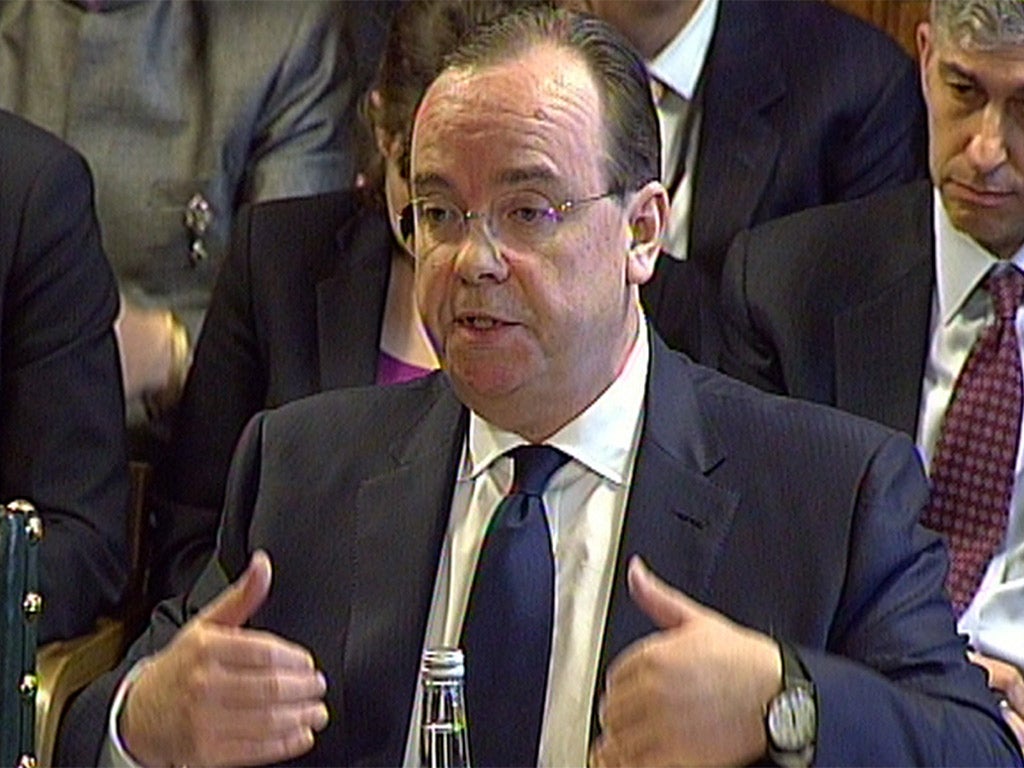

HSBC chiefs say sorry to MPs – but it may be too little too late

Stuart Gulliver and Douglas Flint seemed contrite before the Treasury Committee. But they still didn’t look good

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The men at the top of HSBC lamented the “horrible reputational damage” their bank has suffered over revelations about its Swiss unit’s role in helping wealthy clients to avoid paying their tax as they faced MPs yesterday.

In an attempt to demonstrate at least some humility for a scandal that has ravaged the bank’s international image, chief executive Stuart Gulliver and chairman Douglas Flint repeated apologies for the bank’s conduct – but with rather less qualification than on previous occasions – as they appeared before the Treasury Select Committee.

With the authorities in Belgium, France and the US preparing prosecutions, however, many may feel those apologies do not go far enough.

The UK is finally starting to wake up, too. HM Revenue & Customs chief executive Lin Homer revealed that next week agencies, including the Serious Fraud Office, the Financial Conduct Authority, Crown Prosecution Service and City of London Police, will meet for the first time to discuss how to move forward with the data spirited out of Switzerland by Hervé Falciani, who had been working on an IT upgrade.

Ms Homer said her operation had previously been prevented from sharing the information, handed over by the French, because of the treaty under which it was supplied.

Mr Flint stressed he viewed tax evasion as “abhorrent” during questioning from MPs and said: “I pay all my taxes.”

But his colleague, Mr Gulliver, who enjoys non-domiciled status, was forced on to the back foot from the start as chairman Andrew Tyrie highlighted what he called the “extraordinary arrangements” whereby Mr Gulliver’s salary was paid to a Panamanian company with an HSBC Switzerland account while working in Hong Kong.

Mr Gulliver said he could “understand why people might think it unusual. I grew up in Plymouth. I went to a state school, so I can understand why it might seem strange”.

He insisted the arrangement conferred no tax advantage upon him and was purely aimed at securing his “privacy in the company” where he was one of the highest-paid employees and where colleagues could access his account details.

However, Hong Kong banks are required to publish the salaries of their best-paid staff, but not to name them. That would have made it a relatively simply matter for colleagues to work out how much he was paid.

“You understand how this looks, don’t you?” Mr Tyrie asked. “I understand why it looks puzzling,” Mr Gulliver said.

Asked if he would consider himself “a fat cat”, Mr Gulliver said: “You would have to define ‘fat cat’ for me to be able to comment more meaningfully on that.”

He and Mr Flint accepted a share of the responsibility for what have become disastrous acquisitions for the bank in Mexico – which led to a then record £1.2bn fine to settle US allegations of money laundering – and Switzerland. But they did not take individual responsibility for any of the deals.

Bankers have been able to evade individual blame because of the way decisions have typically been handled by committees. This has riled Mr Tyrie. He asked: “Who is responsible personally for putting such a lot of awful stuff on the balance sheet?”

Mr Tyrie pointed out that Mr Flint had been a strong supporter of the Parliamentary Commission on Banking Standards, which Mr Tyrie chaired and which has played an important role in getting watchdogs to impose requirements on bankers to take more responsibility for their actions.

But Mr Flint said: “It would be dangerous for a strategic decision [such as on a big acquisition] to be taken by a single person. It should be taken and approved by the board and then the shareholders.”

Then it was on to the regular pow-wow with the Conservative MP Mark Garnier about HSBC’s status as a UK company. While location and domicile have not been considered recently, Mr Flint said HSBC was “committed to being in the best place for HSBC”. “Is that the UK?” asked Mr Garnier. “It is today,” said Mr Flint.

Called to account: In their own words

HSBC chairman Douglas Flint on tax evasion: "I pay all my tax and I find it abhorrent that others don’t. If you’re banking outside the country in which you live you have to be transparent"

Douglas Flint on the impact of the Swiss tax revelations: "We have suffered horrible reputational damage"

Stuart Gulliver on the Panama account that once held his salary: "I understand why it looks puzzling… [but] I have paid UK tax on my worldwide earnings since 2003"

"You would have to define fat cats": Mr Gulliver on whether he considered himself to be one

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments