Energy companies rake in ‘eye-watering’ £1bn a week as British families struggle in cost of living crisis

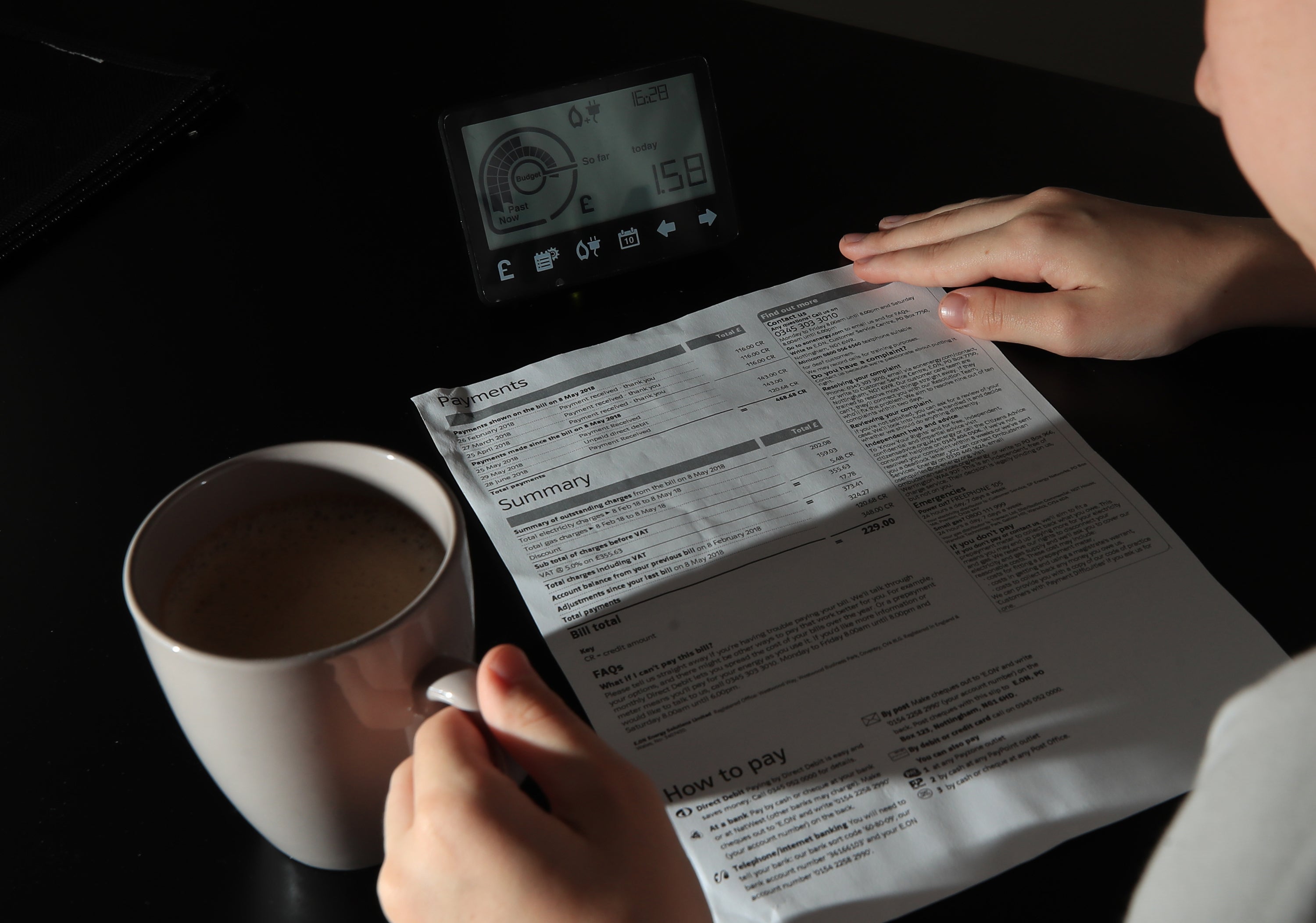

Families have struggled to bear the rising costs, with an estimated 13 per cent of households in England in fuel poverty last year

Energy companies raked in “eye-watering” profits of more than £1bn a week around the world last year as millions of hard-pressed Britons struggled to heat their homes or pay their bills in the ongoing cost of living crisis, The Independent can reveal.

Shell, Equinor, ExxonMobil and BP – some of the UK’s biggest suppliers of gas – made £65bn in net profits in 2023, leading campaigners to accuse the multinational firms of “stoking the energy bills crisis”.

Families have struggled to bear the rising costs, with an estimated 13 per cent of households in England in fuel poverty last year – up from 10.3 per cent in 2018, when higher energy prices started to squeeze incomes. Though regulator Ofgem has brought down the energy price cap to £1,690 from April, the rate is still far more than the £1,138 customers were paying before the energy crisis started in autumn 2021.

Gas and electricity prices have also risen by 19 per cent in real terms over the past year.

Critics hit out at the figures, which were revealed following an analysis by The Independent. Ed Miliband, the shadow secretary of state for climate change and net zero, said: “Labour’s plans will ensure that, while oil and gas giants are making eye-watering profits from the cost of living crisis, they pay more towards the delivery of cleaner and cheaper energy.

“We will set up a publicly owned company, Great British Energy, which will support the creation of thousands of clean energy jobs and help deliver clean energy by 2030.”

Simon Francis, coordinator of the End Fuel Poverty Coalition, said: “Rather than putting customers first, households have been left to build up record levels of energy debt or suffer living in cold, damp homes.

“Meanwhile, politicians in their Westminster bubble stand on the sidelines, trading insults and trying to barter down on the amount of money they are prepared to spend to fix Britain’s broken energy system.”

The Liberal Democrats said that huge profits for oil and gas giants showed that the government should have put in a proper windfall tax.

A windfall tax is levied on profits a company makes as a result of factors outside of its control. Gas prices have soared after Western countries sanctioned Russia following its attack on Ukraine. Russia in turn slashed its gas output. This meant more demand for less available gas, resulting in higher prices and better profits for gas producers. The government introduced a windfall tax in 2022, but said last year that it would come to an end if wholesale prices came down. Critics say the policy needs to be tougher.

Keith Butler, 72, and his partner Helen, 64, are full-time carers for their adopted 22-year-old son Geordie. Geordie is deaf, blind and autistic, and the electrical equipment he needs means the family’s energy use is already high.

Mr Butler said they are facing a “double whammy” of high energy bills and having to survive on the income from his pension. Geordie is fed by a machine that needs to be powered, has an electric bed, and likes to watch videos and TV to keep entertained, all of which require electricity.

The Butlers are not alone in their struggles. The proportion of families who spent more than 10 per cent of their income, after housing costs, on energy bills also increased to 36 per cent last year, up from 27 per cent the previous year. Gas and electricity prices also rose by 19 per cent in real terms over the year, figures from the Department for Energy Security and Net Zero show.

Mr Butler told The Independent: “To pay the utility bills, we’ve had to cut back. We don’t have holidays any more. I don’t really go out at night because I can’t afford it.

I’m trying my best but our bills are creeping up all the time

“We just had a gas bill for £450 for the last quarter, and imagine what it would have been if I hadn’t been trying to cut down. I’m trying my best, but our bills are creeping up all the time.”

Mr Butler wants the government to introduce a reduced energy tariff for vulnerable families, and is also critical of the energy companies who are making big profits from customers like him.

Tom Marsland, of disability charity Sense, which has supported the family with a one-off cash payment, said: “It’s difficult to hear about massive profits at energy companies when we know so many disabled households are struggling to pay for the basics after huge increases to their energy bills.

“Our research has found over half of disabled people have been pushed into debt by rising prices; it cannot be right that energy companies are making multibillion-pound profits at the same time.”

Meanwhile, BP’s new chief executive, Murray Auchincloss, has praised his company’s “strong operational performance” over the past year as the oil giant announced $15.2bn (£12bn) in net profit, while Shell said it had made “good progress over the year” as its net profit hit $19.3bn.

Other big suppliers of natural gas to the UK – a key component in the supply of both heating and electricity to British homes – include US firm ExxonMobil, which made $36.01bn, and state-owned Norwegian firm Equinor, which posted $11.9bn in net profit. Together, they made $82.3bn around the globe, or around £65.4bn.

The Liberal Democrats’ Treasury spokesperson, Sarah Olney MP, said: “This shows the government’s windfall tax is completely failing. The government could be raising billions to protect public services and help millions of families across the country who are in fuel poverty. Instead they choose to let the oil and gas giants continue to make massive profits.”

Analysis from Citizens Advice, published at the end of January, found that 5.3 million people currently live in households that are in debt to their energy supplier.

And 800,000 people went without gas or electricity for more than 24 hours last year because they couldn’t afford to top up their prepayment meter.

The net profits made by BP, Shell, ExxonMobil and Equinor are global and not specific to the UK. The companies pull in vast profits as they drill and explore for the oil and gas which is then sold to suppliers, such as British Gas or EDF.

The Independent asked each company to provide information on their earnings in the UK.

Shell said it did not publish its earnings in relation to specific countries, but revealed that it had paid $1.4bn (£1.1bn) in UK tax in 2023.

Equinor said its specific UK earnings would be released later this year. BP said it does not break down its profits to a country level, but confirmed it had paid $1.5bn in UK tax last year.

ExxonMobil said its profits were almost 20 per cent lower compared with a year earlier. The oil giant said it is investing more than £1bn in the UK “to help meet the country’s fuel needs domestically and to help build the foundations for lower-emission fuels in future”.

Shell has said it supplies around 10 per cent of the UK’s total oil and gas needs, while BP said it is one of the largest oil and gas producers in the UK. Equinor is understood to be a top UK gas supplier, while ExxonMobil is an investor in the South Hook gas terminal in Milford Haven, where much of the UK’s gas is imported to.

Shell makes about 5 per cent of its revenue in the UK, while BP has said its UK business is responsible for less than 10 per cent of its global profits.

Equinor’s UK business said that in 2022, the most recent year for which it revealed its earnings, it made £702m net profit compared to its global net profit of $28.7bn.

ExxonMobil said its UK-based European gas marketing division made £1bn net profit in 2022 – a small proportion of the $55.7bn generated by its global operations.

Ofgem said it does not publish data on which companies supply the most gas to UK homes and businesses.

A spokesperson for the Department for Energy Security and Net Zero said: “We’re providing an average of £3,700 per household to help with bills, and the latest figures show that our energy bill support schemes and progress in making homes more energy efficient have protected hundreds of thousands of households from fuel poverty.

“We’ve halved inflation, and energy prices are now significantly lower than their peak last year – but we recognise the cost of living challenges that families are still facing and will continue to target support at those most in need.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks