Big bank CEOs warn that new regulations may severely impact economy

The heads of the nation’s biggest banks say there are reasons to be concerned about the health of U.S. consumers _ particularly poor and low-income borrowers _ in their annual appearance in front of Congress on Wednesday

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The heads of the nation's biggest banks say there are reasons to be concerned about the health of U.S. consumers — particularly poor and low-income borrowers — in their annual appearance in front of Congress on Wednesday.

The CEOs of JPMorgan Chase, Bank of America, Wells Fargo and five other large firms also took the opportunity to impress upon senators that the Biden Administration's new proposed regulations for the industry may hurt the U.S. economy going into an election year and at a time when a recession is possible.

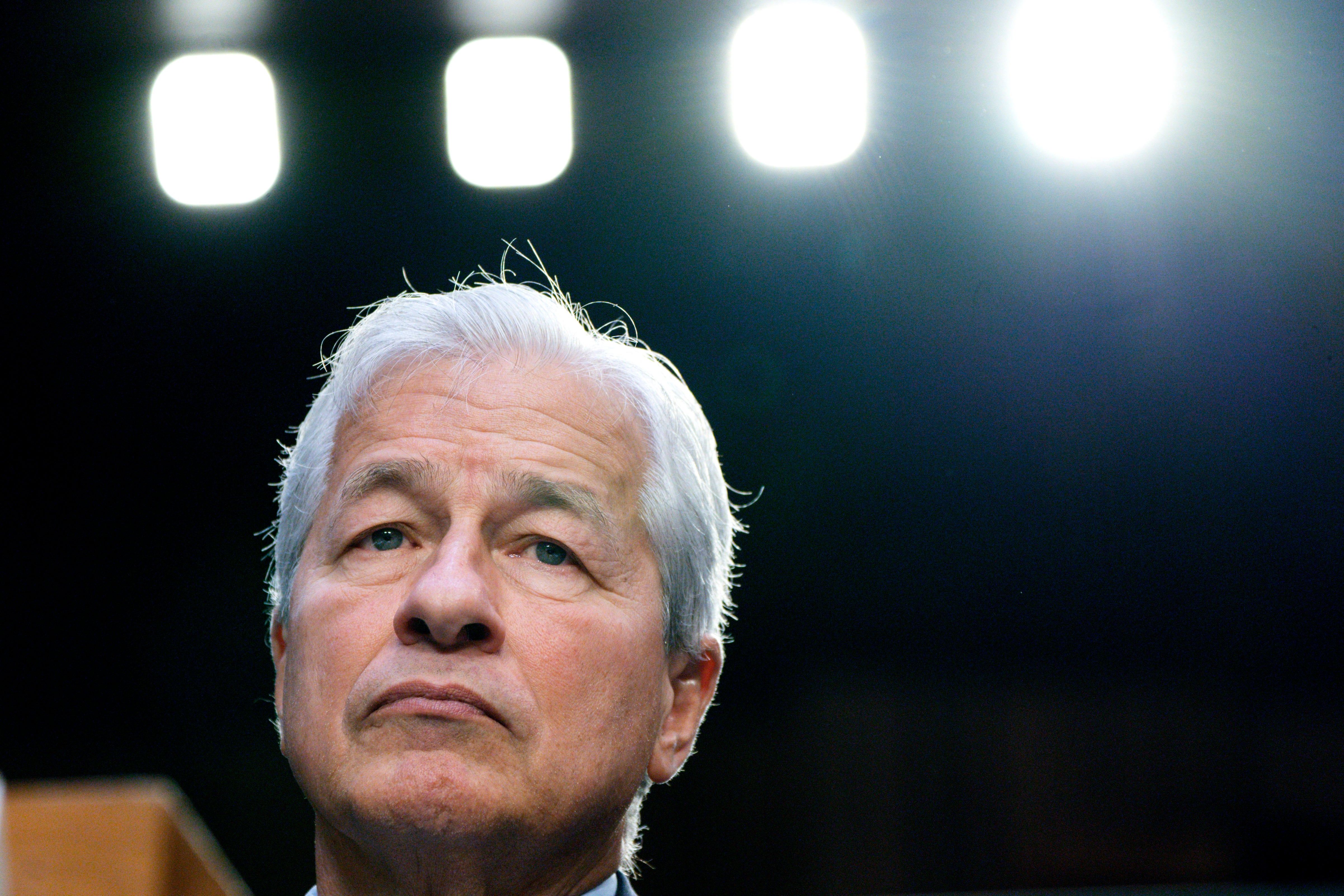

Wall Street's most powerful bankers have regularly appeared in front of Congress going back to the 2008 financial crisis. Among those testifying before the Senate Banking Committee include JPMorgan's Jamie Dimon, Bank of America's Brian Moynihan, Jane Fraser of Citigroup and Goldman Sach's David Solomon.

When both houses of Congress were controlled by Democrats, the CEOs would appear in front of both the House Financial Services Committee and the Senate banking panel. Now that Republicans control the House, only the Senate is holding a hearing this year.

This year has been a tough one for the banking industry, as high interest rates have caused banks and consumers to seek fewer loans and consumers are facing financial pressure from inflation. Three larger banks failed this year — Signature Bank, Silicon Valley Bank and First Republic Bank — after the banks experienced a run on deposits and questions about the health of their balance sheets.

Further, regulators have proposed new rules that could hit bank profitability hard, including new rules from the Federal Reserve that would required big banks to hold additional capital on their balance sheets. The industry is adamantly against the new regulations, known as the Basel Endgame, saying the rules would hurt lending and bank balance sheets at a time when the industry needs more flexibility.

“Almost every element of the Basel III Endgame proposal would make lending and other financial activities more expensive, especially for smaller companies and consumers,” Fraser said in her prepared remarks.

There are also proposals coming from the Consumer Financial Protection Bureau that would rein in overdraft fees, which have also been a longtime source of revenue for the consumer banks.