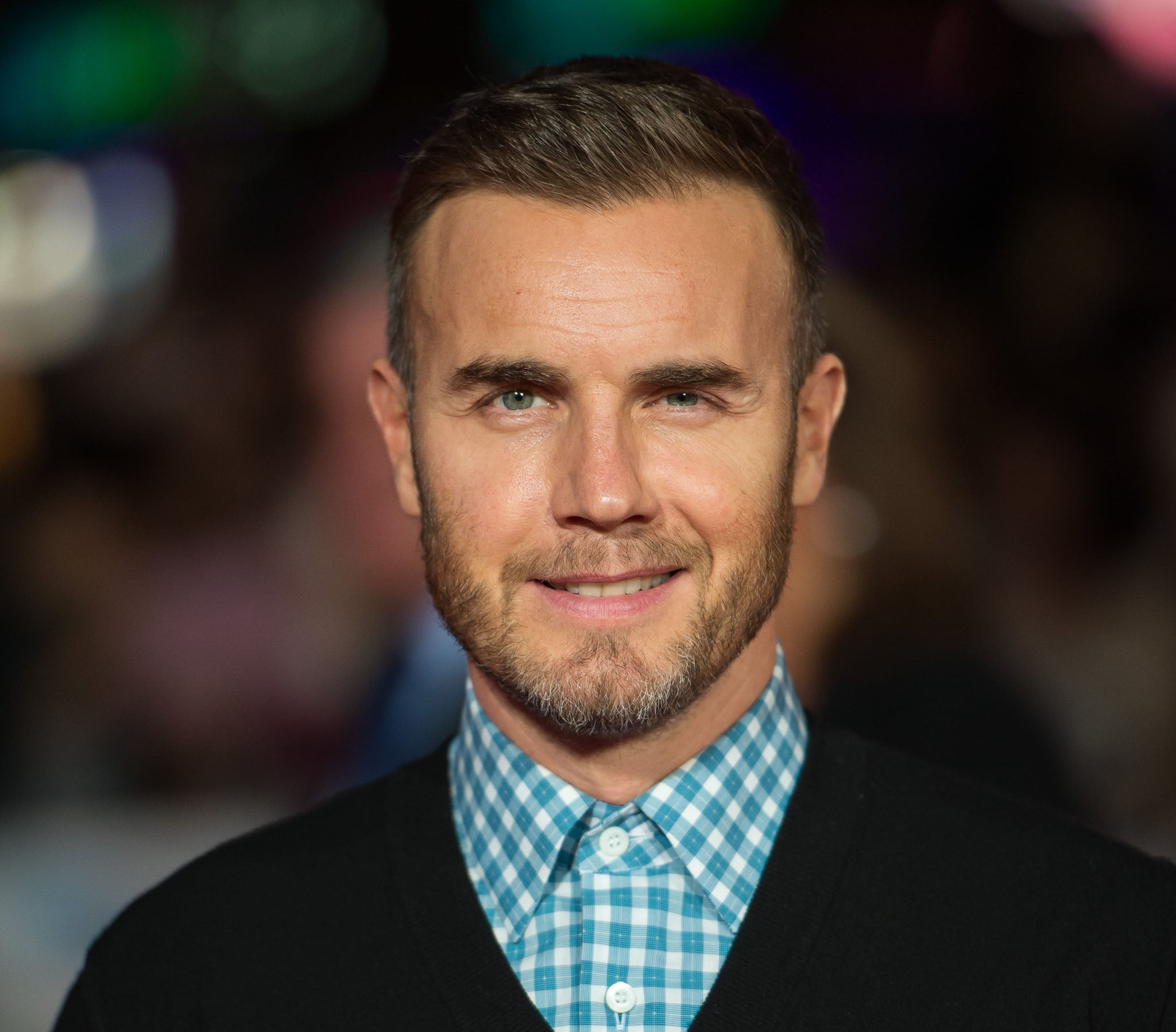

Gary Barlow apologises over tax avoidance before quickly announcing new Take That album

The singer has pledged to settle the situation “ASAP”

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Gary Barlow has apologised over tax avoidance allegations and has pledged to settle his affairs “ASAP”.

The singer, along with Take That members Howard Donald, Mark Owen and their manager, Jonathan Wild, reportedly invested £66m in Icebreaker partnerships which were billed as music-industry investment schemes.

However, in May, a judge ruled that the initiative was a tax-avoidance scheme and HM Revenue & Customs is now expected to demand repayment of the tax relief. The four have been involved in the scheme since 2010.

Many called for Barlow to be stripped of his OBE, although David Cameron rejected the request.

Barlow has now addressed the claims for the first time on Twitter.

He then shortly after announced news of a forthcoming new Take That album.

In July, new allegations emerged that Barlow had been avoiding taxes through an investment scheme called Liberty.

Other investors in the Leeds-based tax strategy include Michael Caine, Katie Melua, Anne Robinson and Paul Nicholson, a loan shark convicted of rape. They were among more than 1,600 who allegedly tried to shelter £1.2billion, making it one of the biggest known tax avoidance schemes.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments