You should read Japan's Brexit note to Britain — it's brutal

Japan first published the message in September 2016

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.You should read Japan's message to Britain on Brexit, first published in September 2016. Especially if you supported Leave. It's a brutal, lengthy, detailed dissection of all the potential economic damage leaving the EU will do to the UK.

The message is addressed to everyone in Britain, not just some government official in Theresa May's Department for Exiting the European Union. Its title is "Japan’s Message to the United Kingdom and the European Union."

The 15-page document is also startling because it isn't couched in vague, political spin. The only thing we "know" about May's Brexit strategy is "Brexit means Brexit." May has given no further details about what her government is trying to achieve.

The note from the Japan Ministry of Foreign Affairs, in contrast, is a list of specific concerns and demands. In sum, it says, we have invested a huge amount of money in Britain. And you guys are screwing it up. Do you want us to withdraw all our cash, companies and investments? Because we can make that happen if you guys don't wake up to reality!

To quote the letter (emphasis ours):

"There are numerous Japanese businesses operating in Europe, which have created 440,000 jobs. A considerable number of these firms are concentrated in the UK. Nearly half of Japanese direct investment intended for the EU in 2015 flowed to the UK ... we strongly request that the UK will consider this fact seriously and respond in a responsible manner to minimise any harmful effects on these businesses."

The most startling aspect of the note is contained in a series of text boxes. "Actual requests from Japanese businesses are listed in the boxes under the headings below," the letter says. One of those boxes says Japanese banks may leave if Britain cannot maintain an EU-like economic relationship (emphasis ours):

"If Japanese financial institutions are unable to maintain the single passport obtained in the UK, they would face difficulties in their business operations in the EU and might have to acquire corporate status within the EU anew and obtain the passport again, or to relocate their operations from the UK to existing establishments in the EU."

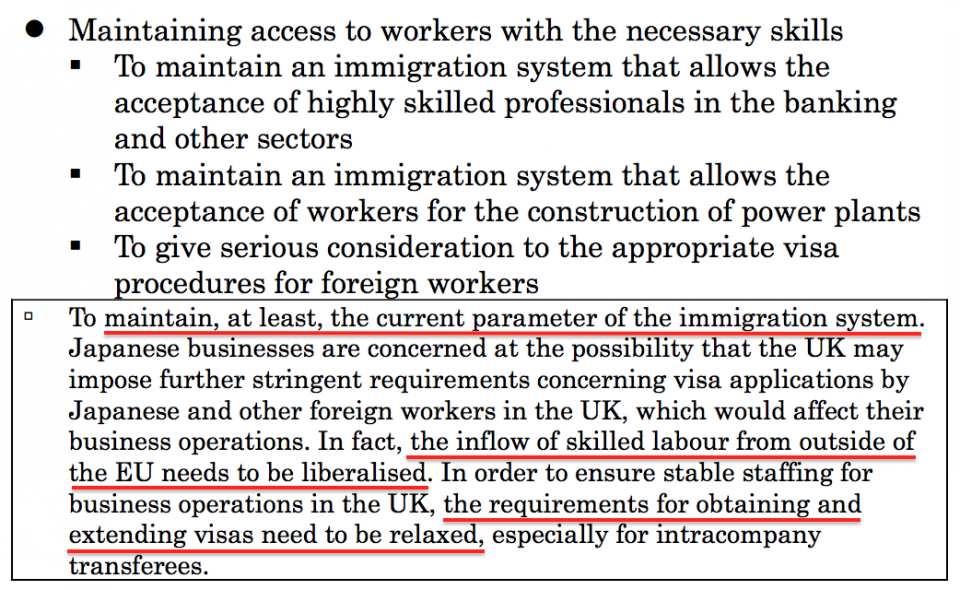

And then there is a bucket of cold water for everyone who wants to reduce immigration (as May herself does). Companies can't survive without flexible immigration, the Japanese say. In fact, immigration should be increased, they say:

Seriously, read the whole thing here.

Read more:

• This chart is easy to interpret: It says we're screwed

• How Uber became the world's most valuable startup

• These 4 things could trigger the next crisis in Europe

Read the original article on Business Insider UK. © 2016. Follow Business Insider UK on Twitter.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments