Weight-loss war heats up as Wegovy rival found to lead to faster and greater results

Shares in Novo Nordisk were down 1.1% after the study

Shares in Novo Nordisk, the company behind obesity drug Wegovy were down 1.1% on Tuesday after data analysis showing a rival treatment leads to faster and greater weight loss.

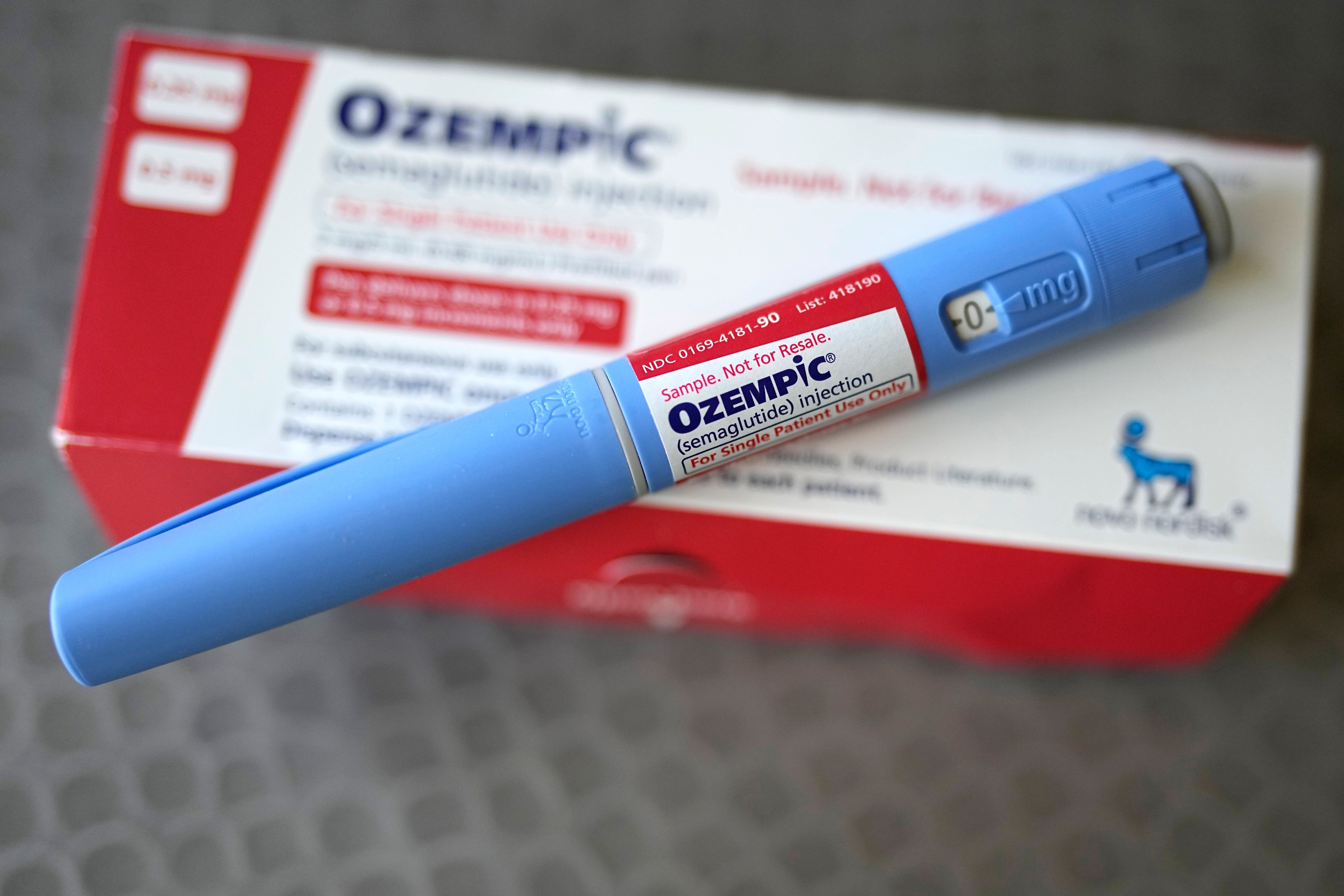

The analysis, published on Monday in JAMA Internal Medicine, examined health records and other data to assess the pace and percentage of weight loss for overweight and obese people taking tirzepatide - the active ingredient in Lilly’s Mounjaro and Zepbound - and semaglutide - the main ingredient in Wegovy and Ozempic.

In the absence of head-to-head randomised controlled trials comparing the two drugs, researchers used the health records and pharmacy dispensing data to analyse weight loss trajectories in 9,193 patients receiving Mounjaro and the same number of closely matched patients receiving Ozempic. The average participant weighed 242 pounds (110 kg), and about half had type 2 diabetes.

After accounting for individual risk factors, patients taking Mounjaro were 76% more likely to lose at least 5% of their body weight, more than twice as likely to lose at least 10%, and more than three times as likely to lose at least 15%, compared to patients taking Ozempic, the report found.

The two drugmakers, historically the world’s biggest producers of insulin, are the first-to-market with highly effective weight-loss drugs, a booming market that could be worth $150 billion in annual sales by the early 2030s, according to some analysts. Both are racing to increase production of their drugs, which are delivered in a once-weekly self-injection pen.

The researchers noted that Ozempic and Mounjaro are both intended for use by people with type 2 diabetes, but half of the study participants were using the drugs for weight loss only, which may have impacted the results.

The results of this analysis were initially published in November on the website medRxiv in advance of peer review.

Shares in Novo and Lilly are at record highs on profits from the weight-loss drugs. Although Novo’s Wegovy has been on the market in the United States since 2021, Lilly’s version, sold as Zepbound in the U.S., only launched there late last year.

Earlier this month Novo Nordisk were reprimanded by UK regulators for failing to disclose fees and expenses paid to individuals and organisations in Britain amounting to about 7.8 million pounds ($9.97 million) between 2020 and 2022.

The UK industry body Prescription Medicines Code of Practice Authority (PMCPA) said that the reprimand followed a voluntary submission by Novo about the payments, which related to more than 150 different bodies and included fees and expenses to health professionals and sponsorship and other payments to healthcare organisations.

Novo said that it had made the voluntary admission in 2023 after it found historical payments that had not been disclosed.

“These payments are for legitimate activities but had been incorrectly categorised in finance systems as a result of human error,” the company said in a statement.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks