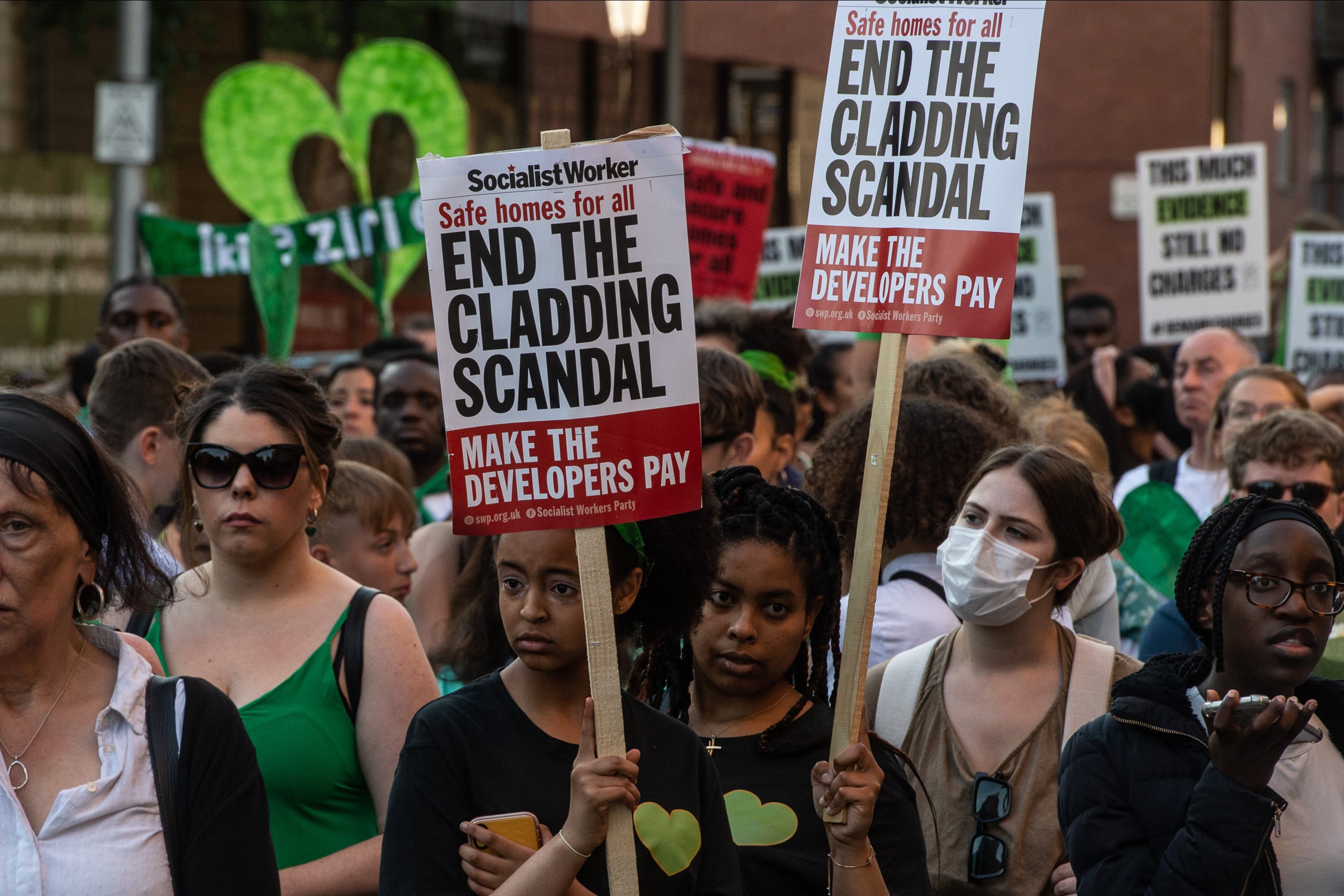

Leaseholders sue over ‘scandalous’ mystery insurance fees taken by freeholders and worth thousands of pounds

Leaseholders to mount High Court battle over ‘national scandal’ of hidden commissions on soaring insurance fees post-Grenfell

Homeowners whose insurance premiums have soared due to the cladding scandal are set to launch a group legal action in a bid to recoup secret commission fees they have unwittingly paid to freeholders.

