How to get the best car insurance deal - experts weigh in

From the shopping around to securing a deal early, check how you can save on quotes

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Experts have given their best tips on how to reduce car insurance quotes as new data reveals prices have soared by almost 50 per cent in the past year.

With interest rates at their highest in 15 years, hefty car insurance quotes are yet another burden putting more pressure on households struggling with rising bills.

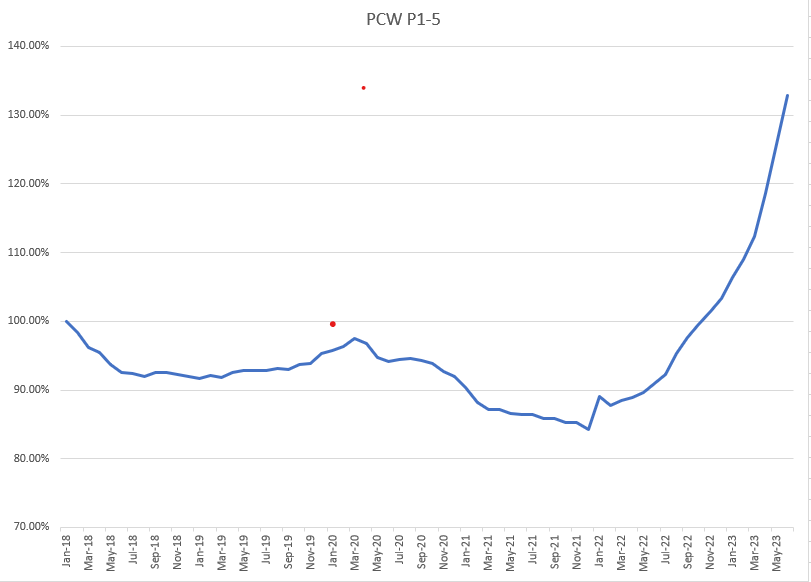

According to exclusive data from the analyst Consumer Intelligence, car insurance costs have increased by 48 per cent on average in the past year, with premiums now at their highest since the start of 2018.

A breakdown of the figures shows location and age significantly impact the price a driver will pay, as people aged between 25 and 39 living in London face the steepest price increase.

Have you been affected by this story? email maryam.zakir-hussain@independent.co.uk

Catherine Carey, head of marketing at Consumer Intelligence, said: “As a result of this inflation and lagging premium increases in 2022, the motor insurance market reported large losses. Insurers are now adjusting prices to recoup these losses and reflect the ongoing impact of inflation.”

What the experts say

Kara Gammell, finance expert at MoneySuperMarket, said whatever your situation, it’s always worth shopping around for cheaper deals.

She said: “Insurers consider lots of factors when pricing a premium, including your age, location, driving experience, and the car you drive. To pay less for the cover you need, it’s best to start looking for a new deal about a month before your existing policy ends.

“Try adding a named driver, increasing the voluntary excess and check you’re on the electoral register. Your occupation can push up the cost of car insurance as some jobs are considered riskier than others, so try selecting a different job description to see if you can reduce the cost. Just make sure the job description you select is accurate and you can cover the higher excess amount if you do need to make a claim.

“With bills and prices rising many of us are finding things tough, and small valid alterations to your circumstances, whilst form filling, can lead to £10s and sometimes £100s of pounds worth in savings.”

Sam White, chief executive of Stella Insurance, said there is plenty you can do to reduce your car insurance costs.

“Get your insurance early. Insurers don’t like people who have taken out a policy on the day that it’s due. So, probably three weeks before your policy is due is a good time to get your insurance,” she told BBC’s Today programme.

“The other thing is shopping around. Your credit score affects your insurance. Trying to manage will have a big impact on the price you pay.”

She also cautioned against trying to manipulate the system by “messing around with rating factors”.

She said: “I know it’s tempting to change things on your proposal document to see if it impacts your price. But insurers use something called a quote manipulation tool and if they see that you have made those changes when trying to get your insurance policy, they will penalise you for it and charge you more.”

The AA advised younger drivers to consider taking the Driving Standards Agency Pass Plus course after the research revealed motorists between 25-39 are among those who face the biggest increase in price rises.

The course improves a driver’s experience in key but tricky areas such as on motorways, and also helps to trim down insurance quotes.

For older drivers, the AA recommends parents encourage their children who can drive to buy their own car, so if they have an accident, your no-claims discount will not be affected.

Craig Mackinlay, MP for South Thanet, echoed the advice to “shop around”.

He said: “With algorithms, when you look for a new policy you are always better off to look 30 days before your policy runs out. Once you start looking within days of your policy running out, the algorithms do not offer you such a good rate.”

Motor expert Louise Thomas at Confused.com car insurance comments: “Even though car insurance prices are increasing, it doesn’t mean that motorists have to pay more than they need to for their policies.”

She suggested the following:

- “Be accurate with your mileage – generally, the more miles you drive, the more likely you are to have an accident and make a claim. Driving fewer miles can be a great way to save money on your car insurance policy, but don’t assume that a low mileage always mean low prices. This might make your insurer think you’re less experienced and more of a risk. And if you underestimate, you could also invalidate your policy. That’s why it’s important to be as accurate as you can

- “Increase your voluntary excess – increasing your voluntary excess can help you get cheaper car insurance, but you need to make sure you can afford to pay it, if you need to claim.

- “Pay for your car insurance annually – if you can afford it, paying for your insurance in one go rather than monthly is one way to get cheaper car insurance. That’s because insurance companies always charge interest for spreading the cost of your cover over the year.

- “Enhance your car security – the harder it is to steal your car, the less of a risk it is. And that usually means cheaper car insurance. If you don’t already have one, you could do things like installing a Thatcham-approved car alarm or immobiliser. You could also add additional security, like a steering wheel lock, or leave your car parked in secure areas overnight.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments