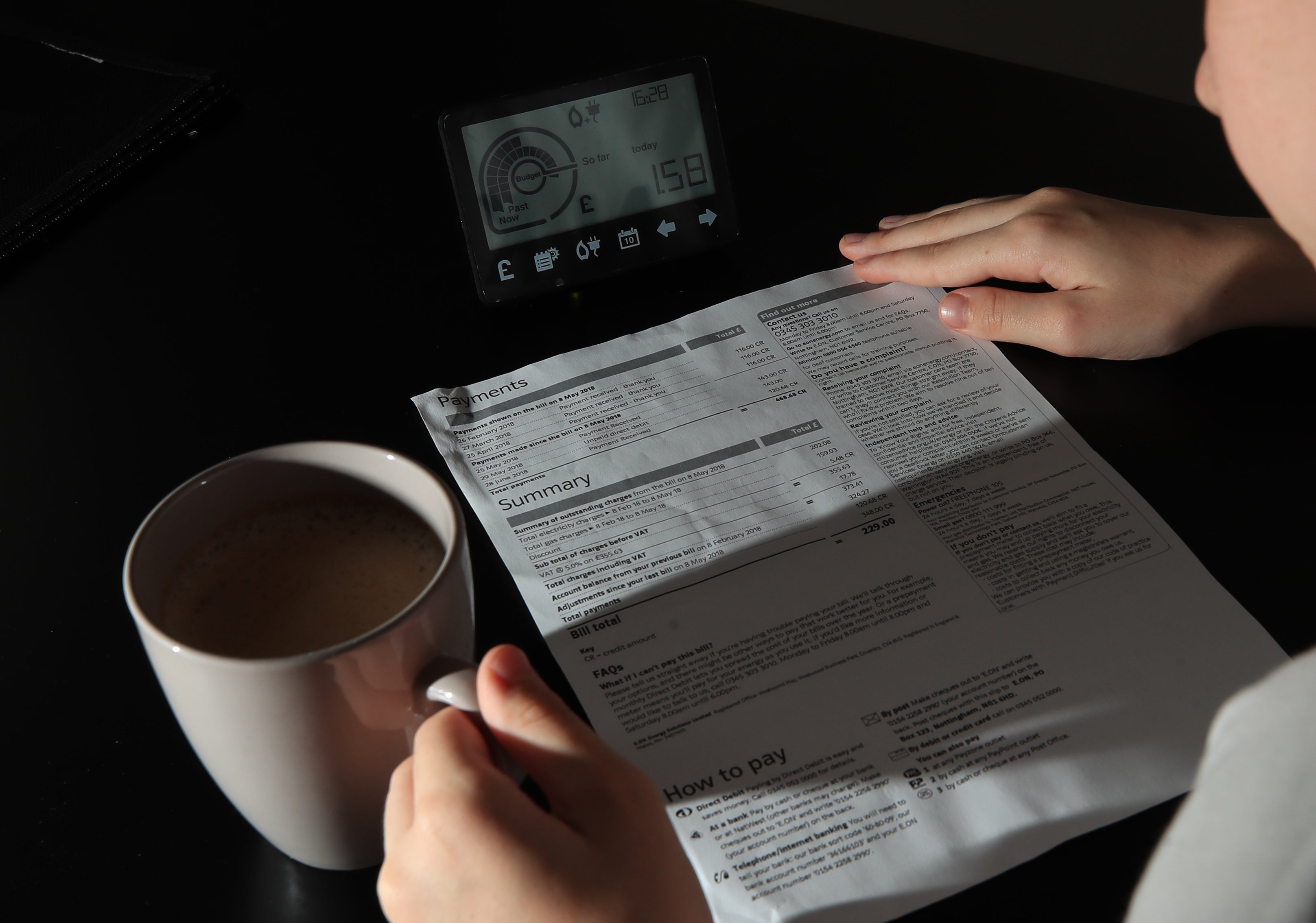

Consumers likely to face increase in loan sharks and doorstep energy sellers

The cost of living crisis will lead to opportunities for fraudsters to exploit a financially desperate public, Trading Standards warned.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.UK consumers are likely to face an increase in loan sharks and doorstep energy sellers as a result of the cost of living crisis, Trading Standards has warned.

The crisis will lead to opportunities for fraudsters to exploit a financially desperate public, especially the most vulnerable, the Chartered Trading Standards Institute (CTSI) said.

Some of the likely consequences included an increase in loan shark activities and energy tariff mis-selling on the doorstep, alongside other “questionable money-saving schemes”.

The CTSI’s warning follows Ofgem raising its energy price cap by 54% or £693 from April 1, while the Bank of England reported that UK inflation rose to 5.5% in January – the highest rate since March 1992.

The CTSI said the challenging economic environment created a “perfect storm” for consumers.

CTSI chief executive John Herriman said: “The cost of living crisis risks a significant rise in consumer detriment that the UK has not seen for decades.

“The Covid pandemic warned us about the depths some will sink to through the scams that emerged out of it. For the unscrupulous, crises are opportunities to make a dishonest profit from the most vulnerable.

“Local Trading Standards services, working in partnership with other agencies, have continually risen to the challenges of protecting consumers, but this has become increasingly difficult after funding cuts of 50% over the past decade.

“Gaps in consumer protection are emerging, and whilst trading standards professionals are doing their utmost to protect the public, we are worried about the potential for significantly increased levels of risk.

“CTSI is in an ongoing dialogue with the UK Government and other stakeholders about how best to protect consumers. These concerns illustrate the need for a consumer protection strategy that recognises these deep impacts and that will mitigate them as effectively as possible.”