National insurance, capital gains, fuel duty: The tax rises which could affect you in today’s Budget

Many experts expect tax rises to be on the cards

Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

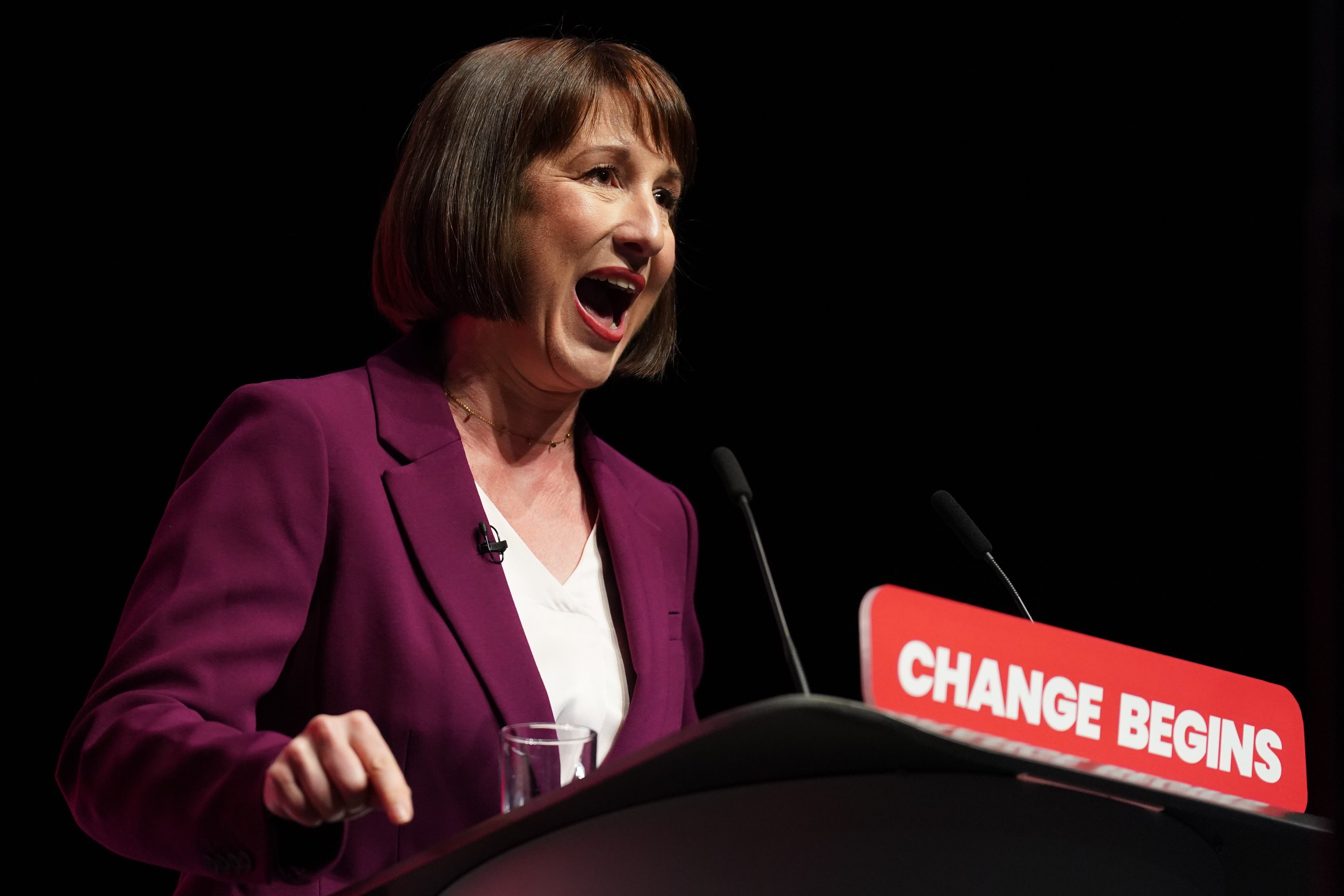

Rachel Reeves will announce Labour’s first Budget in 15 years today, as speculation mounts around what measures could be included.

The chancellor faces a difficult task, with the fiscal event set against the backdrop of the £22bn ‘black hole’ in public spending which she announced in late July.

Prime minister Sir Keir Starmer has likewise warned the fiscal event is going to be “painful” but that there is “no other choice given the situation that we’re in”.

Many experts have taken this to mean tax rises on the horizon, alongside possible spending cuts. But with an absolute commitment to not raising income tax, national insurance or VAT – the three largest sources of revenue – the chancellor will need to look elsewhere to raise vital revenue.

The Institute for Fiscal Studies (IFS) said she has a difficult task ahead of her, having “given herself little room for manoeuvre”.

“Many of the tools best suited to the task of significant revenue-raising have been put out of reach,” added IFS economist Isaac Delestre.

In light of this, it’s likely Ms Reeves’ announcement will be lengthy, bringing in smaller changes and tweaks which could make a big difference when combined.

Here’s your guide to some of the tax rises the chancellor could be considering for her first Budget:

Capital Gains reform

Capital Gains Tax (CGT) is paid on the profit made when an asset which has increased in value is sold. It is applied to things like the sale of personal possessions worth more than £6,000 (apart from a car), property that’s not the seller’s main home, shares and business assets.

It is charged at 10 or 18 percent for basic rate taxpayers, and 20 or 24 for higher or additional rate earners. There is a tax-free allowance of £3,000.

There are several ways CGT could be changed. In the run-up to the election, the Lib Dems and Greens both said they would rethink the tax bands to be more similar to income tax, raising an estimated £5.2bn a year.

Pension tax relief reform

Pension tax relief is a reduction of the amount of tax paid on private pensions. It helps workers save for retirement by boosting their pension pots.

The amount of tax relief a person is granted is based on their income tax. It will effectively cancel out tax on pension contributions up to a maximum of £60,000.

After this, contributions will be taxed at either 20, 40, or 45 per cent, depending on which income tax rate the worker falls into.

However, the chancellor is thought to be considering a flat 30 per cent pension tax relief rate. This would mean that higher earners would effectively pay 10 per cent in tax, while those on the additional rate would pay 15.

The measure would raise around £3 billion a year, with 7 million earners paying more tax. But it would be better news for basic rate earners, who would actually begin to receive a 10 per cent boost to their pension contributions.

Evaluating the idea last year, the IFS said it would “redistribute the burden of taxation from the bottom 80 per cent to the top 20 per cent of earners.”

Inheritance Tax reform

Inheritance tax is a levy on the estate of someone who has died. This is their property, money and possessions. Crucially, it is not paid if the value of these things is below £325,000.

The tax rate is 40 per cent, but it’s only charged on the part of the estate that’s above the threshold. In 2023/24, only 5 per cent of deaths generated an inheritance tax bill, raising around £7 billion.

However, the IFS writes that the tax measure “is littered with special exemptions”. These include a business relief, the ability to pass on agricultural land tax-free, and the tax-free passing on of pension pots.

The economic think tank says that ending these measures alone would raise £4.8bn a year by 2029.

Welfare spending cuts

Labour has made no secret of its ambition to reduce the government’s welfare spending bill, so Ms Reeves will likely take the Budget as her opportunity to do so. Reports indicate the chancellor is looking to shave £3bn off the welfare bill overall.

Speaking at Labour’s party conference, the prime minister said: “We will get the welfare bill down because we will tackle long-term sickness and support people back to work.”

What has been confirmed is a crackdown on benefit fraud, which looks to save £1.6bn over the next five years. Also possible is the mooted reform to personal independence payments (PIP) to provide cash vouchers or expenses rather than regular payments – a Conservative-era policy that Labour has refused to rule out.

Fuel Duty increase

Fuel duties, or taxes, apply to purchases of petrol, diesel and a variety of other fuels used both for vehicles and domestic heating.

The level of fuel duty depends on the type of fuel used, with a litre of petrol, diesel, biodiesel and bioethanol attracting a fuel duty of 52.95p. It was cut by 5p by the Conservatives in 2022, after being frozen at 57.95p since 2011.

It represents a significant source of revenue for the government, expected to raise £24.7 billion in 2023-24, according to the Office for Budget Responsibility – equivalent to 2.2 per cent of all receipts.

Scrapping the 5p cut would raise the government an estimated £2bn. However, doing so would not automatically force fuel retailers to bring down their costs, likely meaning higher fees for motorists, at least in the short term.

Business Rates reform

In its election manifesto, Labour said it was committed to reforming the current business rates system “so we can raise the same revenue but in a fairer way”.

What this means has not been spelt out by the party, but it said the new system will be designed to “level the playing field between the high street and online giants, better incentivise investment, tackle empty properties and support entrepreneurship”.

It’s thought this could take the form of an immediate cut to the rates, while also closing loopholes which allow some firms to avoid tax. This will come as welcome news to smaller business owners, but Labour will be careful to ensure their reform maintains a monetary net zero.

Exchequer secretary James Murray MP confirmed this at a Labour conference fringe event hosted by the British Retail Consortium, saying: “It’s within the current envelope. It’s all about raising the same amount of money overall, that’s the commitment.”

Private equity profits

In another manifesto pledge, Labour said it will announce more details on plans to close the private equity tax loophole in the October Budget.

Due to the ‘carried interest’ law, private equity fund managers pay only 28 per cent tax on their income, which is treated as capital gains. This was the result of a successful lobbying campaign in 1987.

Labour has vowed to change this, making managers pay the 45 per cent higher rate of income tax. It is estimated the change will raise around £600 million a year with just a few thousand people affected.

Employer National Insurance Contributions

National insurance contributions (NICs) are the UK’s second-largest tax after income tax. They are paid by both employees on their own earnings, and employers on the earnings of their employees.

Labour officials say they will uphold the manifesto pledge to not raise NICs for employees above the recently lowered rate of 8 per cent. However, speculation has mounted that this could leave the door open for an increase in the rate paid by employers, with both the chancellor and prime minister refusing to rule out the measure.

Employer NICs are currently paid at a flat rate of 13.8 per cent. Analysis by the HMRC in June showed that increasing by 1 per cent could raise around £8.5bn in the first year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments