One in three Britons have been tricked by scam, research finds

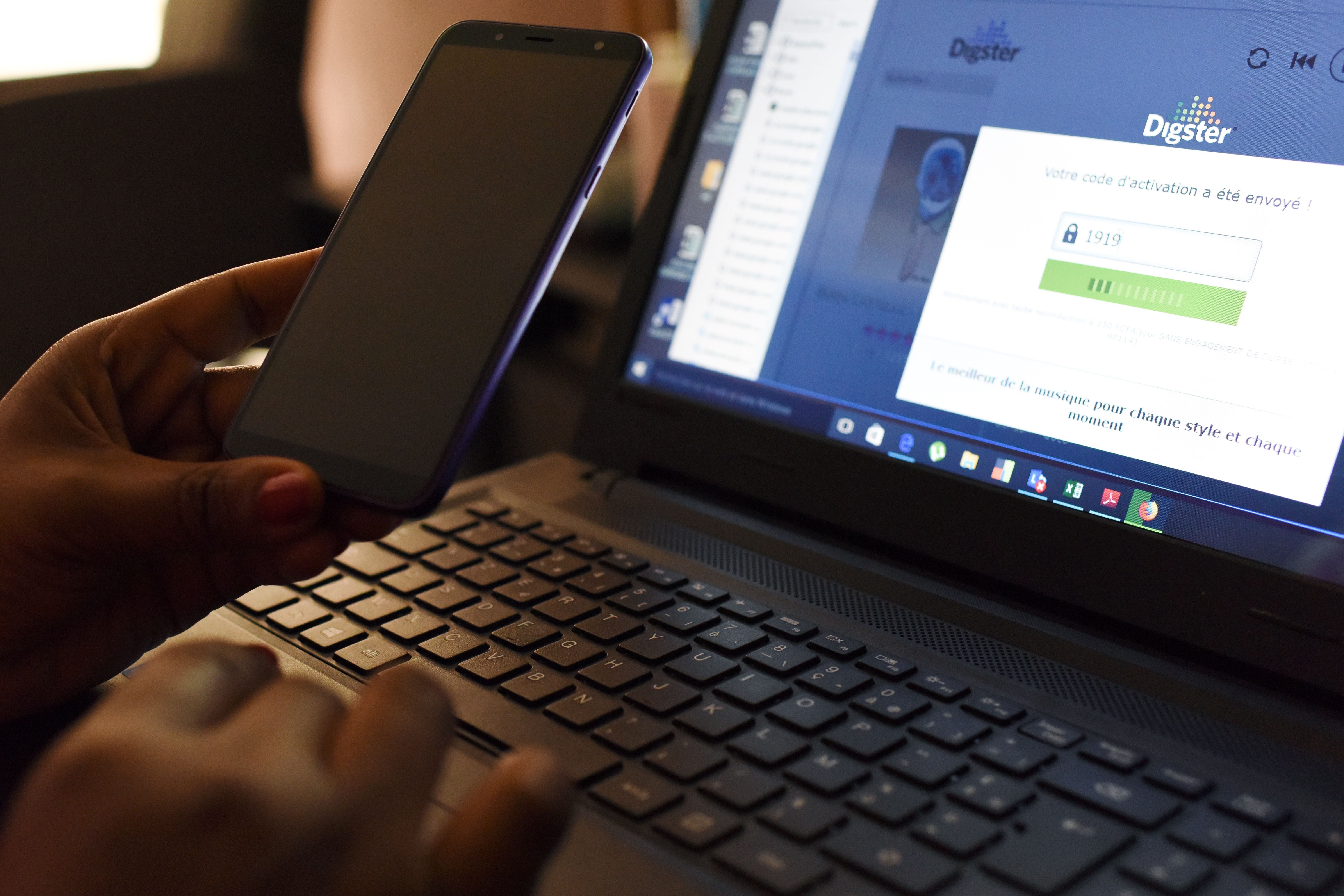

‘It’s clear that scams are becoming increasingly sophisticated and catching even the savviest users out, potentially handing over details that could cost them heavily’

One in three Britons have fallen victim to a scam, with millions handing over personal information which has cost them financially.

A poll of 2,000 adults revealed 30 per cent have been tricked by a text, email or social media message pretending to be from a legitimate person or company.

And while some simply clicked on fraudulent links, one in eight went as far as handing over details, such as bank account information, to criminals.

Of those, 74 per cent ended up out of pocket financially, to the tune of nearly £600 on average.

Overall, 80 per cent of adults have received a suspicious text, email or social media message.

And 79 per cent feel these scams have become more convincing than ever, leaving two thirds fearing for their older relatives falling for them.

Rob Hallett, advisory board member at secure messaging platform LetterBox, which commissioned the poll, said: “It’s clear that scams are becoming increasingly sophisticated and catching even the savviest users out, potentially handing over details that could cost them heavily.

“The problem lies in the fact there’s no need to verify yourself, so generally, anyone can contact anyone else freely – meaning those with dishonest motives can creatively contact you in the hope you’ll hand them sensitive data in good faith without a second thought.

“This research highlights the many reasons we felt compelled to create a service that helps protect users.”

The poll found more than half have found themselves unable to tell the difference between a scam and a legitimate request for information, whether it be by social media or a text.

A third have seen an older family member scammed, with 29 per cent no longer feeling secure using personal information on their mobile phone.

The most common scams encountered included messages regarding Royal Mail deliveries, winning prizes and random suspicious links.

Bank account notices, expired details and incorrect payment login notifications have also been received.

And it’s not just older generations falling for the stings, with 23-year-old Kirpa Longani from London losing £600 in the blink of an eye.

Kirpa said: “I received a text message saying that they have randomly picked winners who bank with Natwest.

“The text message prompted me to share the card details so they could put money into my account.

“After a while, I received a text message saying the purchase has been successful - so I lost £600 in a single transaction.”

The majority don’t think enough is done to deal with such scams by the government or the companies that make it possible such as phone providers or social media platforms.

Confidence has seemingly reached rock bottom on social media with less than one in 10 adults feeling safe – with 58 per cent believing accounts should be tied to genuine names and information.

Facebook was overwhelmingly the top social channel UK adults trust the least.

How easy it is to be contacted by strangers, how frequent scams seem to be and a lack of understanding of how their details are used were the main reasons for distrust, while some worry about how their data is collected.

Rob Hallett, from new messaging service LetterBox, added: “We’ve created our new service in an attempt to combat this ever-increasing digital pandemic.

“Users are required to verify themselves in order to use the platform, so you know you’ll only be talking to a genuine person or business with confidence.

“We’re determined to restore confidence to users in a time where many are losing faith with big corporations mining details and letting people freely scam them without any policing.”

SWNS