The great leasehold hoax: When you buy a property, but don't ever own it

People lucky enough to leave the rental market could find themselves in the leasehold ‘property trap’. Angry at living under feudal rules, this class of mortgaged renters want the homes they paid for, says Harry Scoffin

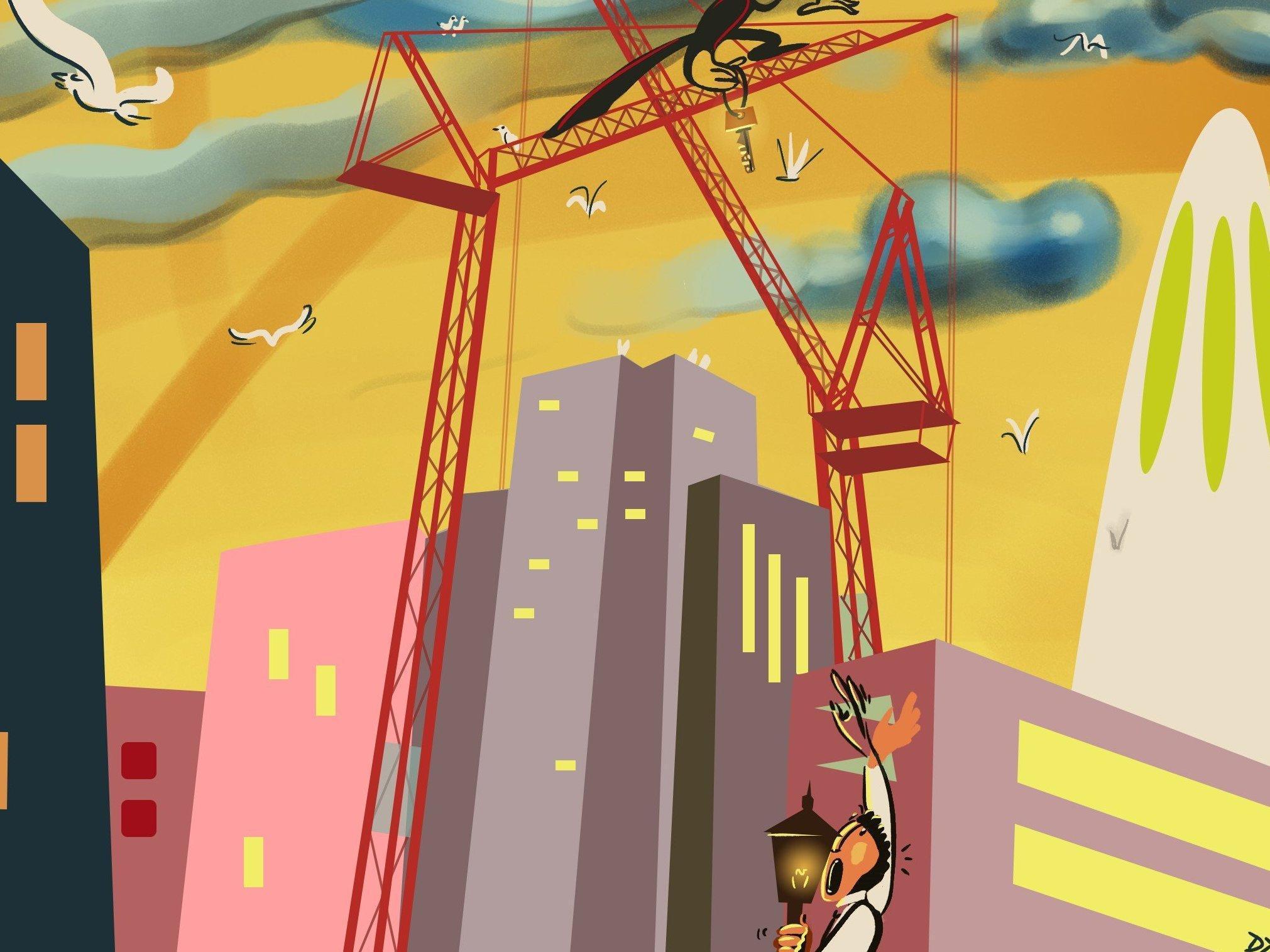

The sun is out in London’s Docklands. In the emerging metropolis at the east side of the capital, where cranes are a permanent feature of the skyline and one-bed flats can go for up to a million pounds, trendy Hubbub Bar & Kitchen is the last place you would expect to hear words like injustice and exploitation.

Outside in the beer garden, local residents gather over drinks to discuss possible names for a new self-help group. “Leasehold Freedom Fighters” is rejected for sounding too political. After some discussion, they settle on “Friends in High Places”. As the first meeting concludes, contact details are exchanged. They plan to meet again.

With Canary Wharf on the doorstep, and the long-awaited Elizabeth Line set to make the West End a 12-minute hop away, it is striking to find people so unhappy with where they are living. But leasehold does not care if you are rich or poor. It preys on those who have the home ownership dream, keen to avoid paying sky-high rents.

This diverse group spans bankers, media types, public sector and office workers, alongside retirees. Some have lived in the area long before its re-development and gentrification.

While it might be difficult to shed a tear for those fortunate enough to have bought in such a sought-after location, these people have in fact found common cause with a group of northern working-class mums, who last year established the National Leasehold Campaign (NLC) to tackle similar issues.

From newbuild houses on private estates across the northwest, to fancy flats in the shiny residential towers crowding the Isle of Dogs, properties originally marketed as offering ‘home ownership’ are uniting people up and down the country in a shared concern.

As London expands and demand for homes across the southeast continues to grow, developers are building ever higher and at much greater densities. Leasehold tenure is exploding as more and more flats are constructed. Unfortunately, many of those who do manage to leave the rental market, proudly brandishing the keys to their new home, fail to understand what leasehold means until it’s too late.

When you “buy” a leasehold flat, you are buying the right to occupy it for a certain length of time. Think of it as a long-term rental, with the minimum term 99 years. You pay most of this upfront. You’ll probably have to take out a mortgage to cover the purchase costs. But it’s not ‘yours’. You don’t own the flat, the building, or any of the land on which it sits. You have effectively signed up to become a renter with a mortgage. Even the law calls you a tenant.

The landowner, known as the freeholder, nominally owns the building and is your landlord. He or she will appoint a managing agent to run the estate, often on a commission basis. The freeholder enjoys an annual ground rent from you, which is essentially profit, unconnected to services that might be provided to tenants (cleaning of communal areas, for instance), which also come at a cost.

Through control of the managing agent, the landlord can choose how high the service charges are set (although the law states that charges must be ‘reasonable’). And he has the all-important power to award contracts to anyone he chooses to undertake works, irrespective of the cost, quality or (say critics) even necessity of the job. But you have to pick up the tab. Every time. There are short and long leases, with leases running down to below the 80-year mark deeply unattractive and hard to remortgage.

Although your charming estate agent may suggest that a 999-year lease is as good as owning the property outright, this is still a glorified tenancy. You will still have to deal with a landlord and his agents when things go wrong.

The landlord has the all-important power to award contracts to anyone he chooses, irrespective of the cost, quality or even necessity of the job. But you have to pick up the tab

“Recently we have seen an erroneous narrative being propagated that freeholders are ‘noble custodians’ of the building and serve some valuable service to the leaseholders. Nothing could be further from the truth,” says Louie Burns, managing director of Leasehold Solutions. He describes them as an asset class, using feudal property laws to make themselves owners of the buildings by proxy.

“They own the buildings to make as much money as they possibly can from them,” he adds. “It shames us as a nation that this feudal, iniquitous system is still thriving in the 21st century when the rest of the world have rid themselves from it.”

But how could such an unjust system come into being in the first place?

After seizing all land in the name of the crown, and under threat from the landowners he had just dispossessed, the new King William I had to act fast to stay in power. The year was 1067. He consolidated his regime by gifting some of his land to a highly select group of people. These palace favourites, the lords, rushed to break the freehold land into tiny parcels and sell them on as leases to lesser men for agrarian use. The innovation allowed for a perpetual form of land ownership.

Leasehold would continue to shape patterns of class formation in early modern England, becoming a key instrument of capital accumulation for the wealthy during the industrial revolution. As people deserted the countryside for the cities, the descendants of William the Conqueror’s noble class were uniquely well placed to seize the opportunities of this new era.

With their monopoly on land, they introduced “building leases” to allow for the building of flats on their estates. Hard-working people became glorified tenants, with freeholders gorging on the ground rents, license and permission fees, building insurance and maintenance charges. Fast-forward 200 years, and little has changed.

With nine out of 10 newbuild properties being sold as leasehold in London today, this is a rigged market. If you want a flat, it almost has to be leasehold. Although there is an established co-operative mode of property ownership for flats, “share of freehold”, this has been shunned by developers and investors as it offers none of the lucrative opportunities that they enjoy with leasehold.

A newer, more advanced form of tenure, “commonhold”, made the statute books in the early 2000s. Commonholders, unlike leaseholders, would own their flats outright and, through an association, own and manage the common areas collectively. With no third-party landlord, residents would be in the driving seat. They would appoint the managing agent. Curiously, London has just one commonhold scheme in existence.

Although it was assumed that commonhold would ultimately make leasehold obsolete, as savvy buyers sought true home ownership, it never took root because of vested interests and poorly drafted legislation.

Conservative MP Crispin Blunt blames leaving it to the market. By splitting the land into freehold and leasehold interests, developers can sell leasehold properties to unsuspecting buyers, pocketing the ground rents through their continued ownership of the freehold, and make a fortune in the process. Still not satisfied, many choose to sell on the freehold to faceless offshore investors.

“Profit making businesses such as housing developers cannot be expected to freely and voluntarily disclose their own ‘monetisation maximisation’ model,” Blunt says.

The MP’s intervention raises questions about our democratic politics. Twenty years after government described the leasehold system as “flawed to its roots”, the question remains: why haven’t we killed it off yet? Is the corporate lobbyist really more powerful than the consumer homebuyer?

There is growing anger from leaseholders in flats who want to be free of “hold”. We hear their stories at the Isle of Dogs beer garden. They have suffered in silence for many years and paid the service charges without question. Yet because these increased modestly each year, leaseholders often didn’t know what was happening until they found themselves struggling to sell their leases on the open market.

Their home was a depreciating asset all along, even with a residential tenure supposed to last a millennium. The financial nightmare gets even worse when buildings are left to deteriorate – the condition of tower blocks has little to no impact on the value of the freehold title or associated ground rent portfolio. The freehold landlord has bought a cash machine. He doesn’t need to worry about keeping the leaseholders happy.

