20,000 graduates overcharged for student loans

More than 20,000 graduates were overcharged on their student loan repayments last year.

They have forfeited hundreds of pounds in overpayments because money is still being deducted from their salaries despite having paid back the full amount they owe on their student loans.

Figures given to MPs for the first time show that 20,900 young people were overcharged last year – about one in 50 of the students who should have finished paying off their arrears.

The figures have prompted claims from Stephen Williams, the Liberal Democrats' higher education spokesman, of "bureaucratic incompetence". He said: "It comes at a time when many people are feeling the pinch and definitely don't want to be paying back more than they have to.

"The Student Loans Company [SLC] needs to ensure mistakes like this simply can't happen. It should start by putting better procedures in place to keep incontact with graduates so it can at least let them know when they are reaching the end of their payments."

One of the reasons cited for the overpayments is that HM Revenue and Customs has to notify the SLC of repayments through the tax system. Bill Rammell, the Higher Education minister, said: "Due to the time lag in the SLC receiving information from HMRC , it is possible for borrowers to overpay before the SLC becomes aware that their repayments should stop."

When graduates try to reclaim overpayments, they have to send all their pay-slips to the SLC so it can calculate the overpayment and make a refund.

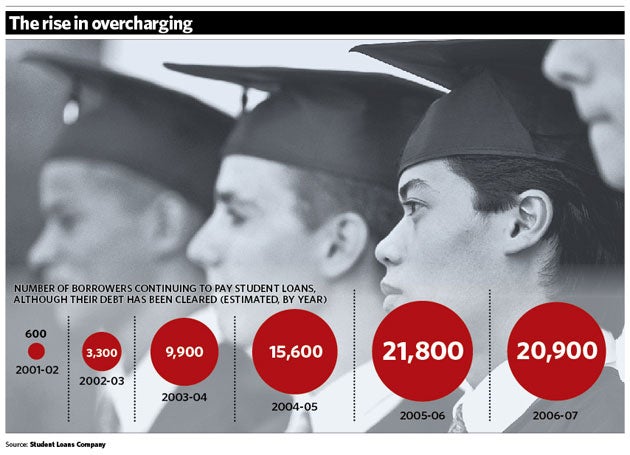

The number of students overcharged has soared from 600 in 2001-02, the first year students could have concluded their repayments, to 20,900 in 2006-07. The figures given to MPs show the numbers have decreased slightly on the previous year when 21,800 students were overcharged.

The rise is being put down to an increase in the numbers reaching the end of their repayments – although the percentage of students overcharged has more than doubled in the six-year periods from 0.9 per cent to 1.9 per cent. At present students start repaying loans once they are earning more than £15,000 a year.

Mr Rammell added that moves were already under way to reduce the prospect of students being overcharged – including the setting up of a new website facility which would allow students to keep track on how much they still owe in repayments.

Since it was established 10 days ago, scores of students have used it to pay off their outstanding debts – with the SLC receiving more than £1m in repayments, including £16,000 from one individual.

Mr Rammell added: "The Student Loans Company is working on further improving the loan end process and has been asked to put arrangements in place which will reduce the number of borrowers over-repaying at the end of repayment."

A spokesman for the SLC said: "We are always conscious of the fact there can be a time lag between the repayments being made and receiving confirmation of that." He said action to reduce the delay would be introduced next year.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments