Mapped: House prices grow to almost two-year high in September

House prices remained fairly stagnant in the last year, with limited activity in the UK housing market

UK house prices grew by 3.2 per cent in September compared with a year ago - the fastest annual rate in almost two years, according to new figures.

Prices increased by 0.7 per cent this month compared with the previous month, Nationwide Building Society said. This resulted in annual growth accelerating from 2.4 per cent in August to 3.2 per cent in September.

This is the fastest annual rate since November 2022, when house prices rose by 4.4 per cent. The average price of a house in the UK is now £266,094.

Property values in Northern Ireland performed the most strongly for annual growth in the third quarter of this year, with prices up by 8.6% year-on-year, Nationwide added.

East Anglia was the weakest performing region, with prices down by 0.8% over the year.

House prices have remained fairly stagnant in the last year, with limited activity in the UK housing market.

Robert Gardner, Nationwide’s chief economist, said: “Income growth has continued to outstrip house price growth in recent months while borrowing costs have edged lower amid expectations that the Bank of England will continue to lower interest rates in the coming quarters.

“These trends have helped to improve affordability for prospective buyers and underpinned a modest increase in activity and house prices, though both remain subdued by historic standards.”

However, he said while activity in the housing market and prices had picked up, it remains subdued compared with historical standards.

Mr Gardner said Nationwide’s most recent data by property type indicates terraced houses have seen the biggest percentage rise in prices over the past year, with average prices up by 3.5 per cent.

Semi-detached and flats saw increases of 2.8% and 2.7% respectively, while detached houses recorded growth of 1.7 per cent.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “These aren’t runaway price rises, but they’re firmly positive, which always helps boost buyer sentiment and keep the wheels rolling on the property bandwagon.”

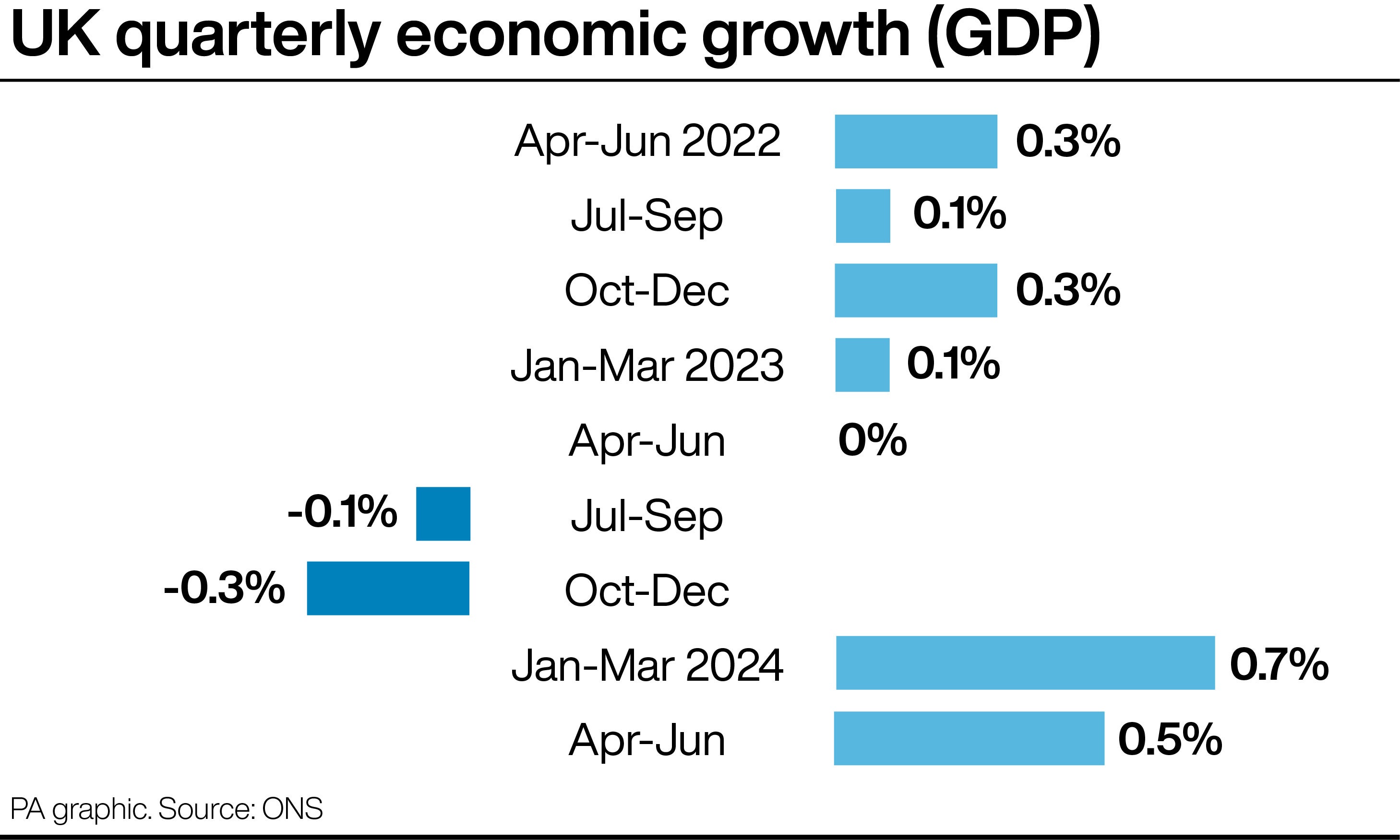

It comes after revised figures show growth across the UK economy was weaker than previously thought over the spring.

The Office for National Statistics (ONS) said gross domestic product (GDP) increased by 0.5 per cent between April and June, revised down from an initial estimate of 0.6 per cent.

Growth was driven by an increase in the services sector, while the manufacturing and construction industries industry dragged on the headline figure, the ONS said.

The figures show that the UK economy continued its recovery from recession at the end of last year, albeit at a slightly slower pace than previously thought.

Liz McKeown, director of economic statistics for the ONS, said: “Today’s updated GDP figures for 2023 and 2024 include new annual survey data, VAT returns and updated information about the relative size of each industry for the first time.

“However, after taking on these improvements, the quarterly growth path across the last 18 months is virtually unchanged.

“Our latest data show that household savings continue to increase and are now at their highest rate since the Covid-19 lockdowns.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks