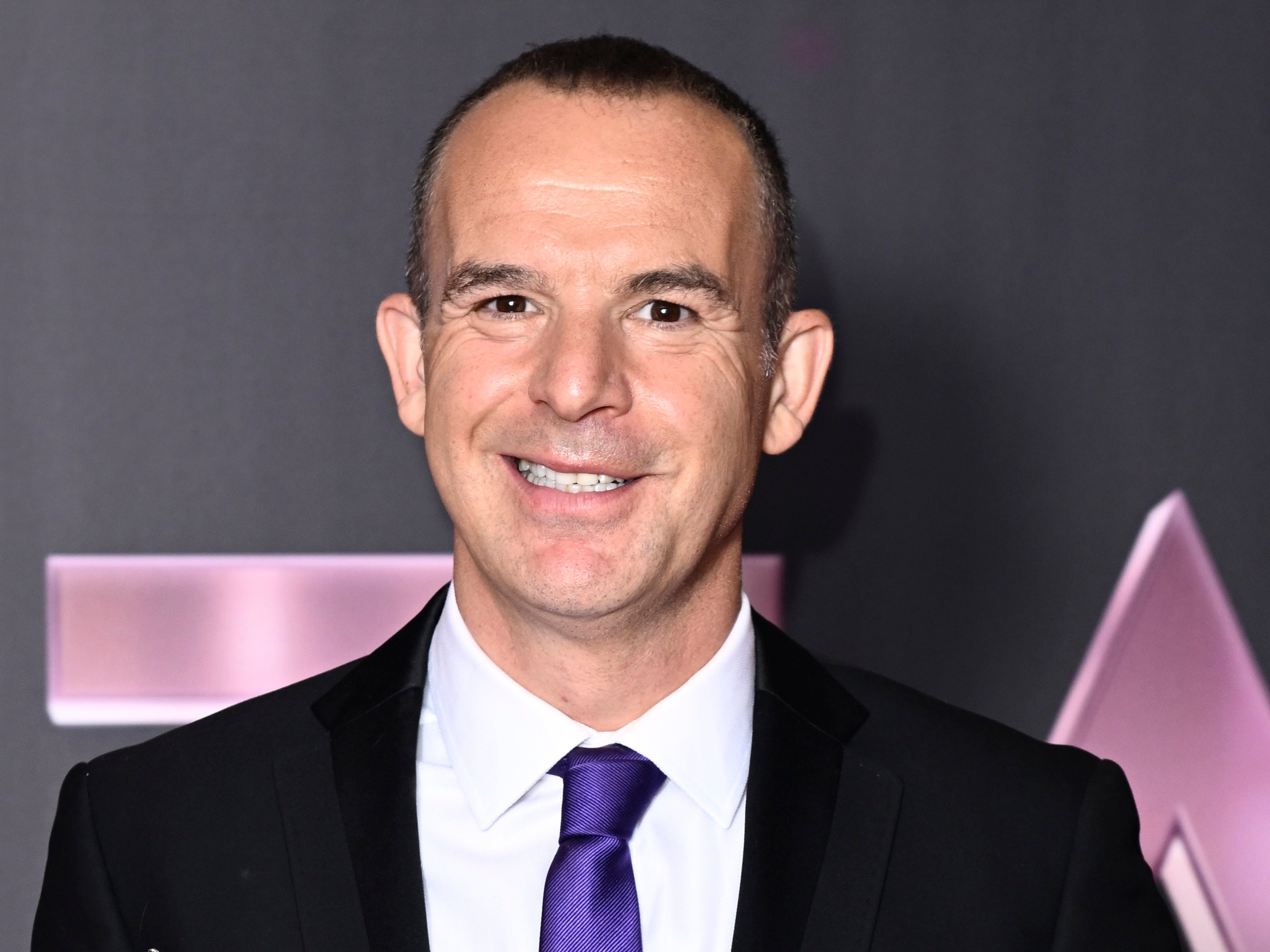

Your support makes all the difference.TV money-saving expert Martin Lewis has become an increasingly important figure to millions of Britons this year as the nation battles a desperately bleak cost of living crisis, dishing out vital personal finance tips at a time when many are tightening their belts.

Bringing compassion and expertise to his appearances on his ITV programme The Martin Lewis Money Show Live, via his BBC podcast, his website and newsletter and through his regular media interviews, Lewis is providing a major public service to those struggling to make ends meet.

No concern is too small to warrant his attention and, in a recent episode of his ITV show, Lewis fielded a call from a viewer who believed she had been overtaxed and wanted confirmation that she was entitled to a refund.

“I’m on a 16-hour contract, and last month, I did lots of overtime. I was put on the basic rate temporarily and overtaxed by more than £800,” she said.

“My tax code is now back to 1257L, but I’m short £500, worrying about money. Will I get a tax rebate?”

Lewis turned to his guest, tax expert Rebecca Benneyworth, for an answer.

“It depends whether she’s on a Month One tax code or not,” Benneyworth replied.

“Month One is often referred to as Emergency Code. If she is, she needs to sort that with HMRC, either by phoning them or by going into her personal tax account through the HMRC app.”

The expert advised the caller to look out for an “X” on her payslip to indicate whether or not she had been placed on an emergency tax code, a designation given when HMRC does not have sufficient details about an individual’s circumstances, such as when they start a new job.

“W1” or “M1” might also appear to indicate the same thing.

“On her tax code, she’ll have 1257L. If she’s got an ‘X’ on the end (1257LX), she’s on Month One,” Benneyworth explained.

“Otherwise, if it’s not got an ‘X’ on the end, it should come back in her next pay packet. If it doesn’t, speak to your employer.”

Lewis elaborated by saying: “If you’ve got the wrong tax code, go to HMRC. If you’re not getting the tax back, go and talk politely to your employer. Many payroll departments are actually pretty helpful if you’re struggling with this.

“Each year, you’re sent your tax code if you’re an employee. The standard one is 1257L. What that actually means is £12,570, which is how much you can earn tax-free each year.

“Millions of people are on the wrong tax code. Some are overpaying and are therefore due thousands of pounds back. Some are underpaying and are therefore going to get a shock as they’re asked for more money.

“So it’s really important, because it’s your legal responsibility – not HMRC, not your employer – to check your tax code.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments