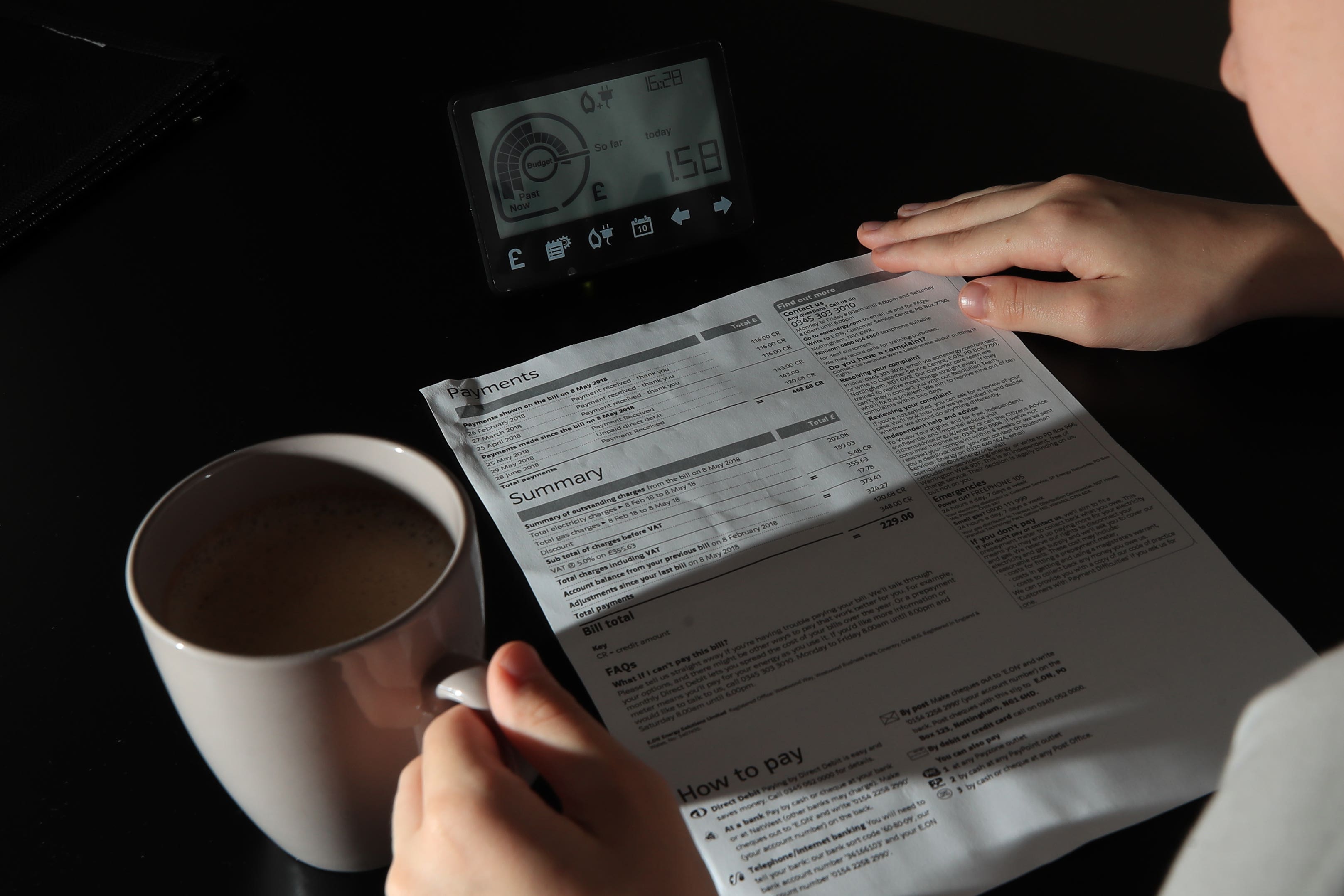

1.3 million households missed a bill payment in a single month, Which? warns

Some 60% of those who could not afford a household bill defaulted on more than one payment in the month to June 9.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.An estimated 1.3 million UK households missed or defaulted on an essential bill in a single month as cost-of-living pressures build up, a survey suggests.

Which? found 60% of those who could not afford a household bill such as energy, water or council tax, defaulted on more than one payment in the month to June 9.

It urged utility firms and supermarkets to work harder to support customers as pressures build on household finances.

Among those who missed one or more bills, two in five (42%) did not pay their energy bill, four in 10 (40%) missed their council tax payment, nearly four in 10 could not afford their water bill (38%) and a third (32%) struggled to pay for their broadband or television package.

Which?’s consumer insight tracker also estimates that 560,000 households missed or defaulted on a housing payment over the month, with one in 20 renters (5.2%) and 1.4 per cent of mortgage holders missing a housing payment.

Overall, two million households missed or defaulted on at least one mortgage, rent, loan, credit card or bill.

The 7.2% missed payment rate is in line with the level seen at the same time in the last two years, but higher than June 2020’s 4%.

More than half of households (56%) – or an estimated 15.8 million – reported making at least one adjustment to cover essential spending such as utility bills, housing costs, groceries, school supplies and medicine in the last month.

The figure has dropped from levels seen over the winter but is significantly higher than the 40% seen two years ago before the cost-of-living crisis began.

It’s incredibly worrying that millions of households are missing bill payments every month

The findings come amid expectations that the Bank of England will raise interest rates again in August and predictions that energy bills will remain high until the end of the decade.

Which? has called on energy firms to ensure their customer service departments are fully staffed and able to support customers who are struggling, and for telecoms firms to clearly advertise their social tariffs to eligible customers.

It also repeated calls for supermarkets to make budget lines widely available, particularly in convenience stores.

Rocio Concha, Which? director of policy and advocacy, said: “It’s incredibly worrying that millions of households are missing bill payments every month. We’d encourage anyone who’s struggling to seek free debt advice and reach out to their bill provider for help.

“As so many people face financial hardship, Which? is calling on businesses in essential sectors like food, energy and telecoms providers to do more to help customers get a good deal and avoid unnecessary or unfair costs and charges during this crisis.”