Martin Lewis reveals three tips for dealing with expiring fixed-rate mortgages in 2024

He warned that most people will be paying £150 more per month per £100,000 of outstanding mortgage

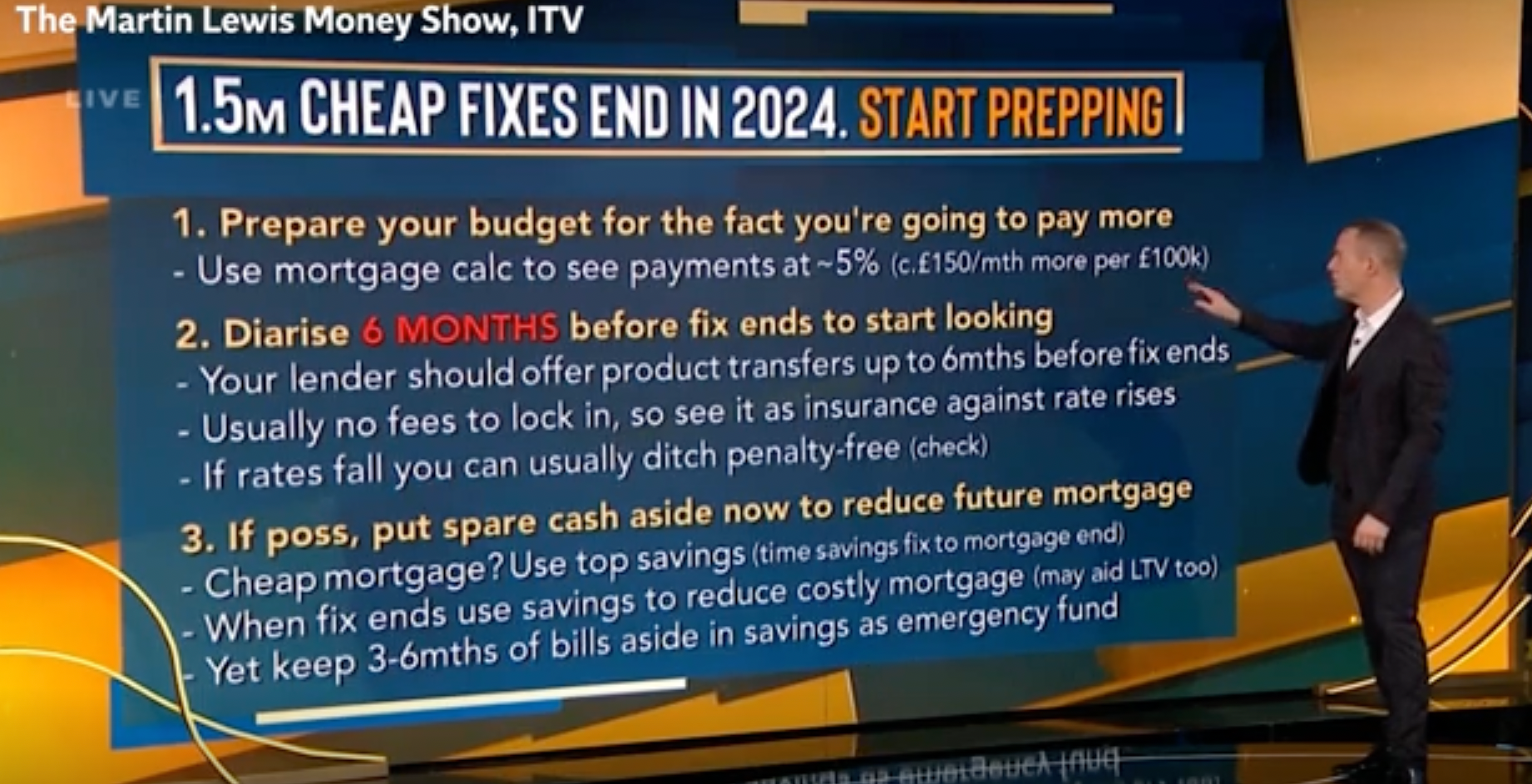

Martin Lewis has revealed three tips for people coming to the end of their mortgage fixed-rate deals in 2024.

The money-saving expert says they should start prepping immediately as many will face paying £150 more per month for every £100,000 of outstanding mortgage.

Speaking during his Martin Lewis Money Show Live on Tuesday evening, he said: “You’re going to be paying a lot more, so I’d be getting on a mortgage calculator right now if you’re a long time away.”

His second tip was for viewers to diary the date six months before their fixed-rate deal ended as lenders allowed customers to lock in offers before their existing deals end.

Thirdly, he told homeowners to put spare cash aside now, if possible, to reduce future mortgage payments while also keeping three to six months of bills aside in savings as an emergency fund.

Nationwide became the latest bank to slash mortgage rates when it announced it was cutting selected mortgage rates by up to 0.81 percentage points from Wednesday and introducing a new range of fixed and tracker rate products.

Many other lenders have slashed their mortgage rates as the new year has got under way – although inflation and wider global uncertainties have prompted some experts to suggest that higher interest rates may be around for a while yet.

Nationwide’s announcement was made as Santander said it is making small increases to some of its products, having reduced some of its mortgage rates earlier this month.

Mr Lewis also discussed tips for increasing the chances people have of securing a mortgage in the first place on the ITV show.

He urged applicants to check their credit on Equifax, Experian and TransUnion files for errors and ensure you don’t miss any payments that could tarnish your credit score.

“I know people who have not got a mortgage because of an old mobile phone that was linked to the wrong address,” he warned, explaining that it could look like fraud.

The 51-year-old also added that new lenders must do an affordability stress test and so will need to see evidence of income, bills and spending. This means the money-saving expert suggests applicants should be frugal leading up to an application.

Lastly, he recommended most people go through a mortgage broker as they can access acceptance criteria that the public can’t.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks