Sri Lankan president says he is seeking to defer loan payments until 2028 amid economic crisis

Sri Lanka’s president says that he is seeking a loan repayment moratorium until 2028 as the debt-ridden county tries to emerge from bankruptcy

Sri Lanka's president said Wednesday that he is seeking a loan repayment moratorium until 2028 as the debt-ridden county tries to emerge from bankruptcy.

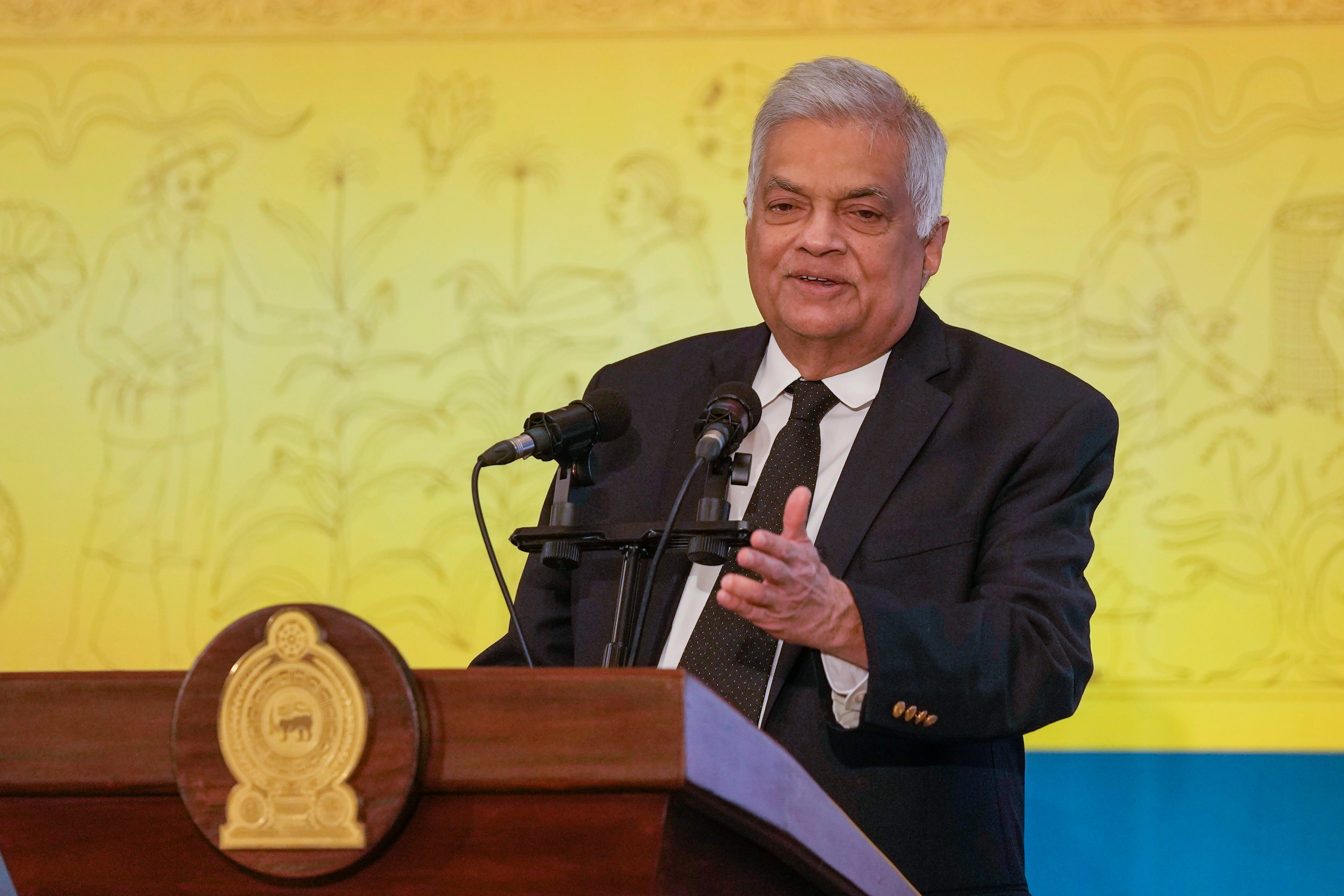

President Ranil Wickremesinghe told Parliament the government is asking lenders to accept a plan to defer payments for five years and then pay down the debts from the beginning of 2028 through 2042.

Sri Lanka declared bankruptcy in April 2022 and suspended repayments on some $83 billion in local and foreign loans amid a severe foreign exchange crisis that led to a severe shortage of essentials such as food, medicine, fuel and cooking gas, and hours-long power cuts.

“Our goal is to obtain temporary relief from debt defaults from 2023 to 2027. Subsequently, we plan to diligently work towards repaying the loans in the period from 2027 to 2042,” Wickremesinghe said.

By 2022, Sri Lanka had to repay about $6 billion in foreign debt every year, amounting to about 9.5% of GDP. The government aims to reduce debt payments to 4.5% of GDP through a negotiated debt restructuring, Wickremesinghe said.

Despite improve economic indicators and ends to the worst shortages, Sri Lankans have lost buying power due to high taxes and currency devaluation, while unemployment has remained high as industries that collapsed at the height of the crisis have not come back.

Last year, Wickremesinghe told Parliament that he is asking to reduce the loans by $17 billion.

Sri Lanka is currently under a four-year bailout program from the International Monetary Fund, through which $2.9 billion is to be disbursed in tranches after biannual reviews.

Sri Lanka has received two payments so far, after receiving promises of debt forgiveness from major creditors like India, Japan and China.

The government is currently talking to private creditors seeking a final agreement.

The worst economic crisis in Sri Lanka's history created public unrest that drove then-President Gotabhaya Rajapaksa to flee the country and resign.

Since Wickremesinghe took over in July 2022, he has managed to restore electricity and shortages of essentials have been largely abated. Sri Lanka's currency has strengthened, inflation has dropped from 70 percent to 5.9 percent, and interest rates have fallen to around 10 percent.

However, Wickremesinghe faces public anger over heavy taxes and the high cost of living.

Wickremesinghe said he hopes to exempt school books, equipment, health equipment and medicine from an 18 percent Value Added Tax in an effort to relieve some of that burden.

Bookmark popover

Removed from bookmarks