Mother once ‘drowning in debt’ with bailiffs at the door shares the simple money tips that saved her

Rosie Forshaw, 33, of Cheshire, aka moneysavingrosie, is sharing her clever ideas in the hope of helping people as the cost of living crisis hits

A first-time mother who was once “drowning” in £3,000 worth of debt with bailiffs at her door learned cash saving hacks to pay off what she owed – and is now helping thousands of other people battle their money worries as the cost of living crisis hits.

Rosie Forshaw, 33, who now lives in Cheshire with her 10-month-old son and husband, who she does not want to name, shares her savvy tips online as @moneysavingrosie and wants everyone to know it’s possible to live “frugally and with dignity”.

As inflation reaches a 40-year high, she is often contacted by strangers asking how to stretch a few pounds and said: “Things are bad and only getting worse. I just want to do what I can to help people.”

Rosie, who now works as a wedding videographer, was herself stricken with anxiety when she fell into debt back in 2012 due to working a zero hours contract in a music venue.

Struggling with bills and buying basic necessities, Rosie ended up with a County Court Judgement (CCJ) against her in 2013, ordering her to pay back around £2,500.

She said: “The debt inhibited every aspect of my life. It made me feel anxious that any phone call or anyone at the door was coming for money.”

“I couldn’t enjoy anything. I tried to come to a settlement with the creditor and they wouldn’t accept my repayment offers.

She added: “I already had anxiety and it just made things worse. There were times when I struggled to leave the house.

“The debt was all I could think about.

“I was scared that whatever I had left would be taken by the bailiffs. It felt so shameful. That’s the worst of it.”

Thankfully, Rosie visited Citizens Advice who helped her reach an agreement with her creditor. In the following year, she moved house, saved all the money she could and paid back her debt.

She said: “I remember the day I got the CCJ. I remember the crying I did when I opened the letter.”

“It was the saddest day. It definitely made me realise I needed help.

“I’d hidden it from my partner at the time. If I’d have spoken to him about it in the beginning, it wouldn’t have got to the places it got to.”

Rosie had spent money on nights out, holidays and takeaways after she started to earn her own money but, as she battled to get out of debt, she began searching for cost reductions in all parts of her life – from rent to food, clothes and furniture .

She said: “Initially, I got the opportunity to move to a cheaper area. That was a massive saving.

“Then it was just about being more thoughtful in terms of saving, being mindful of meal planning, prepping and preserving, packing lunches and that kind of thing.

“I’ve always been someone who likes second-hand clothes anyway. But I made a point of always finding the best prices possible.”

And she added: “The hardest part of saving money is getting started. I now live frugally naturally and have my routine finely tuned.”

The more she learned, the more she wanted other people to know how to save cash too.

She said: “I thought I’d put my tips online.

“Now I get messages all the time from people saying I’ve helped them save money. I offer tips on everything from yellow sticker items to coupons.”

With the cost of living crisis reaching unprecedented levels, Rosie’s tips are now more in demand than ever and she is happy to share them.

One of the most pressing issues she tackles is food costs.

She said: “I batch cook as much as I can. I also go to shops when I know things will be marked down.

“Don’t be afraid to politely ask the staff in your supermarket what time they mark things down.

“And, if something isn’t marked down but I need it and can find one near expiry, I’ll often ask staff if it’s the cheapest that it will be that day.”

She added: “I got a steak just this week for £2 that way.”

Working out what to do with marked down items can be a problem but Rosie says a quick online search often shows how to preserve items for longer.

She said: “I bought six avocados once. I looked online and saw that by putting them in a jar of water they’d last a month – and they did!”

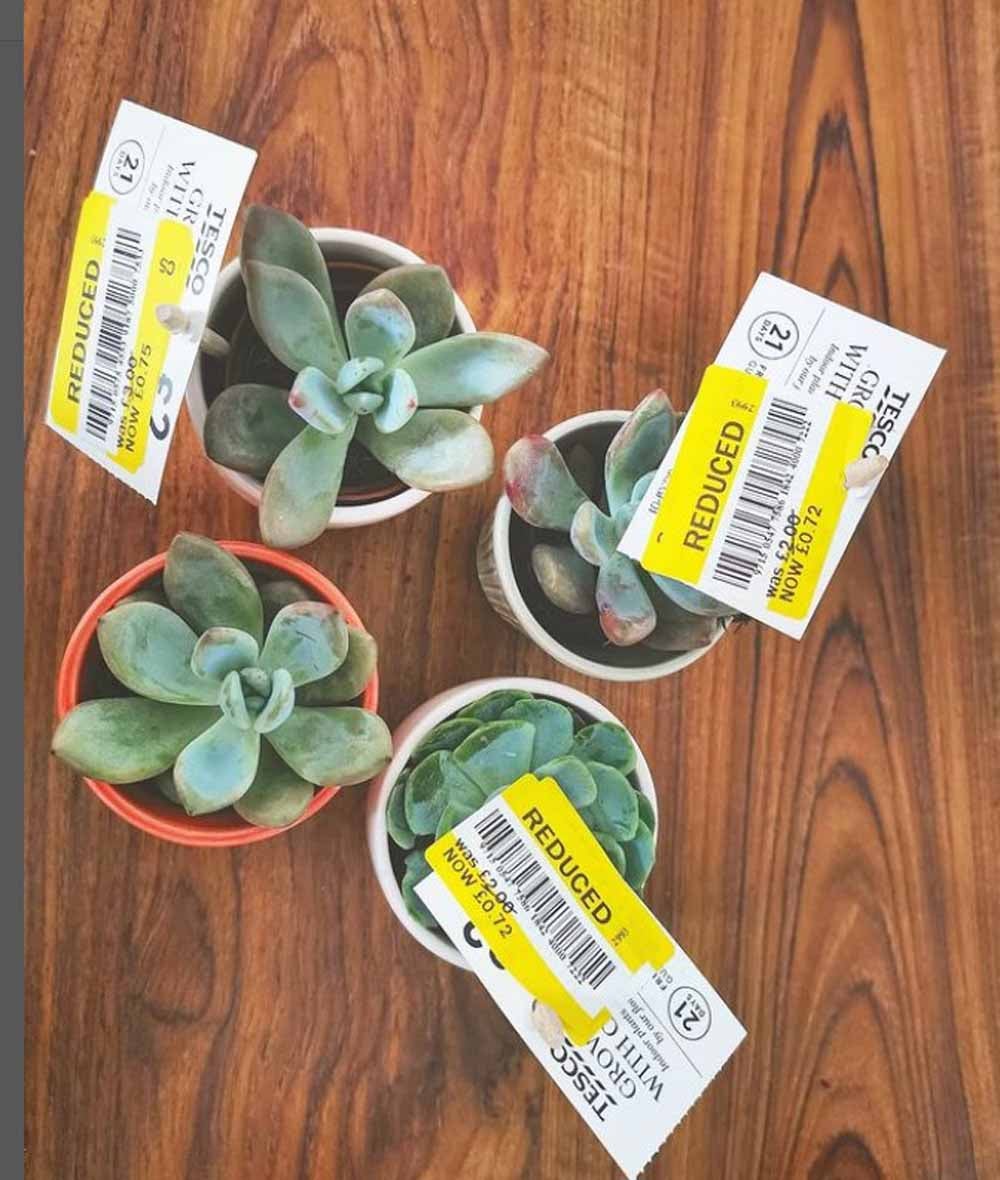

Rosie has sourced everything from cut price baby food to meat for a penny by stalking the yellow sticker aisles. She also gets non-perishable items like houseplants and gifts, explaining: “It’s worth looking in all the aisles for reductions.

“If it’s a change in season or there’s only a few of something left, it’s more cost effective for the supermarket to just get rid.”

Local shops can also offer savings, she said.

“I’d recommend speaking to your local greengrocer or butcher and asking what the cheapest cuts are, how they can be stretched, if they can adjust servings.

“You’re making savings as you have a professional helping you.”

“I’d also recommend cutting down on meat and supplementing with mushrooms and lentils.”

She added: “You can easily halve the portion of mince in a bolognaise for example. Bulk it out and you’ll never know the difference.”

Food waste can bring savings too.

She said: “I keep vegetable peelings and scraps in the freezer for stock.”

“I use things like parsnip shavings in bars that I made for my little boy.

“It’s something that would otherwise have been thrown away.”

And Rosie suggests joining forces with friends and family to buy and share items in bulk such as rice.

She added: “You could do things like clubbing together with workmates and each batch cooking five of the same meal.”

She added: “Swap them round, and you all have a different meal for every night of the week but have only paid for one.”

Rosie also recommends searching for food waste fridges online in your local area as these are often open to the community and are a way of getting cheap or free food which would otherwise end up in landfill.

She said: “We all need to be less ashamed. I lived through the last recession. It was such an isolating experience.

“If we are all more open and willing to share savings, then we can do it together.”

Apps like Olio, which allows surplus food to be shared, and Shopmium, where you find money-off offers, are well worth checking out and Rosie suggests looking in your local paper and even junk mail for coupons.

And she uses loyalty points too, saying: “It’s always worth looking on the Nectar app.

“I got a whole haul of things for 20p once. Often they’ll have specific things to buy, like little bits of garlic and ginger that give great points.

“I’ve paid for furnishings and a whole Christmas dinner with those points.”

Rosie’s money saving ways even helped out with her wedding in September 2018.

She saved thousands by finding free decorations, getting a reduction on her hotel room, using coupons to source a lucky dip of items like bottles of wine as wedding favours and making her own wedding cake.

When it comes to clothes, Rosie’s are mainly second-hand from charity shops and Vinted.co.uk, and she saved hundreds on welcoming her baby son as she got so many hand-me-downs from loved ones.

She scours Facebook Marketplace for other items and said: “Even my sofa was a third of the ticket price as it was ex-display.”

“People need to stop being so worried about things being shiny and new. Not only is it cheaper but it’s better for the environment.”

Planning ahead is another of Rosie’s top tips. She said: “I shop out of season as you get the best bargains.

“I am already looking at Christmas gifts. Superdrug for example often have Christmas sets on sale for 50p in the summer.”

Rosie also threatens to leave subscription services, saying this often leads them to offer her deals, and goes through her outgoings every month with a fine toothcomb.

I’ve had people who are on social media living these enviable lives but are quietly messaging me, asking how to make a few pounds stretch

As her Instagram account has gained popularity, and more than 7k followers, Rosie has received requests for help from unlikely sources.

She said: “I’ve had people who are on social media living these enviable lives but are quietly messaging me, asking how to make a few pounds stretch or asking what time a food waste hub will open.

“Some haven’t been paid or earned anything for months. It’s at complete odds with this lifestyle they are portraying.”

But Rosie is determined to bring hope and her latest mission is to show people that you can buy nutritious food on a tight budget, no matter what supermarket you have near you, including the pricier shops.

Planning to visit all the major supermarkets, she said: “I am going to show that you can stretch a tenner to a proper shop in any one of them, even Waitrose.”

Starting with the Co-op, Rosie says she bought enough food to make breakfast, lunch and dinner for five days for just ten pounds.

Rosie’s meals included pancakes with berry compote, egg fried rice and corn fritters with eggs.

She said: “It’s not the sexiest food but it’s absolutely sustainable. It would keep people full and give them ideas.”

For Rosie, there is no shame in saving whatever money she can.

She said: “The main thing I want to get across is that you can live frugally and have dignity.”