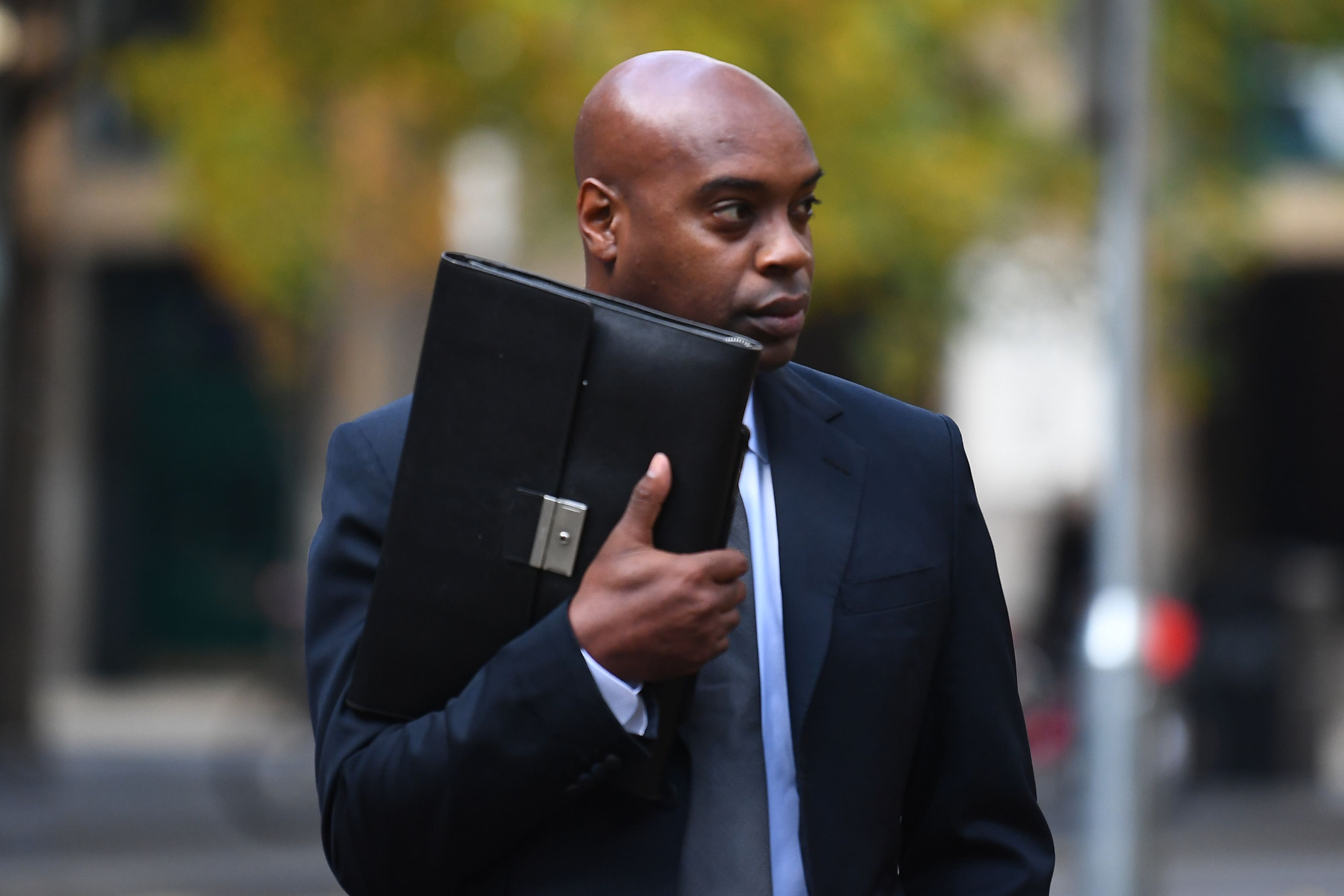

Ex-Premier League star denies investment fraud

Richard Rufus is alleged to have taken millions of pounds in a pyramid scheme while boasting of his success as a foreign exchange trader.

A former Premier League footballer accused of investment fraud said he traded his friends’ and family’s money as a “favour” and did not make a profit.

Richard Rufus, 47, is alleged to have taken millions of pounds in a pyramid scheme while boasting of his success as a foreign exchange trader.

It is said he misled people by saying their investments were low risk and promised returns of 60 percent.

Prosecutor Lucy Organ had previously told the court Rufus enjoyed the “trappings of wealth” with £15 million he garnered from family and friends, which paid for the maintenance of a five-bedroom house on a private estate in Purley, south London, as well as a Bentley and Rolex watch.

She also said that returns were not paid from profits but from conning more people.

Giving evidence at Southwark Crown Court on Thursday, the former Charlton Athletic centre-back said that despite being unregulated by the Financial Services Authority (FSA), he believed he was acting within the law.

He told the jury that he contacted the FSA as well as his accountant, Garth Myers, who informed him of the boundaries of trading in foreign exchange unregulated.

He said: “At the time I was quite explicit to my friends and family saying I can’t solicit for business, I can’t charge a profit regarding this and I can’t take on any form of risk on your behalf because I am doing this as a favour.”

When questioned by his defence barrister, Simon Spence KC, he admitted to not being successful with his foreign exchange investments between 2007 and 2011, blaming his failure on technical issues and greedy brokers.

He blamed latency issues in the software, so that when he wanted to pull his money out, the system did not react immediately and he would continue losing money.

One issue is that certain brokers want to make financial gain for themselves so if a trader is making a lot of money, that means a broker is losing a lot of money

He said: “Quite a few times I have pressed the button to stop out but 25 minutes later the position has not closed, and it is still going down and I made official complaints with brokers for my money back.”

Another factor Rufus blamed was the failure of a system called stop loss, which is supposed to limit the amount of money you lose, but he claimed brokers sometimes continue to let it run to make more money for themselves at the expense of traders.

He said: “One issue is that certain brokers want to make financial gain for themselves so, if a trader is making a lot of money, that means a broker is losing a lot of money.”

Rufus, of Crystal Palace, south-east London, denies three counts of fraud, using around £2 million in criminal property and carrying out a regulated activity without authorisation, between May 2007 and April 2012.

He began playing for Charlton Athletic immediately after he left school but was forced to retire early at the age of 29 in 2004 because of a knee injury.

On the cusp of his retirement, he began learning how to trade in stocks, shares and futures, spending £40,000 to $50,000 on courses as well as hiring a mentor for 12 months.

He also invested in property, buying and refurbishing and selling on, and started a company called Hoyland Homes to build property on an old petrol station. He later abandoned the project as it was “taking up too much time”.

The trial continues.

Bookmark popover

Removed from bookmarks