How can Britain stage an economic recovery after the Brexit crisis?

From his booklet, ‘Beyond Brexit: Liberal Politics for the Age of Identity’, Liberal Democrat leader Vince Cable explores how the UK can prosper socially and financially in the 2020s

Without an effectively functioning economy, such objectives as “fairness” cannot be realised, and political extremes flourish. What Britain needs to prosper socially and financially in the 2020s is a longer-term strategy for sustainable growth which addresses the country’s deep failings in respect of skills, short-term financial horizons and housing. And, now, those of us who oppose Brexit and economic nationalism generally face the challenge to say how we would improve the functioning of an economy damaged by the financial crisis and then, again, by Brexit. Good economic management will be more critical than ever.

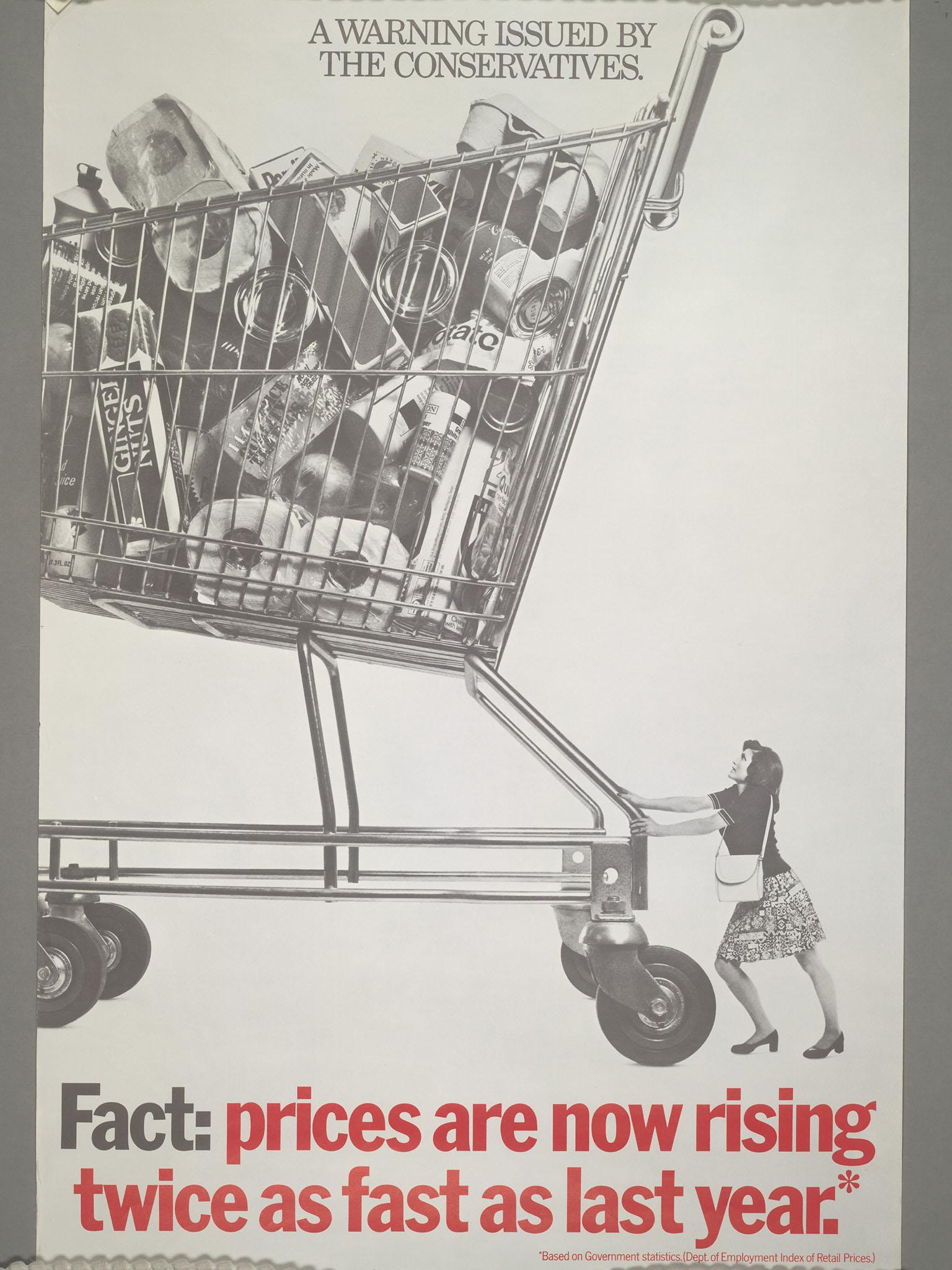

In the late 1960s and 1970s Britain suffered from “stagflation”: rates of inflation well above historic trends and occasionally reaching double figures (leading to a balance of payments crisis under a fixed exchange rate system) combined with slow growth relative to developed-country comparators.

What followed was a revolution in policy terms which came to be known as “Thatcherism” (with similar reactions elsewhere, notably the US): a fundamental switch from state ownership and controls to much greater faith in private ownership and market freedom (and with it, toleration of greater inequalities); independence for central banks to control inflation; fiscal rules to stop the build-up of unsustainable deficits and debt; and full-blooded engagement with an open “globalised” economy through trade, financial markets, international investment and (to a degree) migration. The Blair/Brown era of Labour government cemented this transformation.

Yet after the 2008 financial crisis no such fundamental rethinking of economic policy has occurred. On the British left (as also in the US and France) there is much denunciation of “neoliberalism” and austerity but little indication of what this means in practice except in a few exotic (and disastrous) experiments, as in Venezuela. There has been a revival of belief in nationalisation, though not in explaining how it would actually work.

There is a reaffirmation of the belief in more progressive taxation, but no developed economy has yet moved strongly in that direction. And led by the Democrats in the US, the emergence of the “Green New Deal” is proving a rallying point for mobilisation around a powerful and compelling theme – combatting climate change – albeit, so far, without realistic thinking on the financing of it.

If there has been any kind of paradigm shift it has been a revival of economic nationalisation, mainly in the form of trade protectionism (and anti-immigrant attitudes) in the US and disengagement from EU integration in Britain by the decision, as part of Brexit, to leave the EU Single Market.

It makes no sense to go back to the 1970s, as some on the left wish to do: restoring price, rent and exchange controls (or trying to); renationalising utilities and the manufacturing industries which used to constitute the “commanding heights” of the economy; abandoning fiscal rules in the name of “ending austerity”; bringing back penal tax rates on high incomes and corporate profits.

Nor is there much attraction politically (or economically) in taking the Thatcherite revolution to another level, as some on the Brexit right wish to do: scrapping many of the remaining labour, consumer protection and environmental regulations; pursuing as a matter of doctrine, rather than fiscal necessity, a “small state” agenda in respect of tax and government spending.

In reality there are market failures and government failures. Good policy is about getting a sensible balance between making use of markets where possible and government where necessary – not a philosophy that will appeal to demagogues, but correct, nonetheless. Economic competence is not a message that stirs the soul but, without it, rising living standards and socially progressive measures are not possible. And we start from a position where there are major elements in the current model that we should be fighting to preserve as well as some major failures to correct.

One of the big advances of recent years which populists of the right and left are trying to undermine is independent central banks, overseeing financial stability. Unsurprisingly, the Bank of England is one of the main targets of the Brexit right and the radical left, complaining about the “liberal elite”, as represented by the Federal Reserve in Trump’s US and the European Central Bank in the eurozone.

What is fundamentally at issue is the principle that day-to-day economic management, be it of monetary policy or financial regulation, should be left to politically independent “experts” acting on the basis of evidence. That principle should be defended as tenaciously as the principle that operations in NHS hospitals should be carried out by medical professionals rather than witchdoctors or cranks. I made my maiden speech in parliament in 1997 in support of Gordon Brown’s decision to grant operational independence to the Bank of England, one of the most important parts of his legacy.

Where politics come in is in setting the rules for the Bank to follow, reflecting the experience of a major financial crisis and the fact that inflation is no longer the issue it was a generation ago

Where politics come in is in setting the rules for the Bank to follow, reflecting the experience of a major financial crisis and the fact that inflation is no longer the issue it was a generation ago (indeed, deflation has emerged as a real threat). The first changes could be to recognise the reality that the aim of policy, especially for interest rates, is to keep the economy growing as fast as possible.

The way of expressing this, technically, is to set a target of money GDP (inflation plus real growth) which is pretty much what has happened in practice. The second is to acknowledge that where inflation has been dangerously high is in the property market.

That is partly an issue of supply and demand, as I discuss below, but also of the availability of credit. Instead of politically driven, counter-productive and costly schemes like Help to Buy, the availability of credit should be determined by the Bank in what are now called “macro-prudential” policies. And third, one of the very painful lessons of the financial crisis is the danger posed by financial institutions that are not closely regulated (or supervised), and that accumulate high levels of leverage (debt), threatening the stability of the system.

I have argued that the British financial service industry and its collection of banks (and shadow or quasi banks which create credit like banks) is simply too big for a medium-sized country. Brexit will now reduce it, but unfortunately in a way which randomly cuts its export earning potential rather than by ending activities which are high risk and of questionable value. Adair Turner, the former financial regulator, and Mervyn King, the former governor, have described how we cannot simply apply sticking-plaster solutions to a financial sector suffering from fundamental instability

Perhaps the most serious issue, looking forward, relates to the vulnerability of the economy if we again face recession or depression (a period of falling production, wages and prices). The weapons to fight a crisis of this kind are heavily depleted. Interest rates are already close to zero. Government debt is already at levels which have historically occurred after times of war. The economy has been kept going by quantitative easing (the Bank of England buying government bonds to force down long-term interest rates, or purchasing assets in the hope that this will boost confidence to invest or spend). The side-effects (widening inequality of wealth) have become politically toxic.

In future, perhaps sooner than we think, the authorities may be forced into more extreme alternatives. Even if the international economic outlook is benign – which is increasingly unlikely – a disruptive Brexit could trigger a serious downturn requiring emergency action. One possibility discussed during the financial crisis, but not acted upon, would be for the government to finance its spending – either boosting spending through a tax cut, or handing out vouchers to spend, or investing in capital projects – by borrowing from the central bank. This is, in effect, “printing money”, the original “magic money tree”.

Were we to find ourselves in another major financial crisis, or a deep depression caused by other factors, such unorthodox measures would prove necessary. But it would be essential to maintain the separation between monetary policy, managed by technocrats on our behalf, and budgetary (fiscal) policy run by politicians.

If it were not, it is not difficult to see how populist politicians, if in power during the next crisis, could manufacture short-term popularity by seizing control of the Bank of England to harvest the “magic money tree”. Debasing the currency is bound, in due course, to have the same baleful consequences as it did for medieval monarchs and modern dictators. We should not be looking to the likes of Venezuela and Zimbabwe for a template for monetary policy.

All the more reason, then, to ensure that budgetary policy also operates within rules (though we can sensibly argue about what they are). The current battle between the European Commission and Italy over Italy’s chronic inability to set a sustainable budgetary policy reinforces that principle.

In Britain, the phrase “the end of austerity” has the effect, if not the intention, of conjuring up a world where budget rules can be broken or no longer apply. We should be having a proper national debate about how much the public is willing to pay in higher taxes (and what taxes) to pay for better financed public services. Liberal Democrats are clear that some rises in general taxation are justified, in particular to pay for healthcare, and that changes to the way we tax wealth are essential to fund the services and investment the public wants to see.

What makes no sense is vague appeals to have Scandinavian levels of public sector spending without any way to meet the costs in the long term – the stock in trade of the present Labour Party.

What is required are rules of the kind originally set out by Gordon Brown – and in the EU in the Maastricht conditions – requiring governments to balance their (current) budget over the economic cycle (an elusive enough concept), policed by an independent body (currently the Office for Budget Responsibility). The major unresolved controversy is what to do about public investment. In theory public investment should be able to pay for itself and therefore not add to government debt.

But in practice a lot of public investment, however worthy (like school buildings), simply adds to debt, and the Treasury treats all investment as no different from current spending (a source of some tension within the coalition). What is needed is an arms-length and professionally staffed body, perhaps constituted like the Green Investment Bank set up by the coalition, which can vet and promote public sector investment projects which the private sector will not undertake but which produce a clear, long-run economic return.

Railways and housing are obvious areas and the next generation of renewable energy. The ambition to mobilise political energy around a Green New Deal can be a central part of this investment provided it is separated from magical money.

The UK pension fund sector is very fragmented, and a proactive government should amalgamate them into bigger wealth funds to enable them to diversify in this way

There is a deep pool of potential infrastructure investment in pension funds. But the UK pension fund sector is very fragmented, and a proactive government should amalgamate them into bigger wealth funds to enable them to diversify in this way.

Another important role for public investment is to pump-prime private investment in some of the “left behind” areas of the UK. There is a category of projects which do not require financial subsidy but do require the “comfort” of government co-financing or enabling investment in the form of a key piece of infrastructure. The regional growth fund operated by my department during the coalition (since relegated in importance) provides a model.

Private businesses bid for investment funds. These were vetted by a politically independent team of advisers led by Michael Heseltine and then subject to a detailed economic evaluation before being signed off by ministers. In this way, substantial new investment was generated without the overheads associated with the earlier regional development agencies. Future investment could be via some hybrid of the regional growth fund and regional development agency model, seeking to devolve decision-making away from Westminster and to put a local democratic process in place to oversee it.

The big underlying issue behind budgetary (tax and spending) policy is how big the state’s share should be. The effect of a period of “austerity” under the current, Conservative, government has been to take the public spending share of the economy (including investment) from 41 per cent in 2015 to 39 per cent in 2018 (and tax revenue as a share of the economy largely unchanged from 36.2 per cent to 36.15 per cent).

Under the coalition the public spending share went from 43.75 per cent to 41 per cent (and tax from 35.2 per cent to 36.2 per cent). Despite the fierce ideological arguments around austerity, the shares haven’t greatly changed. The “small state” revolution, if that was what it was, didn’t get very far. And Britain is somewhere in the middle ground of developed economies, spending and taxing far less than some countries (France and Sweden) but more than others (the US).

Here, economically liberal and social democratic values pull in opposite directions. My instincts are that important public goods are underfunded (health, education, policing) and taxes need to be raised to pay for them. The Lib Dems “1p in the pound” on income tax is a statement of intent to move in that direction; but we have yet to see how much appetite there is for funding a much bigger state (as opposed to taxing “someone else“ (the super-rich or multinationals).

One important question, not raised since the debate around the poll tax a generation ago, and its replacement by a new form of residential property taxation, is whether the tax base should change in a fundamental way. The one, big, radical reform which is crucial is to shift tax from work (income tax and national insurance) to land.

The more successful western economies have long appreciated that a judicious mixture of competitive private enterprise and state intervention works best

Land taxation has long been advocated as a form of tax which is economically sensible (it taxes something in fixed supply, encouraging efficient use), which cannot be avoided by shifting overseas (as can taxation of income and profit) and is relatively efficient (requiring collection from landowners rather than vast numbers of property owners). A prototype has been designed, replacing business rates by a landowner’s levy, which could progress from there to residential land (also replacing council tax). There are administrative and political challenges, but it is the direction in which we should be travelling.

Another fundamental change, which is obscured by arguments about how to squeeze more tax out of companies, is to shift to shift tax away from equity (risk capital) and on to debt, which is currently treated as tax-deductible. The coalition recognised the need to make this change as a step to a more entrepreneurial business sector but it has not yet been followed through.

Arguments about how to divide up the spending cake, or how to realise the tax revenue to pay for it, beg the question of what government can do to help the economy become more productive and environmentally sustainable. The more successful western economies have long appreciated that a judicious mixture of competitive private enterprise and state intervention (within agreed international rules) works best. The serious issue here is not how to create a “small state” dominated by Conservative ideologues or a “big state” fantasised by Corbynistas. It is how to make government smarter and more entrepreneurial. There are three specific things which British governments should be doing more of.

The first is that while Britain has a good record in promoting, financing and safeguarding the quality of scientific research, this is not true of innovation – translating science into new products and processes through investment. UK R&D spending (especially the D) for non-military purposes lags behind that in comparator countries. Tax incentives (R&D tax credits) have helped but are wasteful of resources compared to targeted investment by government alongside the private sector.

The Catapult network launched under the coalition through Innovate UK now provides a good structure, but it needs considerably more sustained government support. Professor Mariana Mazzucato has described the model of an entrepreneurial state working alongside the private sector, which has led to breakthroughs in space exploration, the internet and pharmaceuticals and will be necessary for future success in dealing with climate change or cancer.

Second, all the evidence suggests that a more educated labour force raises the performance of the economy. Britain should aspire to be a successful knowledge-based economy – ideally, the best-educated country in the world. There have been piecemeal attempts to raise school standards, particularly in core subjects like literacy and maths, albeit at the expense of creativity. And there has been a massive expansion of higher education, even if it is often simply satisfying a perceived need for paper credentials. The priority now is to help young people prepare for a world of rapidly evolving technologies in which traditional skills and professions are becoming redundant and the premium is on adaptability: learning how to learn.

There are two glaring failings at present. The first is the lack of resources for the FE sector, both in providing basic skills for young people who do not go to university and providing progression for many more people to progress to higher apprenticeship and other advanced training. The apprenticeship levy – essentially another employee tax – has badly set back progress that was starting to be made. Raising the demand and supply of quality apprenticeships must now be a priority. One way in which this could be made a reality is to put Britain to work on a radical programme of new house building with an associated skills academy to train people in construction.

Second, adult education has been allowed to atrophy. What is needed is a much stronger commitment to lifelong learning. The concept of Individual Learning Accounts, which was briefly tried but discarded two decades ago because of fraud and lack of financial control, should be revived as a way of giving adults an incentive to keep learning and relearning. I established a commission to take forward this proposition for the Liberal Democrats. It is possible to see how such a system would work with a state-financed Individual Learning Account of – say £10,000, topped up by private and corporate contributions used to finance tuition fees whenever they are incurred and across the range of higher, further and adult education without discrimination.

I know from my experience in government the enormous barriers to creating a level playing field between the various forms of post- school learning. Snobbery and ignorance play a big part. In the civil service and in politics there is a strong bias to traditional undergraduate learning (based on some imagined variant of Oxbridge colleges) as the “gold standard”. I don’t for one moment decry the merits of universities which have recently transformed the economic outlook of many provincial towns and, at best, can do wonders for creative and critical thinking. But in a world of scarce resources they have been wrongly allowed to crowd out equally valuable institutions of learning (and virtual learning).

My final role for the state is to build on the industrial strategy developed in my period as business secretary and before and continued by my current successor. The twin ideas are to develop public-private partnerships especially in areas of high risk and uncertainty into which the private sector alone will not venture; and, a related point, to provide longer-term horizons than capital markets will normally allow. There are successful experiences to draw on in automobiles, aerospace and life sciences. Examples include the development of the next generation of motor vehicles, including electric cars, the Aerospace Growth Partnership, sponsoring new biotech companies, and the promotion of the fintech sector.

Concretely, this will involve the government establishing priorities, a process sometime pejoratively called “picking winners”. The experience of the 1970s, including Concorde and the nuclear advanced gas-cooled reactors, provided many examples of failures which absorbed and wasted a lot of scarce capital. But recent experience, including mine, has suggested some useful lessons. One is the value of co-investment, so that the state leverages private investment rather than replaces it and goes with the flow of the market rather than against it. Recent experience with automobiles, aerospace and biotech, the Green Investment Bank and the Regional Growth Fund all followed this model.

Then, there are sectors like the creative industries, professional services, construction and IT, where there isn’t a demand for large amounts of state capital but for a good framework for training, intellectual property rights, better functioning credit and equity markets and funding of early-stage innovation. The work is often unglamorous, and this is not territory for ideologues and showmen. But there are undoubtedly areas where the state will need to go where the private sector currently fears to tread – for example, renewable energy, where recent decisions on solar and tidal make a nonsense of long-term sustainable energy strategy.

There is also too trusting a belief that competition will somehow naturally emerge as part of the workings of a market economy. In reality there are powerful forces working in the opposite direction, creating and entrenching monopoly power through the use of intellectual property rights – which may be necessary to spur innovation but also acts to protect monopoly positions – and through the sheer scale of new technology platforms. The next chapter deals specifically with this challenge.

This article is extracted with thanks from Sir Vince Cable’s booklet, ‘Beyond Brexit’, a collection of essays on the future of liberalism

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments