Bank of England may have to hike interest rates to 7% to curb inflation, economists warn

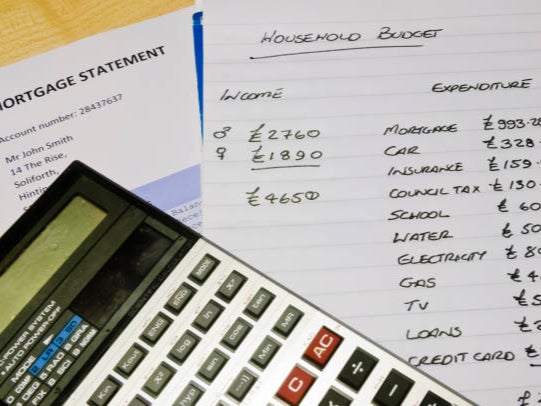

Fears heighten for UK economy and household budgets as expert says ‘hard landing increasingly likely’

The UK base rate could be raised as high as 7 per cent to tackle stubbornly high inflation, a leading economist has warned – hitting stretched mortgage-holders even harder.

Allan Monks, of JP Morgan, said some indicators suggested the Bank of England’s key rate would have to rise a further 2 percentage points as prices continued to climb.

It’s only two weeks since the base rate was hiked by 0.5 percentage points to 5 per cent to bring inflation under control, leaving homebuyers struggling to meet rising loan repayments.

Financial markets are expecting the Bank to increase the base rate above 6 per cent by the end of this year, and his remarks heighten fears for the UK economy and household budgets.

On Tuesday the average five-year fixed-rate deal jumped above 6 per cent for the first time since November, and mortgage-holders were warned that fixed-rate deals could jump to 7 per cent this summer.

A typical five-year home loan has risen from 5.97 to 6.01 per cent, according to financial data experts Moneyfacts. And the average two-year fixed-rate mortgage has gone from 6.42 per cent to 6.47 per cent.

Some experts have urged the Bank of England to rethink the use of “out-of-control” interest rates to tame inflation, fearing that rising interest rates could tip the economy into recession.

Mr Monks wrote that a hard landing for the UK economy “looks increasingly likely”. But his central forecast is for a moderate peak rate of 5.75 per cent in November.

The Organisation for Economic Co-operation and Development has said the UK is the only G7 nation where inflation is rising.

JP Morgan warned that surging borrowing costs could hit business confidence and drive up unemployment.

The National Institute of Economic and Social Research estimated last month that 1.2 million households would become insolvent this year as a result of higher mortgage payments.

But savers have been trying to make the most of rising interest rates, which have led some banks to offer savings rates as high as 6 per cent – their highest level in at least a decade, albeit still behind inflation, which is currently 8.7 per cent, against a target of 2 per cent.

Grilled by MPs on the liaison committee, Rishi Sunak refused to say whether he would hit his target of halving inflation by the end of the year, but vowed to “just keep throwing everything at it”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks