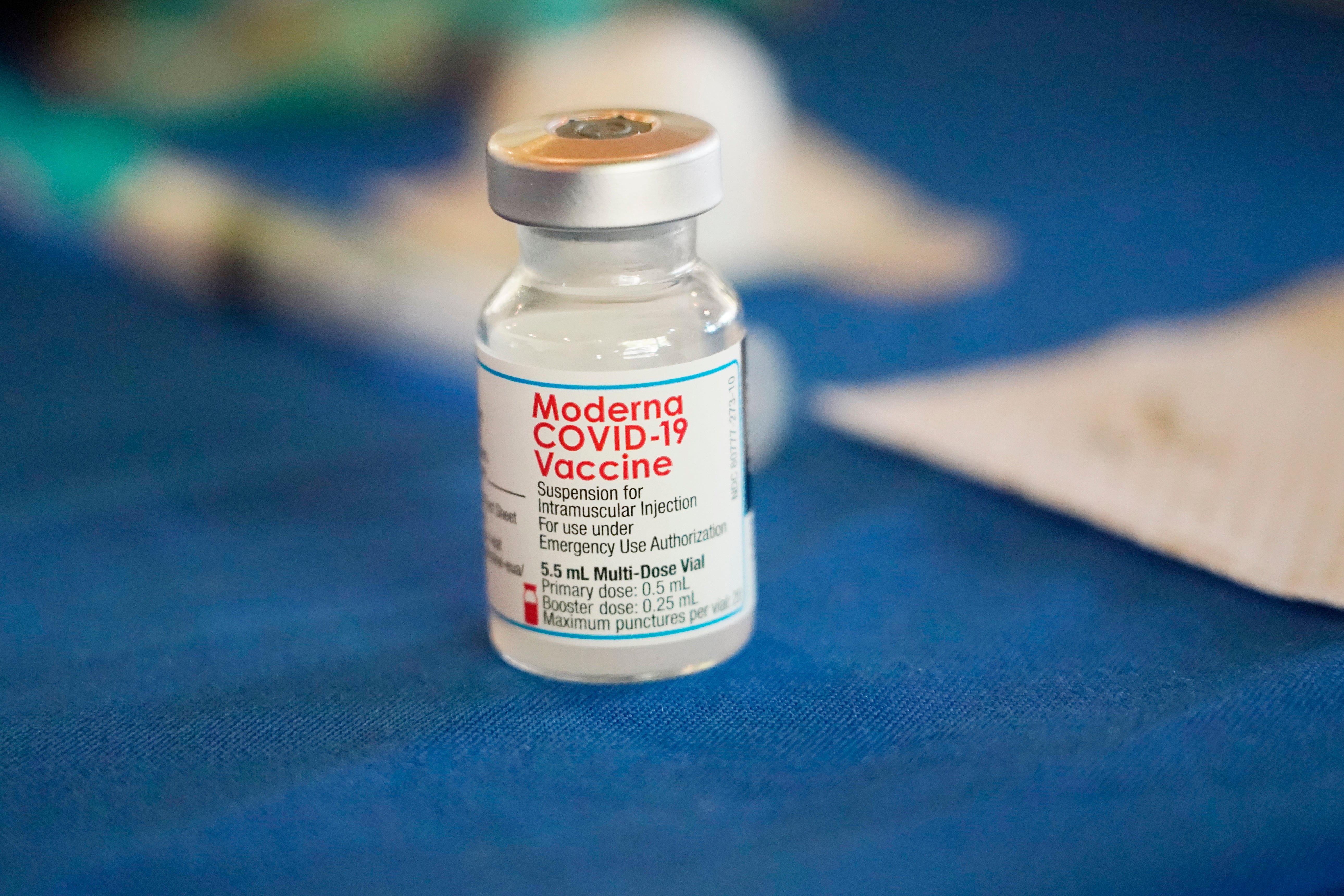

COVID-19 vaccine sales push Moderna past expectations in Q2

Better-than-expected COVID-19 vaccine sales pushed Moderna past Wall Street’s second-quarter forecasts

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Better-than-expected COVID-19 vaccine sales pushed Moderna past Wall Street’s second-quarter forecasts.

The company said that its Spikevax vaccine brought in $4.53 billion during the quarter. Analysts were looking for around $3.6 billion, according to FactSet.

Moderna shares surged at the start of trading Wednesday.

The company's vaccine sales represent a drop from the nearly $6 billion in sales the vaccine brought in during the year’s first quarter, when a virus surge through the United States pushed more people to seek protection.

But those sales could pick up again later this year.

Moderna has developed an updated version of its vaccine for a fall booster campaign that combines the original shot with protection against the omicron variant.

Federal regulators also recently endorsed the vaccine for children as young as six months old.

The COVID-19 vaccine is Moderna’s main source of revenue, outside of grants and money from collaborations. Total revenue climbed 9% in the quarter to $4.75 billion.

But operating expenses also swelled 78% to $2.3 billion for the vaccine maker, which has several products in late-stage clinical trials, the most expensive phase of research.

Net income plunged 21% to $2.2 billion in the second quarter, and earnings totaled $5.24 per share.

Analysts expected earnings of $4.58 per share on about $4.1 billion in revenue, according to FactSet.

More than 77 million people in the U.S. have become fully vaccinated with Moderna’s two-dose shot, according to the Centers for Disease Control and Prevention. Over 128 million have done so with rival Pfizer’s vaccine.

Another competitor entered the U.S. vaccine market last month, when federal regulators authorized a fourth option from Novavax, a protein vaccine that was found in large studies to be about 90% effective at preventing symptomatic COVID-19.

Shares of Cambridge, Massachusetts-based Moderna Inc. jumped more than 15% in morning trading to $185.54 while broader indexes climbed slightly.

___

Follow Tom Murphy on Twitter: @thpmurphy