Following the Grenfell Tower tragedy in 2017, insurance premiums for thousands of buildings affected by the cladding scandal have skyrocketed, with The Independent recently highlighting the case of a homeowner in Hertfordshire who saw her saw her annual bill soar from £247 to £2,626 in just two years.

But with the government having so far failed to step in and help to reduce premiums for these homeowners, as many as 900,000 leaseholders are estimated to have also been forced to pay a hidden commission – which is often split between the insurance broker and the building’s freeholder.

The Financial Conduct Authority (FCA) warned in 2022 that such commissions tended to be worth 30 per cent of the premium but could be as high as 62 per cent, more than half of which was paid out to the freeholder – the owner of the block - in nearly four out of 10 cases analysed.

Now a lawyer who successfully challenged a £100,000 commission charged at his block of flats in London’s Docklands earlier this month is spearheading a class action lawsuit which hopes to recoup millions of pounds secretly paid out to freeholders and insurance brokers.

Liam Spender, head of real estate litigation at the firm Velitor – which has secured funding from Balance Legal Capital LLP for leasehold homeowners to bring a no-win, no-fee claim – estimates that some 900,000 flats owned by the largest freeholders could be affected.

Velitor alleges that the practice of charging secret commissions is unlawful, as leaseholders were never told and therefore have not given “informed consent” – meaning these commissions remain the property of leaseholders.

Speaking to BBC Radio 4’s Today programme on Wednesday, Mr Spender claimed the FCA’s figures suggest as much as £480m could have been paid out in commissions between 2019 and 2022.

Mr Spender said: “The plight of leaseholders and their unconscionable and unlawful treatment by some freeholders is nothing short of a national scandal. This legal action will be a significant step in addressing it.”

When Julie Fraser, aged 61, bought her leasehold flat in Runcorn in 2016, the service charge at the property – which included insurance costs – was £254 per quarter.

But with Ms Fraser and her roughly 280 fellow residents still waiting for the dangerous cladding on their blocks to be remediated, these costs had soared to a peak of £700 by 2022, leaving her £3,800 in arrears despite making a £500 payment last week.

Ms Fraser, founder of the Liverpool Cladiators campaign group, said: “The cladding on our homes is dangerous and needs to be urgently replaced. Ever-longer delays mean that for several years our buildings’ insurance has skyrocketed, and there is no sign it will ever come down.

“These charges have pushed me into debt and I know many others in the same situation. I’ve asked just how much commission insurance brokers and freeholders have been raking in and never got a straight answer.

“We need to know if, and by how much, they have been profiteering off the back of the cladding scandal.”

Giles Grover, a leaseholder and co-leader of the End Our Cladding Scandal campaign, investigated the insurance commission charged to residents in his own block in Manchester, which has been found to have the same type of cladding as Grenfell Tower – with their premiums rising by 500 per cent.

Mr Grover, who believes he and fellow residents across three blocks have paid out nearly £100,000 in hidden commissions over the past three years, said: “It is disgraceful that, while residents were dealing with unsafe cladding in the aftermath of the Grenfell tragedy, insurance brokers and freeholders were splitting hidden commissions on our building insurance.

“In just three years our insurance costs rose more than five times to over £440,000 a year. Charging high rates of commission on such huge sums for doing next to no work will have made them a packet. I would say they are nothing but freeloaders, profiting from the misfortune of others.”

The new claim will be pursued in the High Court on behalf of leaseholders who opt-in and will seek to reclaim the hidden commissions, any resultant increase in insurance premium tax, and interest going back at least six years.

To take part in the claim, leaseholders must sign up via a dedicated website. Velitor, which will take 40 per cent of any damages won, estimates leaseholders could receive between £1,500 and £3,500 for each flat.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks