Three graphs that show UK’s looming economic turmoil

Millions face unprecedented spike in energy bills and second-biggest fall in living standards since records began

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK is facing a recession with inflation set to soar to its highest rate since 1982, the Bank of England has warned.

The Bank on Thursday raised interest rates by 0.25 per cent to 1 per cent in a bid to temper the spiralling cost of living, and warned that the economy was likely to shrink in the final quarter of the year.

Although the central bank’s Monetary Policy Committee (MPC) has not formally predicted a recession, the move raised the likelihood of the economy shrinking.

The following three charts explain the UK’s looming economic tumult.

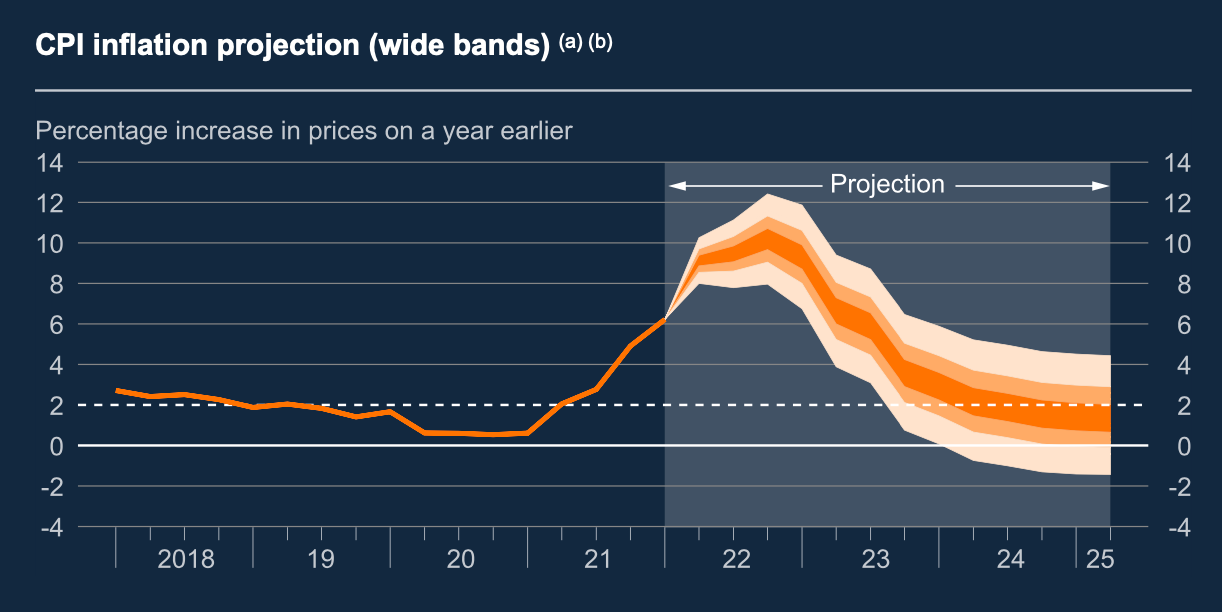

Inflation to soar

Inflation will rocket to more than 10 per cent by the end of 2022 – the highest rate in 40 years – as millions face an unprecedented spike in energy bills and the second-biggest fall in living standards since records began.

A further 40 per cent rise in the energy price cap is then expected in October, according to the Bank of England, to meet the surge in wholesale energy costs driven up by president Vladimir Putin’s war in Ukraine.

The price cap will see inflation peak at a later point in the UK compared to other countries, prompting warnings from the Bank of England that it could drop down more gradually.

Average gas, electricity bills, food prices and other essential goods are all expected to continue to rise, the Bank’s MPC said on Thursday.

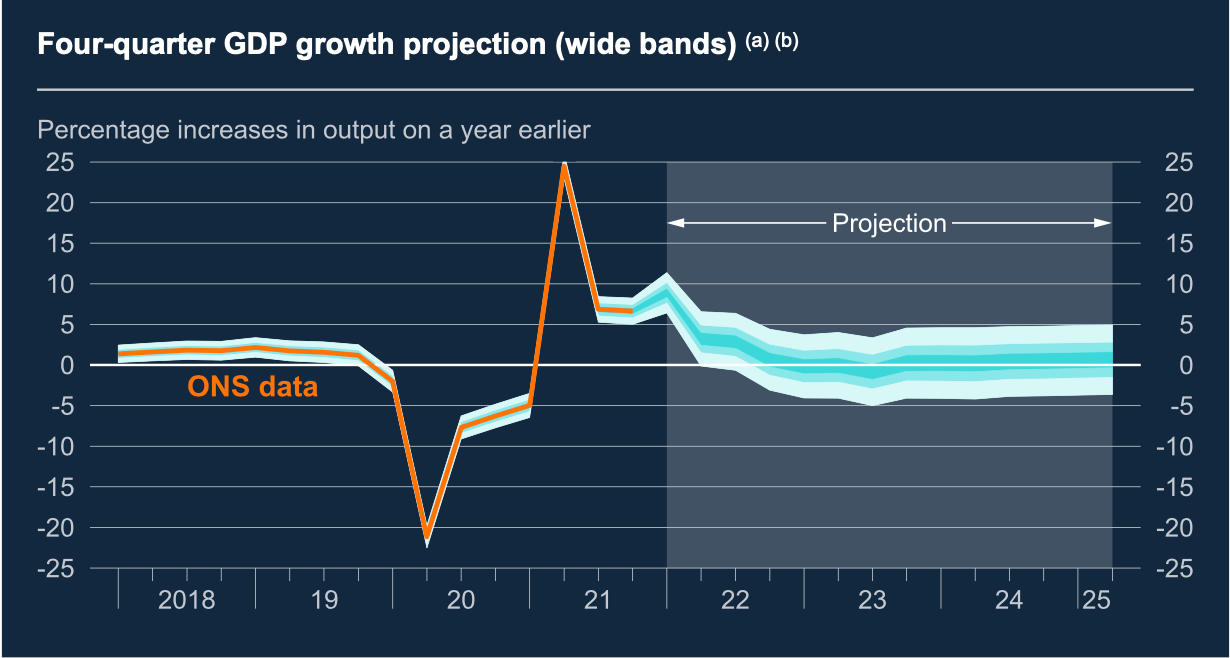

GDP growth to flatline

The economy is expected to shrink in 2023 following a downgrade in the final quarter of this year. The Bank has anticipated growth of 1.25 per cent next year, but now say that output will fall by 0.25 per cent instead.

The chart predicts near-stagnant growth for three years - with the Bank forecasting zero growth in 2023, followed by 0.2 per cent in 2024 and 0.7 per cent in 2025.

With the central bank predicting inflation to be up 10 per cent and GDP growth down 1 per cent for the final quarter of 2022, the projection seems to meet the remit of “stagflation”.

The figures will pile pressure on chancellor Rishi Sunak to provide more support for struggling families.

Unemployment to surge

As inflation falls, unemployment will rise, the Bank expects.

Despite the UK’s labour market having recovered to pre-pandemic levels in recent months, driven by the lifting of Covid restrictions and the resultant improvement in economic outlook, unemployment is expected to surge as the looming economic disaster rears its head.

The Bank of England warns that unemployment could rise by 8 per cent by 2025 - the worst level since the banking crisis ended.

Its base prediction is for a increase in unemployment from 3.9 per cent to 5.5 per cent in three years’ time, which would leave around another 450,000 people out of work.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments