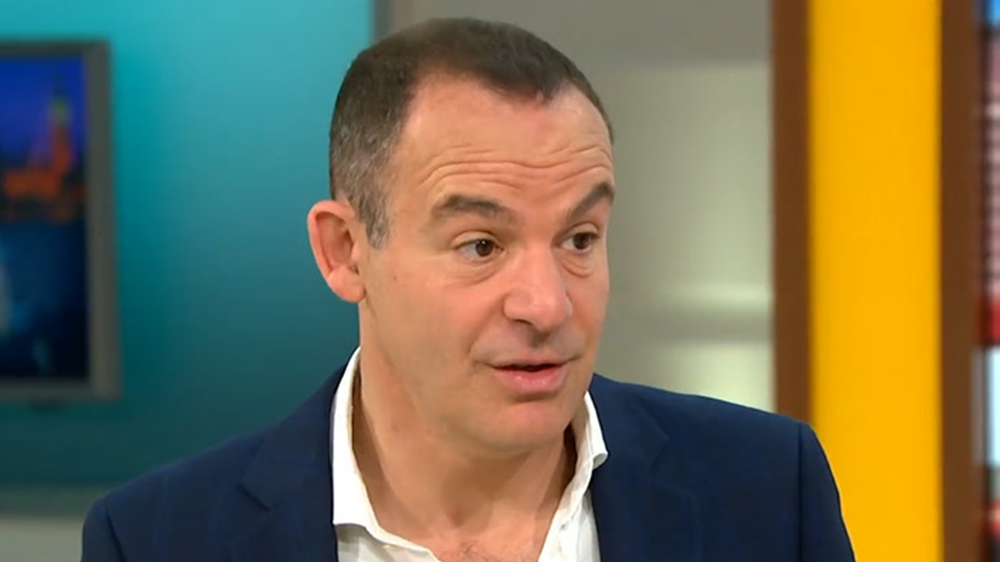

Martin Lewis issues ‘very depressing’ pension warning

‘Important to know when you’re likely to die’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Martin Lewis has issued a grim warning about pensions, saying that it is “important to know when you’re likely to die” so that people can work out how much they need to save for retirement.

Some people choose to retire at 55 - generally, the age at which people can access a private pension fund. But with an average life expectancy of 79 for males and 83 for females, some Britons could be retired for nearly three decades.

The state pension age is currently 66 for both men and women but many have to top this up with additional funds - usually a workplace pension - because of the low amount given.

For this reason, Mr Lewis said, it is important to know “when you’re likely to die” so that savers can work out how much they need to put away for their retirement.

Mr Lewis, the Money Saving Expert founder, was speaking last week as a think tank warned that nine in 10 workers were saving less than needed for a decent standard of living in retirement.

The Institute for Fiscal Studies said that workers in their thirties and forties are heading for an uncomfortable retirement. It also warned that the wealth of today’s pensioners was breeding complacency on this issue within the government.

The introduction of pension freedoms has given people flexibility over their retirement, but individuals, rather than employers or insurance firms, now often bear the burden of the risk of poor investment performances and uncertain lifespans, it added.

The IFS launched a pensions review in partnership with the abrdn Financial Fairness Trust, a charitable trust which funds work to tackle financial problems and improve living standards for people on low-to-middle incomes.

It published a report on Thursday, which said: “We need a major review of pension provision now in order to give us a chance of avoiding a future that looks worse than the present.”

The report added: “While current pensioners are still doing well on average… the future looks risky at best for many current workers hoping for a comfortable retirement.”

A Department for Work and Pensions (DWP) spokesperson said: “Automatic enrolment has succeeded in transforming pension saving, with more than 10.8 million workers enrolled into a workplace pension and an additional £33 billion saved in real terms in 2021 compared to 2012.

“We’re also supporting proposals to expand automatic enrolment, enabling millions to save more earlier. These changes will particularly benefit groups – including women, young people and lower earners – who have historically found it harder to save for retirement.

“Alongside this, the package of measures announced in January, including a consultation on ensuring pensions deliver value for money, will improve security and create better returns for savers, so they can enjoy the retirement they’ve worked so hard for.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments