Fears interest rate cuts will be delayed after inflation falls less than expected

This is the lowest level inflation has been at since September 2021

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.UK inflation slowed less than expected in March, leading economists and traders to be cautious about possible interest rate cuts in the summer.

The figures released by the ONS on Wednesday morning showed that inflation was 3.2 per cent in March, slightly higher than the 3.1 per cent predicted by economists.

Despite inflation falling it does not mean that prices are falling, only that they are rising at a slower pace. However, this is still the lowest level inflation has been at since September 2021.

ONS chief economist Grant Fitzner said: “Inflation eased slightly in March to its lowest annual rate for two-and-a-half years.

“Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago. Similarly to last month, we saw a partial offset from rising fuel prices.”

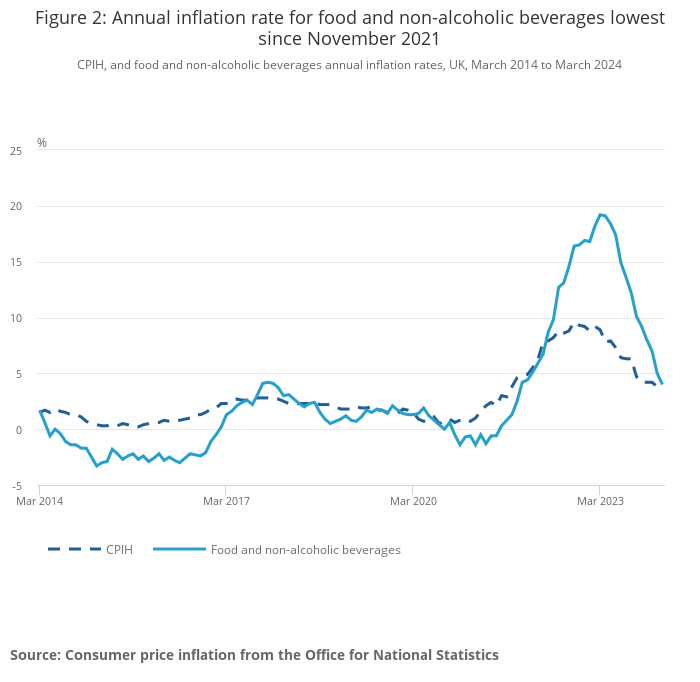

Inflation for food and non-alcoholic drinks dipped to 4 per cent for the month, from 5 per cent in February and is now at its lowest level since November 2021.

The increased slowdown was partly driven by a fall in meat prices and lower rises for bread and cereals, the ONS said. The price of some bakery goods, such as chocolate biscuits and crumpets, also fell between February and March 2024.

Prime Minister Rishi Sunak hailed Wednesday’s inflation figures, saying they demonstrated his economic plan is working.

He told broadcasters: “Today’s figures show that after a tough couple of years, our economic plan is working and inflation continues to fall.

“Having been 11% when I became Prime Minister, it’s now fallen to just over 3%, the lowest level in two-and-a-half years.

“We have also seen energy bills falling, mortgage rates falling and, just this week, data showed people’s wages have been rising faster than inflation for nine months in a row.”

He added: “My simple message would be: if we stick to the plan, we can ensure that everyone has a brighter future.”

Chancellor Jeremy Hunt reiterated Mr Sunak’s view. He said: “The plan is working: inflation is falling faster than expected, down from over 11% to 3.2%, the lowest level in nearly two-and-a-half years, helping people’s money go further.”

Rachel Reeves, Labour’s shadow chancellor, said: “Conservative ministers will be hitting the airwaves today to tell the British people that they have never had it so good. However, after 14 years of economic failure under the Conservatives working people are worse off.

“Prices are still high in the shops, monthly mortgage bills are going up and inflation is still higher than the Bank of England’s target. At the same time Rishi Sunak risks crashing the economy again with his Liz Truss-backed £46 billion unfunded tax plan to abolish national insurance.

“The truth is Rishi Sunak is too weak to fix the economy his party broke and too out of touch to deliver for working people. It’s time for change. Only Labour has a long-term plan to grow our economy, cut people’s bills and make working people better off.”

The latest figures are moving gradually closer to the Bank of England’s (BoE) 2 per cent inflation target as it considers when it should make the first cut to interest rates.

The BoE hiked interest rates to a 15-year-high of 5.25 per cent to combat skyrocketing inflation. Despite inflation gradually falling, economists are sceptical that this will hurry the BoE into making a decision to cut interest rates in the summer.

Traders have gone one step further and think the BoE could now wait as late as November before it begins cutting interest rates.

Ian Stewart, chief economist at Deloitte, said: “Inflation is in retreat but the Bank of England cannot yet be sure that it is beaten. Headline inflation is likely to drop below 2% in the coming months, but to be confident it will stay there wage pressures need to ease.

“With earnings growing at close to 6%, and the economy reviving, the Bank will be in no hurry to cut interest rates.”

Ruth Gregory, deputy chief UK economist for Capital Economics, said: “The smaller-than-expected fall in CPI inflation from 3.4% in February to 3.2% in March (BoE and consensus 3.1%, CE 3.0%) and drop in the core rate from 4.5% to 4.2% (consensus & CE 4.1%) raises the risk that inflation will follow the trend in the US and soon stall.

“The chances of interest rates being cut for the first time in June are now a bit slimmer.”

Suren Thiru, the economics director at the Institute of Chartered Accountants in England and Wales, said: “A landmark decline in inflation is locked in for April, as lower energy bills following the reduction in Ofgem’s energy price cap will have almost certainly pulled the headline rate below the Bank of England’s 2% target.

“Though this [March] inflation fall won’t be sufficient to drive a cut in interest rates next month, this outturn may persuade more rate setters to vote to loosen policy, providing a clear signal that rate cuts are on the horizon.”

The inflation figures come after the International Monetary Fund’s (IMF) latest economic forecasts on Tuesday revealed that the UK will eke out slower growth this year than previously thought and remain the second-worst performer in the G7 group of advanced economies.

It said that the global economy had been “remarkably resilient” over the past two years but the escalation of conflict in the Middle East risks pushing up food and energy prices across the world.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments