Ajit Singh: the radical economist who carried out ground-breaking work on corporations and stock markets

Berkeley in the 1960s was a radical hotbed, and his time there shaped his life

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Ajit Singh was something of a contradiction: an atheist, yet proud Sikh, a radical challenger of orthodoxy, yet devoted Fellow of Queens’ College, Cambridge for over 50 years. Above all, however, he was an outstanding academic who believed in open debate with those from whom he differed over theoretical and applied work and, above all, policy implications.

His seminal research focussed on corporations and stock markets and their role in economic growth, at first in advanced economies and later developing countries. He made major contributions to the study of deindustrialisation, long-term structural change and economic growth in developed and developing economies and to development policy. His research led him to be an implacable critic of the neo-liberal policy consensus of the IMF, World Bank and Washington.

Born in 1940 in Lahore in pre-Partition India, he graduated from Punjab University, took an MA in Economics at Howard University, Washington, then in 1960 moved to Berkeley. The latter shaped his life. He took pride in being taught by the leading orthodox economists, Harvey Leibenstein, Tibor Scitovsky and Dale Jorgensen, but came under the influence of the radical thinker Robin Marris, who was working on his path-breaking The Economic Theory of Managerial Capitalism. Singh became his research assistant, and chose takeovers as his PhD topic, which resulted in one of his key publications, Takeovers: their relevance to the stock market and the theory of the firm.

Berkeley was a hotbed of student politics and led to the birth of the Free Speech Movement on the campus and the subsequent development of direct action. It was at this time that Singh developed from a quiet, serious young man into the firebrand that he became in Cambridge, after Marris invited him there.

He was appointed as a Research Officer at the Department of Applied Economics in 1963, followed by an assistant lectureship at the Faculty of Economics and Politics. Cambridge became his home until he died. He became a British citizen but remained a true Indian; his friends took great pleasure in watching him fail the “Tebbit test” when India were playing.

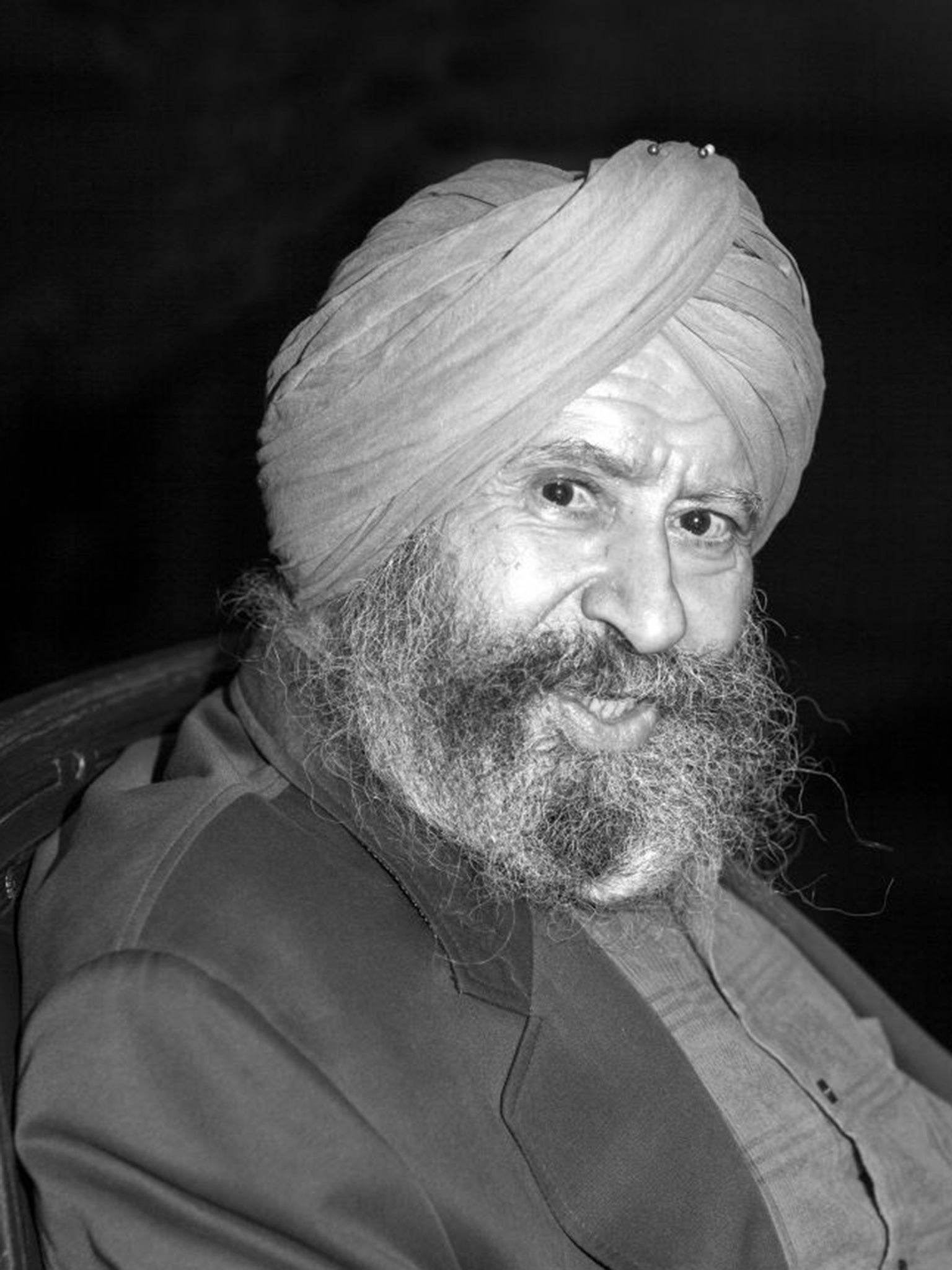

He was a remarkable sight in Cambridge during the 1960s and ’70s – black beard, brightly coloured turban, upright and athletic, full of energy and confidence. He was an active member of the Left and stout defender of non-orthodox economics and of student rights. This led to fierce struggles, some won, some lost, but despite the intensity of these debates he refused to drawn into a battle of personalities, preferring the battle of ideas. As a teacher he was inspirational, if a little awe-inspiring.

He worked with Geoffrey Whittington pioneering computer-based analyses of large scale corporate databases which underpinned decades of subsequent research by themselves and others. The publication of Takeovers was delayed by work on the book they co-wrote, Growth, Profitability and Valuation.

The theoretical approach to the analysis in Takeovers (1970) is rooted in the theories of the firm, which drew upon the 1930s work of Berle and Means. They had shown that corporations typically had dispersed share ownership and professional management. For reasons of personal aggrandisement and higher remuneration, management would pursue growth at the expense of shareholders’ value. Marris hypothesised that takeovers would constitute a market for corporate control which would curb managerial cupidity; Singh showed conclusively that in the UK there was no empirical basis for this view. His research over several decades with other colleagues demonstrated that mergers and acquisitions might yield quick financial returns to the participants but little long-term benefit to shareholders or the economy. On the contrary, they induce myopic behaviour, with companies too narrowly focused on their short-term valuation.

In the mid-’70s he studied the relationship between deindustrialisation, long-term structural change and economic growth, first in advanced countries and then developing economies. A key theoretical contribution was that a country needs a manufacturing sector large enough to ensure a sound balance of payments at a socially acceptable level of economic activity and of the exchange rate. This formulation is as relevant today as it was in 1977.

In 1982 he was diagnosed with Parkinson’s disease, but for the next 30 years he took on a daily workload and travel schedule that would have challenged a healthy young man. It was remarkable feat of willpower that lasted, without self-pity, until the very end.

From the 1990s onwards he concentrated on developing economies and the form of national and international policies relevant for their socio-economic development. He challenged the view that financial systems would converge towards liberal, deregulated stock market-based forms, as in the US, and away from more bank-based civil law systems such as Germany. He argued that the capital account liberalisation – easing restrictions on capital flows across a country’s borders – advocated in the 1990s would not be helpful. He was concerned that this would leave them exposed in times of adverse circumstances, and this concern proved to be well-founded. This debate mirrors those taking place in Europe following the financial crisis of 2008.

Ajit’s work led to many honours. He was appointed to an ad hominem Chair in Cambridge in 1995, and received the Glory of India Award in 2011 for “individual excellence… and for an outstanding contribution for the progress of the nation… and worldwide”.

He will be remembered as a man who relentlessly pursued knowledge he hoped would improve the human condition, the sine qua non of a left-wing social scientist. He was accessible to everyone, with no pomposity. He will be missed for his twinkling eyes, full of humour, his determination in the face of adversity and his considerable charm. He will be remembered for his loyalty to friends and colleagues, to his beloved Queens’ College and to the hundreds of students he taught and mentored over 50 years.

Ajit Singh, economist: born Lahore 11 September 1940; died Cambridge 23 June 2015.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments