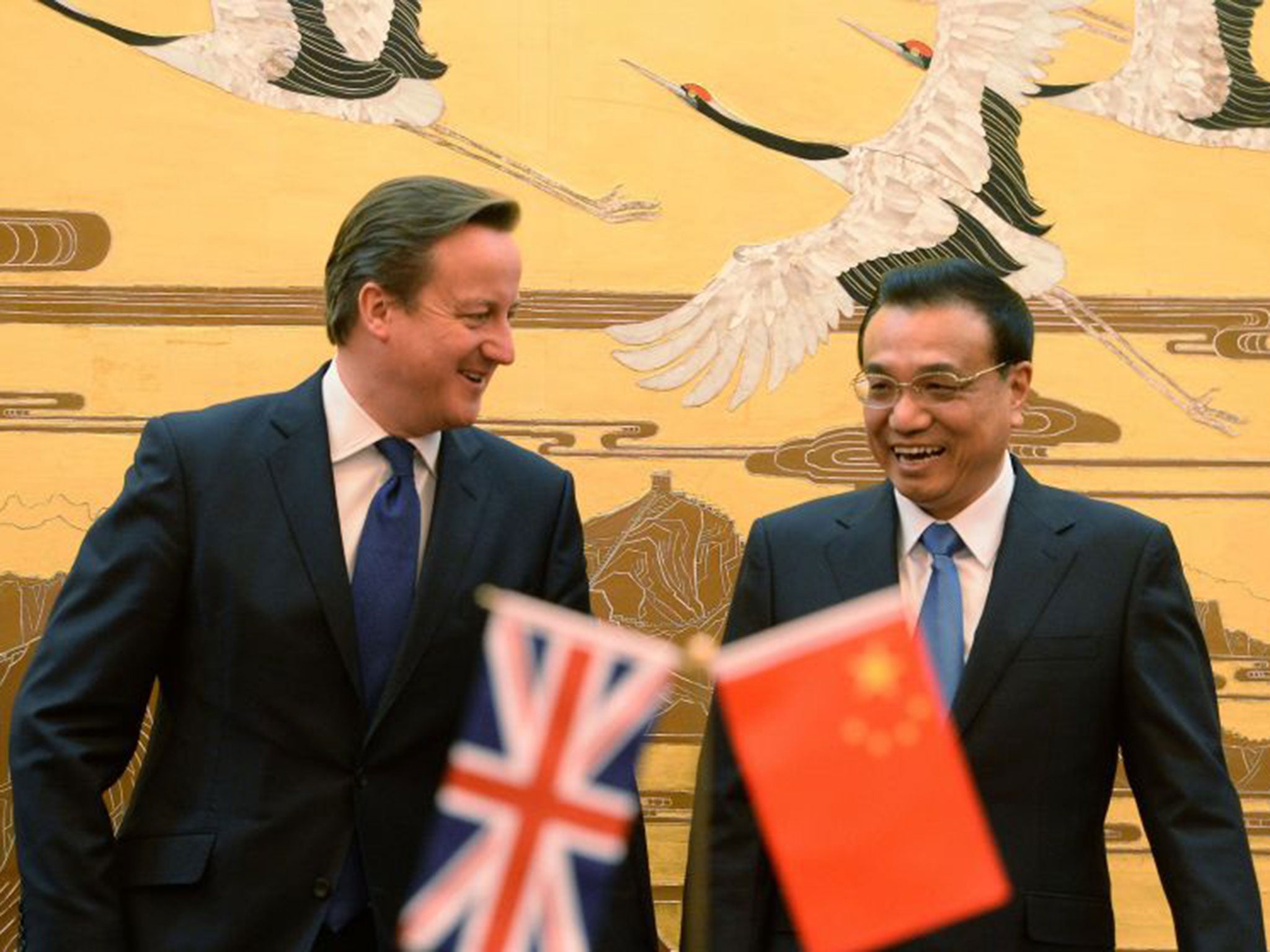

Li Keqiang visit to Britain: China needs us as much as we need them

The visit of the Chinese Premier will be of mutual benefit, despite claims Britain is a second-tier European nation

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Li Keqiang, the Chinese Premier, is visiting a second-tier European nation this week: Britain. At least, that’s what the Chinese ambassador to the UK, Liu Xiaoming, implied last week when he told journalists our country has slipped behind Germany and France in the estimation of the authorities in Beijing.

As he put it: “Before I came here, we used to say, when we talked about Europe: ‘Britain, France and Germany’. But unfortunately many opportunities were missed in the past year so people now start talking about ‘Germany, France and Britain’.”

It’s true that Britain does less trade in goods with China than those other two major European nations. Nevertheless, there is a large amount of mischief in this comment from the ambassador, doubtless designed to play upon British insecurities. The reality is that, in financial terms, China needs Britain just as much as Britain needs China.

To understand why it’s useful to start with a figure: $4 trillion. This is the rough size of the foreign exchange reserves that China has accumulated over the past 15 years as a result of the unbalanced way Beijing has run its domestic economy. Around two-thirds is estimated to be stored in US government debt and mortgage securities. Those bonds are safe, but the returns are low – and they will fall further if the Chinese currency continues to appreciate against the dollar.

This is why China has been seeking, for some time now, to put more of its national wealth in real productive assets abroad. This means acquiring stakes in Western energy and infrastructure firms and other, smaller, companies. But China has run into big obstacles investing in the US and Europe. In 2005, a bid by a Chinese oil company to acquire a Californian energy firm failed amid opposition in Congress. And while Germany and France have been willing to sell and buy goods from the Chinese they, too, have been resistant to approving Chinese ownership of domestic assets.

This is where Britain comes in. The Coalition wants to boost domestic infrastructure investment, but because of its austerity commitments it cannot spend money itself. So it has rolled out the red carpet for the Chinese in the hope they will help to fill the gap. The China Investment Corporation, the country’s sovereign wealth fund, has a 10 per cent stake in the consortium that owns Heathrow Airport and a similar sized stake in Thames Water.

The Chinese are investing in the redevelopment of Manchester airport. Chinese nuclear companies will have a 30 to 40 per cent equity stake in the consortium that will construct a new nuclear power station at Hinkley Point in Somerset. More nuclear deals are expected. According to research by the Heritage Foundation China has a stock of investments in Britain worth around $19bn (£11.2bn). That compares with $9.2bn in France and $5.6bn in Germany.

Yesterday’s additional visa liberalisation for Chinese tourists in Britain also reflects this pattern of mutual benefit. Many wealthy Chinese, alarmed about domestic pollution, food safety, poor schools and even future political instability, are keen to emigrate to the West and shift their assets here. A report this month suggested more than 60 per cent of high-net-worth individuals in China have either already emigrated or wish to do so. With this travel liberalisation Britain is making itself an increasingly attractive destination.

Another major theme this week is the City of London’s status as a European hub for trading the Chinese currency, the renminbi (RMB). An announcement is expected allowing a massive Chinese commercial bank to set up a branch here, after a rule change by the UK financial authorities. Beijing was frustrated in the wake of the 2008-09 financial crisis by the Federal Reserve’s massive monetary stimulus programmes, which pushed down the value of the dollar. This ravaged the paper value of the country’s vast foreign exchange reserves.

That has persuaded the Chinese authorities that they must become less reliant on the US currency and that they should encourage the international use of their own instead. By promoting the RMB as a new international currency to corporations and investors London is, thus, offering a valuable service to Beijing.

All this means British ministers can afford to hold their heads up with their Chinese counterparts this week. We are not going “cap in hand” to Beijing. The relations between our two nations are based on clear, mutual, economic interest.

Ben Chu is the author of ‘Chinese Whispers: Why Everything You’ve Heard about China is Wrong’

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments