Five new laws coming in today and how they will affect you

It is now a legal requirement for dog owners to have their pets microchipped

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Following the introduction of the National Living Wage and unwelcome increases to council tax, today sees another wave of new laws come into force in the UK.

You must microchip your dog

All dog owners in England, Scotland and Wales are now required by law to microchip their pet, and keep their details up-to-date on an authorised database such as Petlog.

The Government says the measures will make it easier to find lost and stray dogs, which currently cost taxpayers and charities £33 million a year, and trace the owners of animals that attack other people.

However, a senior vet has advised dog owners to ignore the new law, as the chips can lead to health problems among puppies and smaller breeds.

From 6 April owners of dogs found not to have a microchip by the will be given a short period to comply with the law before facing a fine of up to £500.

More than one million dogs in the UK have not yet been microchipped - one in eight of the estimated canine population - the Department for Environment, Food and Rural Affairs said.

The new law does not replace previous requirements for dogs to wear a collar and tag with their owner's name and address when in a public place.

Non-EU workers earning less than £35,000 face deportation

Changes to UK visa rules mean that overseas workers will not be allowed to stay in the country for more than five years unless they can prove they earn more than £35,000.

If that applies to you and your five-year visa expires soon, you could face imminent deportation.

The new law will not currently apply to nurses, PhD-level jobs and those on the official Shortage Occupation List, although the exemptions could change in the future.

However most teachers and people working in IT and marketing could be packing their bags sooner than they had hoped.

More than 110,000 people signed a petition against the changes, which were called “discriminatory” by campaigners.

In a response to the petition, the Home Office said the £35,000 threshold was announced in 2012 and all affected migrants and employers had been informed.

State pensions will be paid differently

If you plan to retire on or after 6 April, the way you receive your pension will be different. Instead of a basic state pension plus an additional pension, there will be a flat-rate payment of £155.65 a week. This is an increase from the previous minimum of £120.

This is supposed to make government pensions easier to manage and understand, but a survey by consumer group Which? found that 44 per cent of 50 to 64-year-olds do not know what the new rate will be, and only 18 per cent knew if they had ever been contracted out of a state pension.

Women and the self-employed may find themselves better off under the new system, according to the BBC. But to receive the full rate, you need to have paid National Insurance for 35 years, meaning younger retirees could lose out.

The lifetime allowance for pensions has also been reduced from £1.25 million to £1 million.

A new personal allowance will boost savings

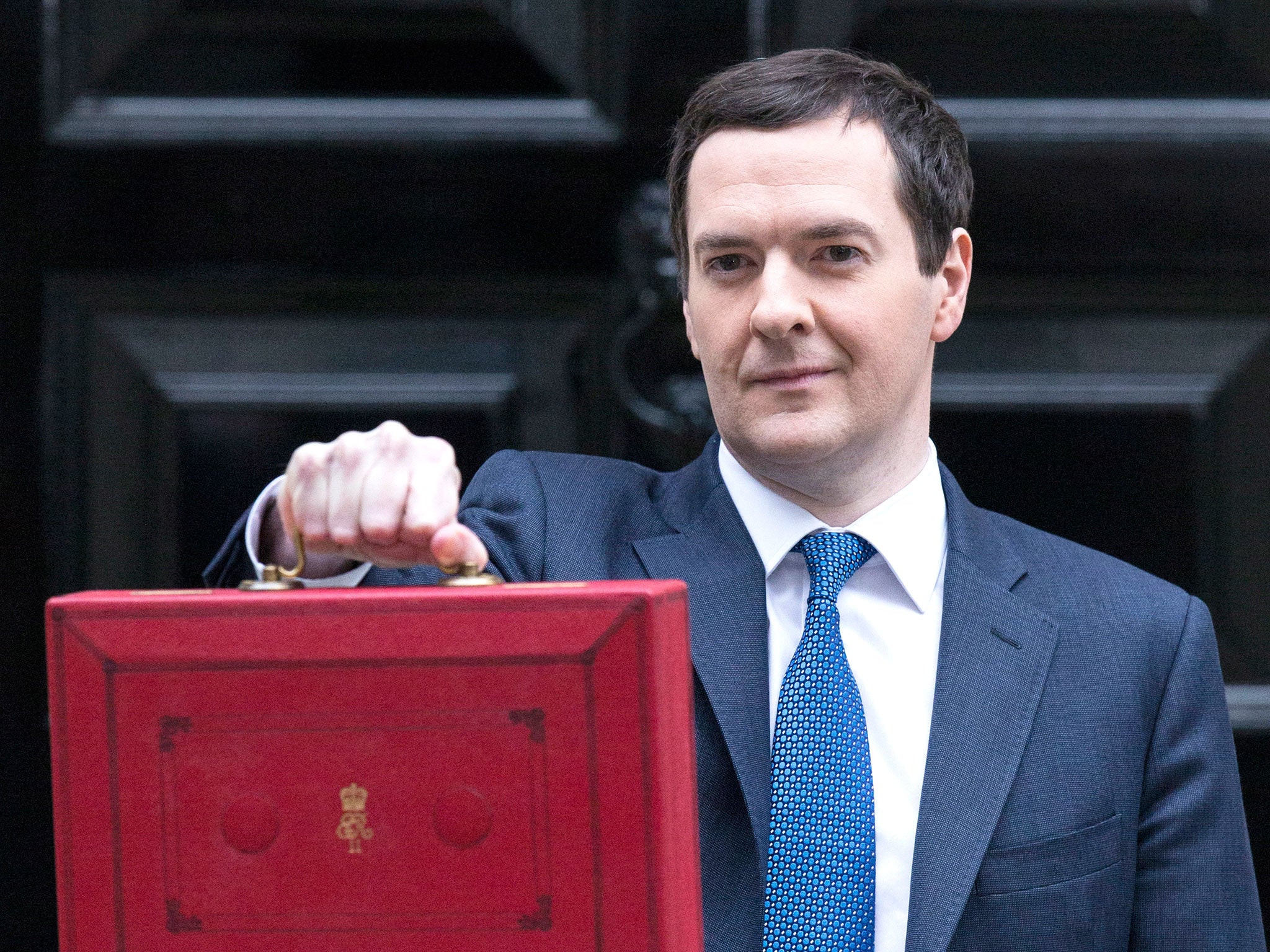

Another policy announced in last year’s budget that came into force on 6 April is the introduction of the ‘Personal Savings Allowance’, which will allow people to earn up to £1,000 in interest tax free.

Previously, earnings on savings were automatically taxed at 20 per cent by your bank or building society.

This change will benefit almost anyone with a savings account, but if you pay the higher 40 per cent rate of tax, your allowance will be £500, and the richest earners on the top tax rate of 45% per cent will not have an allowance at all.

A new 10 per cent tax on share dividends has also been introduced, with a £5,000 tax-free allowance.

Capital Gains Tax changes

The higher rate of Capital Gains Tax (CGT) has been reduced from 28 per cent to 20 per cent and the basic rate from 18 per cent to 10 cent.

These changes are now in effect for all disposals, as is an extension to Capital Gains Tax entrepreneurs’ relief.

The relief is being extended to external investors in unlisted trading companies. The new rules apply to newly issued shares purchased on or after 17 March, providing they are held for a minimum of 3 years from 6 April 2016, and subject to a separate lifetime limit of £10 million of gains.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments