The magic money tree does exist, according to modern monetary theory

As the political climate turns against the acceptance of austerity, a new book argues it is time to reject the hegemony of neoliberalism

After seven years of austerity, we are accustomed to thinking of the economy as a household with the nation’s credit card maxed out, to paraphrase David Cameron. The fetishisation of debt translated into massive cuts to UK spending on public services. At the same time, there remains widespread public anger that the big banks continued to make record profits and bonuses in spite of George Osborne’s assurances that we would all be in it together.

That was then though. Both Cameron and Osborne have since departed. This year, the political climate turned on its axis. The Conservative majority of 2015 gave way to a hung parliament with 40 per cent of voters opting for Corbyn’s Labour. The electorate’s acceptance of austerity mantras had evidently reached its limit.

Against this backdrop, the publication of Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World could not be more timely. It is written by 65-year-old Australian heterodox economist William Mitchell and the journalist and author Thomas Fazi. The book’s introduction is topically titled “Make the Left Great Again”; a sentiment that will no doubt chime with many progressives.

It diagnoses that neoliberalism was not just a right-wing Thatcherite-Reaganite prospectus. The centre-left, as embodied by Mitterrand’s socialists in France, Blair’s New Labour and the Democratic Party in the US, was complicit in its imposition. This consensus culminated in the decimation of manufacturing, decline of union membership, the expansion of financial services, wage flattening, falling living standards and the privatisation of public services. At the heart of neoliberalism was the assertion that the free market is the supreme arbiter with the economy managed by technocratic expertise. The flip side of this depoliticisation resulted in ordinary people becoming alienated and disillusioned with the social democratic parties that formerly represented them. Instead they turned to anti-establishment (usually hard right) parties.

Furthermore, Mitchell and Fazi point out that the notion that neoliberalism is anti-state is a misconception. In fact, the state has been essential to the neoliberal project as became evident in the aftermath of the 2008 financial crisis. The state is not only required to bail out corporations and banks but to create new markets and in an authoritarian mould to police its citizens. However, Mitchell and Fazi intend to reclaim national sovereignty as part of a 21st century progressive vision. This is where modern monetary theory (MMT) comes in.

Bill Mitchell is one of its key proponents. MMT is one of those Alice in Wonderland, down the wormhole kind of concepts that neutralises every received wisdom – from that childhood conversation when your father sat you down to explain banks using saving deposits to invest in other businesses right up to politicians telling us that the UK is broke. In other words, prepare to be blown away and forget what you think you knew about money.

MMT essentially proposes that money is created ex nihilo or out of nothing. Whether it is private banks, central banks or governments, money is an abstract concept of ones and zeros. Thus, when your bank lends you a mortgage, it essentially creates money by typing it up on a computer. Similarly, the government has the power to create “fiat money” – that is money established by government regulation or law as opposed to currencies with intrinsic value, such as gold.

In effect, the usual dictum of “tax and spend” is inverted to “spend and tax” with spending stimulating jobs and growth, which can later be taxed. Taxation is not therefore a way of raising revenue but a tool for either controlling the money supply or shaping policy through incentives. Of course, it is much more complicated than that as certain conditions must be met. Public spending cannot be unlimited and must be commensurate to the capacity of the economy amongst other things in order to avoid hyper-inflation.

Both authors have been on a global book tour taking in the US and Europe. In London, Mitchell and Fazi gave their talk at the Newington Green Unitarian Church – one of Britain’s oldest nonconformist churches. Mary Wollstonecraft was the most famous member of its congregation and was inspired by the sermons of the radical minister Dr Richard Price in her thinking on the new French republic and the rights of women.

The setting is certainly suitable for the preaching of a heretical doctrine. In fact, I am reminded that it is the 500th anniversary of Martin Luther pinning his 95 theses to the door of a Wittgenstein church. The parallels are hard to overlook; then as now Europe was in crisis with Britain exiting the established order.

Huddled on a church pew for the interview, I ask Mitchell what exactly is MMT? He answers that it is “a lens through which we can understand the monetary system”. Remarkably, the elemental question – where does money come from? – does not have a settled answer amongst economists, experts and policy makers. Organisations such as Positive Money have already embarked on the process of demystifying money creation. I am reminded of the chapter “The Great Money Trick” in Robert Tressell’s The Ragged-Trousered Philanthropists in which loaves of bread are used to illustrate how the concept of money and surplus value (profit) guarantees perpetual penury for the working class and concentration of wealth for the ruling class.

So how might all of this play out post-Brexit? Mitchell and Fazi seem to be making the progressive argument for Brexit (nicknamed Lexit). This is in keeping with the old-left position that the EU does not represent genuine international solidarity. They acknowledge that it is difficult to make progressive arguments for sovereignty as nationalism has been condemned to a default reactionary position.

Yet polling demonstrates that sovereignty was the most common reason for people voting Brexit. Mitchell and Fazi reformulate a progressive definition of sovereignty as having democratic control over the economy rather than simply within ethno-nationalist parameters. According to Mitchell, sovereignty is absolutely fundamental in order for countries to exercise power over their money creation. As long as a country has its own central bank and currency then it is free to spend. While Greece, bound by the constraints of the European Central Bank and the euro, does not have this freedom. After the talk, Mitchell tells me that sovereignty entails having a currency issuing monopoly: “The reality is that national governments are the monopoly issuers of their own currency.”

Mitchell also debunks the idea that governments borrow money from international markets and with it the notion that they are hostage to the market. He has recently written a blog on how Corbyn should not be afraid of global markets. Mitchell cites the 2001 Argentinian debt default as demonstrating that a country can get away with it and recover. Similarly, Iceland imposed capital controls (measures to regulate capital flows in and out of a country) in order to steer the economy through rough waters after its banking system crashed.

In the same vein, Mitchell proposes that governments do not use bonds and gilts to raise revenue. He cites a previous Australian Conservative administration issuing debt when they were running surpluses as an example of the use of bonds as corporate welfare thus “exposing the game”.

At the recent Labour conference, Shadow Chancellor John McDonnell stated that Labour would take private finance initiative (PFI) contracts back into public hands. So how would financing of infrastructure work under a Corbyn government? At the start of the year, this question might have appeared absurd yet only this month The New York Times published an op-ed piece titled “Get ready for Prime Minister Corbyn”.

Here is where quantitative easing (QE) comes in. QE was intended to stimulate bank lending in the aftermath of the financial crisis. However, growth levels have remained stagnant in Britain and Europe. In reality, the banks simply said thank you for the free lunch and used QE to restore their balance sheets. Studies have shown that much of QE ended up contributing to stock market and property bubbles.

Economist Richard Murphy – whose work has focused on tax avoidance and the offshore world – proposed what came to be termed “people’s QE”. For a while, this was a central tenet of the Corbynomics programme. Murphy’s basic idea was that if QE could be used for the banking system, then why not use it to build new homes or create climate jobs? As long as sufficient value was created then the nemesis of hyper-inflation could be avoided.

It therefore appears that Theresa May’s oft-repeated refrain attacking Corbyn on the grounds that there is no such thing as a magic money tree is not exactly true. So if money can basically be created with the press of a button, then suddenly our world appears to be (pace Panglossian disciples) the craziest of all possible worlds.

At this point, you might understandably be asking why on earth we do not just spend our way out of the current mess. And while we are it – give the NHS more money, shelter the homeless and feed the poor of the world. This is where we come up against the ideological edifice of neoliberalism.

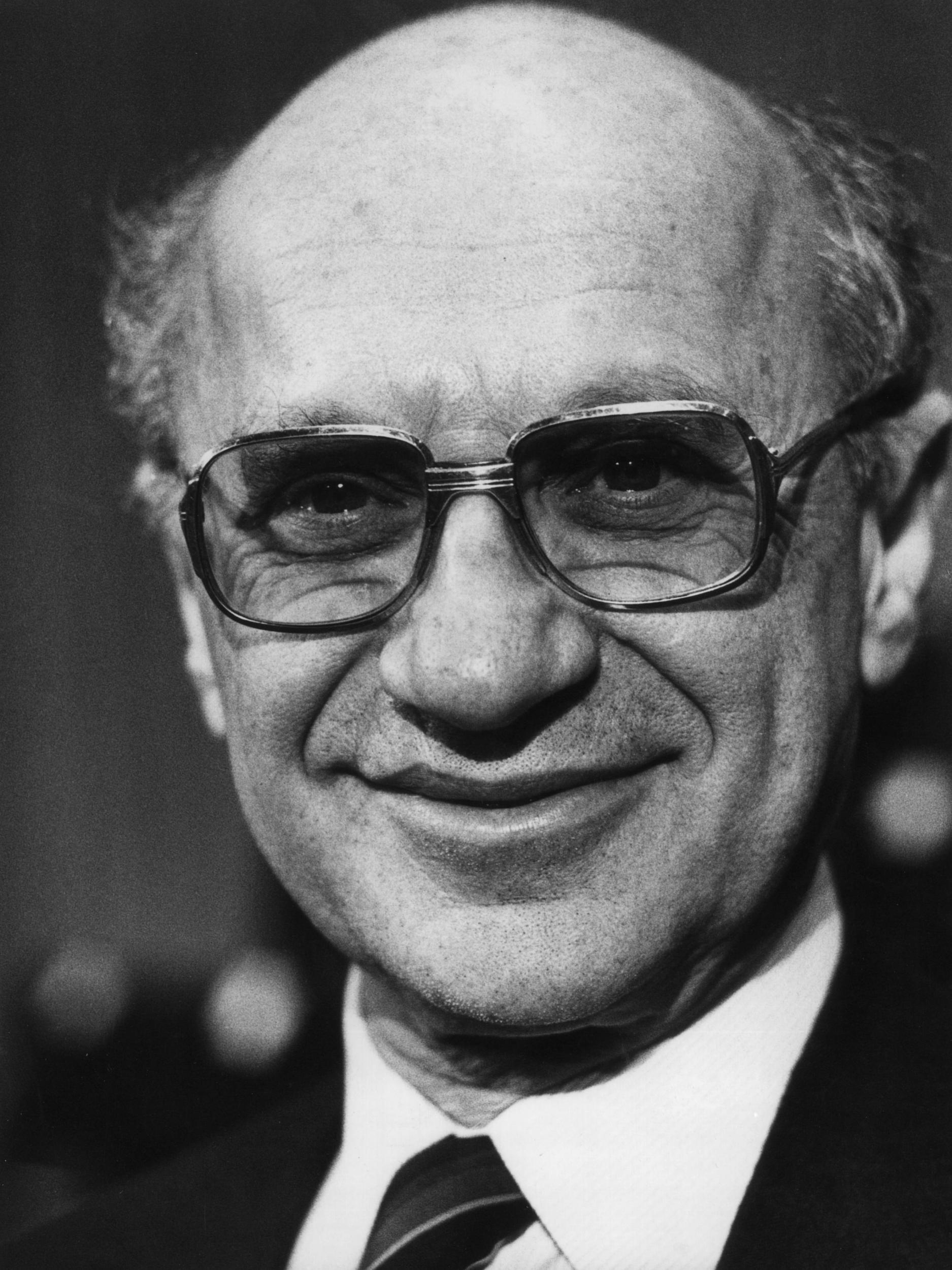

Monetarist doctrine states – as per the Chicago School’s Milton Friedman – that the money supply must be controlled in order to limit inflation. Thus, government debt must be prioritised. The Maastricht treaty, which founded the EU, stipulated limits on public spending. Greece is the textbook example of austerity in which debt repayments are prioritised in order to appease creditors (mainly banking institutions).

However, even mainstream economists feel that the logic of austerity is somewhat fallacious. Keynesian economics posits that public spending stimulates growth with debt as a secondary consideration. As the New Economics Foundation think tank points out, Britain has historically seen much higher levels of public debt. The debt/GDP ratio was higher during a whole century between 1750 and 1850 (at the time of the Napoleonic wars and the height of Britain’s imperial glory) as well as in the aftermath of the Second World War when the welfare state was created.

While a landmark 2014 study demonstrated that the UK coalition government’s welfare changes enabled tax cuts for the wealthiest thus cancelling out any impact on the deficit. Former Greek finance minister Yanis Varoufakis has also argued that the austerity strategy applied to Greek debt has been extremely counterproductive. The combination of bailouts with cuts has depressed the economy resulting in an increase of the debt (as a percentage of GDP).

The ascendancy of neoliberalism was such that its ideology became an all-pervasive atmosphere. During the event, Mitchell asks how many in the audience have heard of the Powell memorandum. Only a couple of hands go up. Lewis Powell was an American lawyer – later appointed as a Supreme Court justice by Richard Nixon – now indelibly associated with his eponymous 1971 memorandum. This outlined a blueprint for the American conservative movement and the network of think tanks funded by business interests. It recommended that the business class should close ranks in order to present a united front. It also stipulated that lobbyists would be needed to influence policy makers and legislators. And it suggested that infiltration of the media and academia would be necessary in order to achieve the goals of unshackling free enterprise from government interference.

So what would happen if governments followed through on the logic of MMT? Well for a start the Goldman Sachs, JPMorgans and HSBCs of this world would not be as rich or powerful and in the worst-case scenario they might even cease to have any purpose. A recent comprehensive survey from the pro-market Legatum Institute confirms that significant majorities of the British public are in favour of renationalisation of utilities and railways. The public is equally split on nationalisation of the banks with 50 per cent in favour. Corbyn and McDonnell have proposed a national investment bank with a network of regional banks in order to help rebalance the economy and encourage lending.

Whether or not one accepts MMT, it is increasingly apparent that public and democratic oversight of finance and money is becoming a central pillar of progressive postcapitalism alongside public control of public services, a green economy, full automation and the four-day week.

Youssef El-Gingihy is the author of ‘How to Dismantle the NHS in 10 Easy Steps’, published by Zero books

Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World by William Mitchell and Thomas Fazi is published by Pluto books

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks