Treasury tax rules force NHS patients to wait longer

Leading doctors write to chancellor and health secretary demanding urgent action on ‘ludicrous situation’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Hundreds of appointments and crucial patient scans have been delayed because punitive tax rules are forcing NHS doctors to work less hours, a new survey has revealed.

The Academy of Medical Royal Colleges (AoMRC), an umbrella organisation for 24 separate medical colleges in the UK and Ireland, has now written to the chancellor Sajid Javid and health secretary Matt Hancock, urging them to take action.

A survey of AoMRC members has revealed the impact on patient care from the Treasury’s tax rules, which reduced the amount of tax relief that can be applied to pension schemes with a new lifetime allowance limit of £1m.

It has meant some hospital consultants and senior managers are being hit with tax bills running into tens of thousands of pounds.

Data seen by The Independent, has also revealed a 9 per cent increase in the numbers of NHS staff opting out of the NHS pension scheme and blaming the tax rules as the reason.

In 2014-15 the number of staff opting out of the pension was 39,805 but the numbers peaked in 2016-17, when the tax rules were unveiled, to 47,943. For the latest year, 2018-19 the number of opt-outs was 43,309, an increase of 9 per cent in five years.

According to data from NHS Business Services Authority, which administers the pension scheme, more than 2,700 NHS staff have opted out of the pension scheme between April and September this year and specifically cited the tax allowance rules as the reason.

Carrie MacEwen, chair of the Academy of Medical Royal Colleges, said: “This is self-evidently a ludicrous situation which is having a direct impact on the care patients are receiving and staff across the NHS.

“Fewer doctors means the ones that can afford to stay and work are getting burned out, so everyone is impacted. All this will take to fix is a bit of creativity when it comes to the rules and less intransigence on the part of Treasury.”

The AoMRC asked its members for examples of how the pension tax rules were impacting on delivering service.

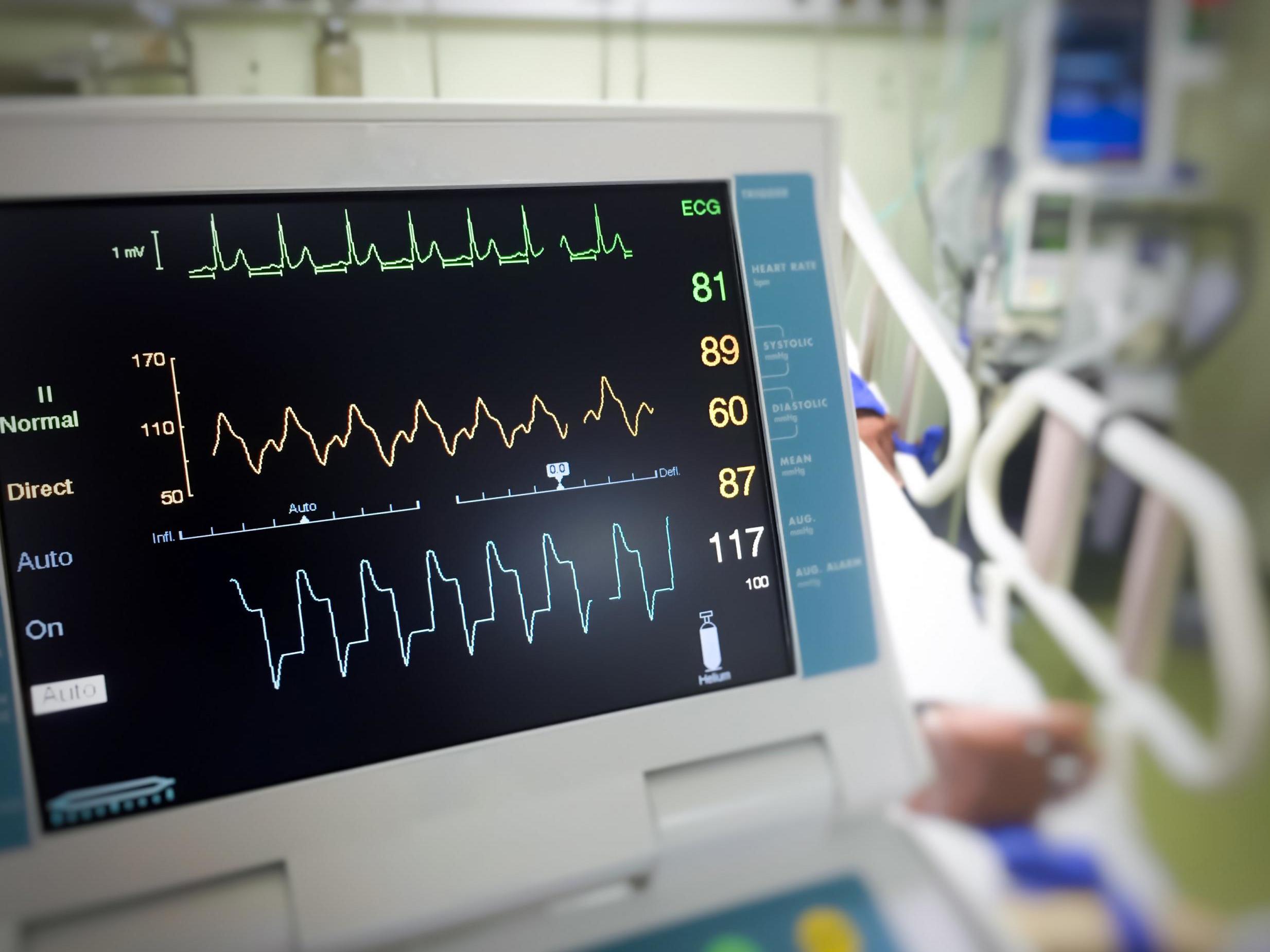

Among the examples included seven out of 35 intensive care consultants reducing their working week at London’s Guy’s and St Thomas’ NHS Foundation Trust while 720 appointments were lost at The Royal Cornwall Hospitals Trust after three paediatricians slashed their hours.

Radiologists at Nottingham University Hospitals NHS Trust said reduced hours meant the number of vital CT and MRI scans that could be carried out halved from 1,200 a month in January to 600 in July.

Saffron Cordery, deputy chief executive of NHS Providers, which represents the interests of NHS hospitals said: “It simply isn’t good enough that patients are paying the price because we have not yet found a national solution. Trusts are telling us they are reducing the number of scans they carry out because radiologists are forced to retire early. Operations are being cancelled as anaesthetists reduce their hours and wards are being closed because the senior staff needed are not there.

“With performance already stretched going into winter, the pensions issue is now affecting the ability of the NHS to manage demand over winter safely.”

A consultation by the government on planned changes to pension tax rules closed on Friday. The Department of Health and Social Care has already moved to relax rules for doctors allowing them to pay tax bills from their pension funds and changing the level of their contributions.

A spokesperson from Guy’s and St Thomas’ NHS Foundation Trust said:: “A small number of consultants have reduced their hours this year. This is for a variety of reasons and cannot solely be attributed to the current pensions tax issues. We have an ongoing and active recruitment plan in place to ensure that we are always able to provide the best possible care to our patients.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments