Cigarette companies accused of supplying black market in Britain

MPs says Treasury is being cheated by firms that deliberately flood European markets

Major UK cigarette firms are accused today of fuelling the multimillion pound black market in smuggled tobacco that cheats the taxpayer out of millions of pounds.

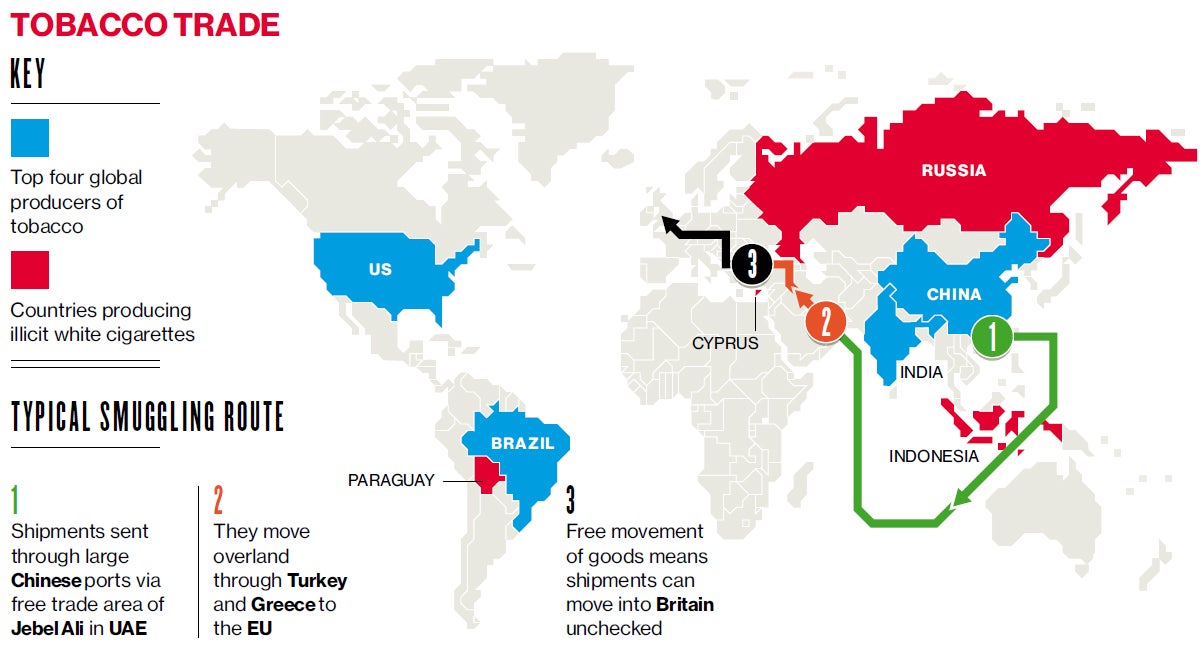

Click image above to enlarge graphic

Companies oversupplied some European markets with hand-rolling tobacco by 240 per cent and then turned a blind eye when it was smuggled back to Britain, according to MPs.

They criticised the tax authorities for failing to prosecute or fine any of the big four tobacco companies, despite one, which HM Revenue and Customs (HMRC) has declined to name, failing to cooperate fully with the authorities to clamp down on the problem.

Only one letter of warning has been sent and a project set up to try to tackle the problem, with test purchases in “high-risk” countries, had to be scrapped after HMRC realised it did not have the powers to operate. The issue has contributed £660m to the £1.9bn loss to the public purse from avoiding tax on tobacco and cigarettes. “[HMRC] has failed to challenge properly those UK tobacco manufacturers who turn a blind eye to the avoidance of UK tax by supplying more of their products to European countries than the legitimate market in those countries could possibly require,” said Margaret Hodge, chairwoman of the Public Accounts Committee (Pac), which makes the claims in a report published today.

The Pac said companies that failed to cooperate should be publicly named, but HMRC said that it could only do so in “very limited” circumstances. The accusation by the MPs follows a near doubling in the consumption of hand-rolling tobacco in Britain despite an overall reduction in smoking. Nearly two-fifths of all tobacco used in Britain is considered illicit compared with less than 10 per cent of cigarettes, the report says.

The “high-risk” oversupply countries included the Benelux nations – Belgium, Netherlands and Luxembourg – and Spain, where many Britons go on holiday. A single “white van man” bringing back a load of illicit tobacco could cost the Exchequer £60,000 in lost revenue.

The MPs did not name the non-cooperative member of the big four – which includes BAT, Philip Morris International, Imperial Tobacco and Japan Tobacco. But it said the companies had a “poor record” of addressing the problems, had been slow to respond and provided little information to the tax authorities.

But the industry contested the claims and said Britain – despite having some of the most punitive taxes in the world – also had some of the highest profit margins. “We don’t oversupply, it wouldn’t make any sense to do that,” said Simon Evans, a spokesman for Imperial Tobacco. “The UK is one of our most profitable markets.”

He said that Imperial Tobacco was “joined at the hip” with tax authorities in trying to combat the illicit trade. The company had previously come under fire by the Pac when George Osborne accused it of being “crooks” or “stupid” by selling cigarettes to countries like Afghanistan and Moldova without thinking they would be smuggled back to the UK.

HMRC said that despite the concerns of the MPs, the illicit market in cigarettes had been more than halved with nearly 3.6 billion illicit cigarettes and more than 1,000 tons of rolling tobacco seized in the last two years. “Relentlessly disrupting criminal businesses is at the heart of HMRC’s strategy to clamp down on this illicit trade,” said a spokesman.