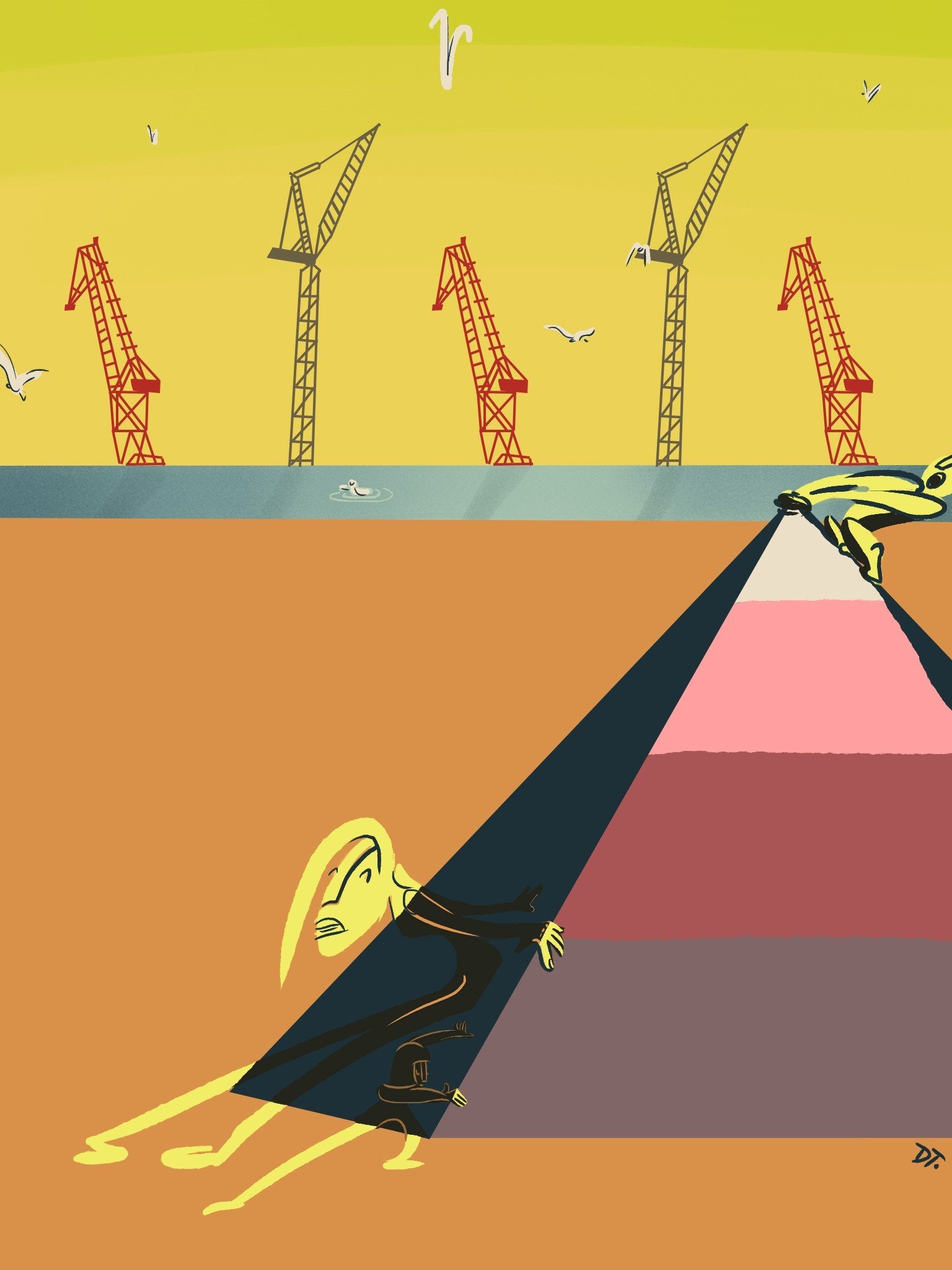

And those leaseholders who went public with their experience in the past risked angering their neighbours, who did not want to see the value of their homes affected by negative publicity; some faced threats of legal action from the freehold landlord. And when your landlord controls every element of the way your block is run, right down to whether your windows get cleaned, it is understandable that many people preferred to stay quiet.

Unsuspecting first-time buyers signed leases with toxic doubling ground rent clauses. When they wanted to buy the freehold, they found it had been sold on to shadowy offshore investors

Things changed when the big developers applied the leasehold model to houses, many of which were made available through the government’s Help to Buy scheme. They targeted the northwest, where 69 per cent of houses sold in 2016 were leasehold. Unsuspecting first-time buyers signed leases with toxic doubling ground rent clauses. And when they wanted to buy the freehold, they found it had been sold on to shadowy investors who had either taken it off the market or quadrupled the cost.

Trapped in unsellable, newbuild leasehold houses, three brave women decided to take on the industry and government. They wielded placards outside new housing developments that were being sold off-plan, warning prospective buyers to avoid leasehold products. They even had themselves chained up as they sat in mock prison cells. Politicians and the media started taking notice, with the wider “fake home ownership” scandal coming under scrutiny.

Joanne Darbyshire, a co-founder of the NLC, says the campaign moved quickly to broaden its reach by articulating the experiences of leaseholders in flats.

“It didn’t take long for us to realise that the leasehold scandal was so much more than leasehold newbuild houses,” she says. “Newbuild flats were also being sold with onerous ground rent terms and we learnt about the immoral and unethical behaviour of a number of freeholders. We knew the NLC had to campaign for all leaseholders.”

With more than 12,000 people now part of the NLC Facebook group, which is being used to direct leaseholders to complete consultations on reform, Darbyshire and her fellow campaigners are giving those who live in flats a newfound confidence to stand up and be counted. After the northwest, London is the next highest represented area on the NLC.

Labour MP Jim Fitzpatrick, whose constituents are attempting to overcome collective action problems with Friends in High Places, says: “Whether it is spiralling service charges, inflated refurbishment costs, fraudulent insurance premiums, obstructing residents’ associations being formed or various other ways to cheat decent residents, including forfeiture, the rules have to change.”

His Poplar and Limehouse constituency has the second highest number of leasehold properties in the country, after the City of London and City of Westminster. In 2016, Poplar and Limehouse saw the highest number of leasehold properties sold across England and Wales, at 97 per cent.

Whether it is spiralling service charges, inflated refurbishment costs, fraudulent insurance premiums, or various other ways to cheat decent residents, including forfeiture, the rules have to change

Anxious to ease the housing crisis, Tower Hamlets council is approving leasehold developments all the time. It did not respond to requests for data on what some have identified as a new, more disturbing trend within the murky world of leasehold. The emergence of mixed-use schemes, where squeezed local authority and prospective buyer are enticed by the prospect of building a new school, doctors’ surgery, bars, restaurants and shops under newbuild flats, demonstrates the way leasehold is taking over. Where buildings are over 25 per cent non-residential, developers have artfully curtailed residential rights to almost nothing.

An investor who gains the freehold of a mixed-use building can use his total control of the service charges from the residential floors to subsidise his commercial operations. Of course he’s not supposed to do this, but the ease with which service charge accounts can be delayed and fudged, and residential spending conflated with commercial makes it a temptation few will resist. If you don’t need to pick up the tab, why would you?

The freehold landlord is safe in the knowledge that while leaseholders theoretically hold the power to win disputes at the property tribunal, the chances of them finding the time and resources to cobble a case together against him are slim. People have lives, families, jobs. How many can dedicate the months, if not years, a legal battle can take?

And why should a flat dweller have to go to court to force his landlord to clean his windows or repair his lifts or employ decent door staff for a reasonable cost? Especially when that landlord can bill him through the service charge for his own legal costs. Yes, go to the tribunal and if you lose you cold pay both sides’ legal costs. Think of that playground game where the bully forces his victim to smack himself round his own face and you’ve pretty much got the leaseholder’s plight.

And to top it all off, the tribunal is not even a court equivalent. According to Christopher Howarth, a senior researcher working in the House of Commons: “It does not have the time or interest for long and complex cases, does not take evidence on oath and is easily swayed by the legal firepower at the disposal of large landlords.”

Lacking the ability to break free of “hold” by buying out the freeholder, through a process known as enfranchisement, and also barred from the Right to Manage (RTM), a way of cutting out the landlord by making the managing agent accountable to leaseholders only, flat dwellers in mixed-use developments are in a special kind of leasehold hell.

The Law Commission, which has been tasked by government to review the law on enfranchisement to make it “easier, cheaper and quicker”, claims there is no need to change the arbitrary 25 per cent rule. As developers move away from buildings that are predominantly residential, officials seem to be turning a blind eye to the fact that many more families and young people are set to fall into the leasehold property trap. The Law Commission has been inviting views on its enfranchisement. Leaseholders will certainly be kept busy, with a commission spokesperson confirming that “the Right to Manage consultation paper will be published in early 2019, and the consultation will last for two months”.

They say reform is on its way. But John Paterson, a veteran leasehold campaigner, is not hopeful. He says the government has known about the outrageous racket of leasehold housing since the 1980s. But there has been no meaningful change.

Paterson feels sure he knows where this latest chapter will end. “The government likes to stick with 1925 Law of Property and the idea of caveat emptor. It will consider that it has warned of the problems of leasehold tenure and, therefore, if individuals fail to heed these warnings it is their own fault.”

Paterson is not far off. The current administration seems content to sit back and watch existing leaseholders face surging ground rents. It hides behind the argument that intervention would set a ‘dangerous’ precedent. However, they are not warning of the problems of applying leasehold to flats. If anything, they have embarked on “Project Save Leasehold”.

While Thatcher, Major and Blair envisaged the end of leasehold, May’s administration defends the feudal system. The ruling party sees a cross-class alliance conspiring to bring it down – and it doesn’t like it.

Just last month, Heather Wheeler, the minister for housing and homelessness, claimed in parliament that “leasehold can be an effective tool for making multiple-ownership more straightforward”. Within minutes, her claim was ridiculed online. In surprising numbers, leaseholders were citing US condominium and Australian strata-title as superior models to the leasehold regime.

Wheeler’s colleague, the housing secretary James Brokenshire, has demonstrated his personal commitment to “Project Save Leasehold”. He is engaging in what campaigners have called “death-by-consultation”. Not only that, he is actively sabotaging the plans of his predecessor, Sajid Javid. Private Eye says choosing to set ground rents on new leases at £10, as opposed to making them zero financial value, will ensure leasehold persists.

With a housing target of 300,000 new homes a year by the mid-2020s, existing leaseholders are pained at the thought of yet more innocent homebuyers falling into the leasehold property trap. As a party which says it is committed to the principle of home ownership, it is ironic that the Conservatives are effectively forbidding young people from owning their own homes by allowing flats to be sold as tenancies. England and Wales are the only countries left that have this feudal system. In failing to act against this burning injustice, the Conservative Party may very well be signing its death warrant.

Back in the Isle of Dogs beer garden, leaseholders mention a new development going up. They call it “Desmond Town”. Richard Desmond, the ex-press baron, wants to create an income stream of more than 1,500 new homes. There will be a new secondary school, healthcare services, lifestyle facilities, and restaurants and bars. Unfortunately, residents will have no way of buying him out. And if current rules stay the same, they will have no ability to get control of their building and service charges. As London Docklands continues to be a construction site, Friends in High Places has a huge fight on its hands to end leasehold for good.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks