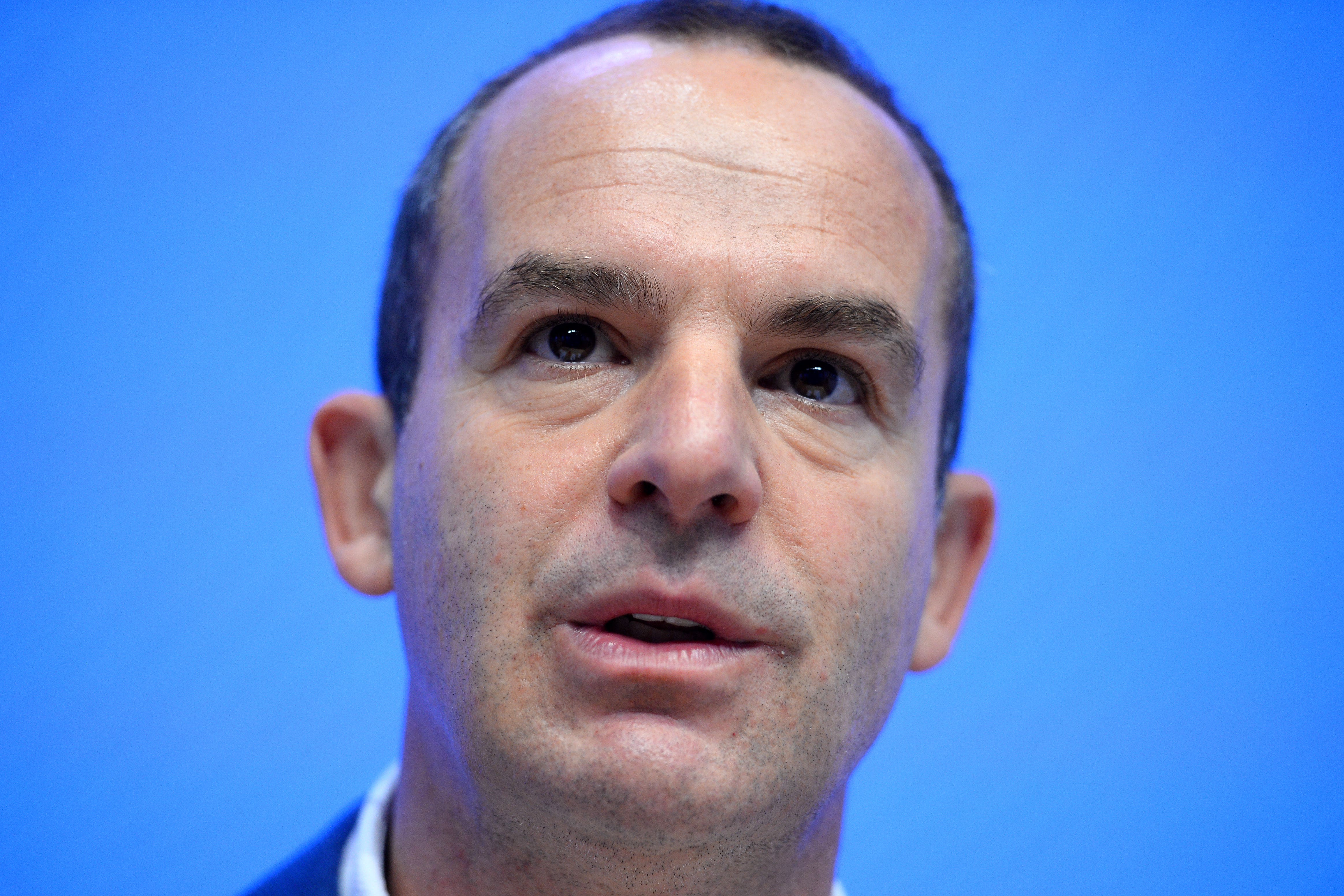

Martin Lewis shares little-known tip that could boost your pension by thousands

The MoneySavingExpert founder highlights how people could get extra £300 a year

Martin Lewis has warned grandparents they could be missing out on thousands of pounds in state pension funds if they look after their grandchildren while the parents are working.

Taking to Twitter to reveal another financial saving grace for households during a crippling cost of living crisis, the MoneySavingExpert (MSE) founder said: “There’s a little known benefit for grandparents who look after their grandchildren while parents work. If ur [sic] a parent of an under 12, if your parent (ie child’s grandparent) do childcare so you can work, u can apply to get em “Specified Adult Childcare Credit”.

“This means they get the National Insurance years that normally go to a parent who is off work looking after children (as you’re working you’ll usually be getting from work). This can add £1,000s to a state pension.”

Mr Lewis is referring to compensation that grandparents under the state pension age can receive known as Specified Adult Childcare credits.

Other family members who look after the children while the parents are working can also receive these credits which are worth £300 a year.

They count as a national insurance contribution credit for those who do not work.

You need at least 10 years’ worth of NI payments or credits to qualify for the state pension and at least 35 years’ worth to get the full amount.

According to the government website, the benefit works by transferring the NI credit attached to Child Benefit from the Child Benefit recipient to a specified adult.

Who is eligible?

The grandparent or family member must be under the state pension age, which is 66 years of age.

The child must be aged under 12, or under 17 if they are disabled.

You must be a resident of the United Kingdom, meaning England, Scotland, Wales and Northern Ireland, but not living in the Channel Islands or the Isle of Man.

The child’s parent must be entitled to Child Benefit and have a qualifying year for National Insurance.

You can apply for the Specified Adult Childcare credits here.

If you need any help, you can call the national insurance helpline on 0300 200 3500.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks