What will an interest rate cut by the Bank of England mean for you?

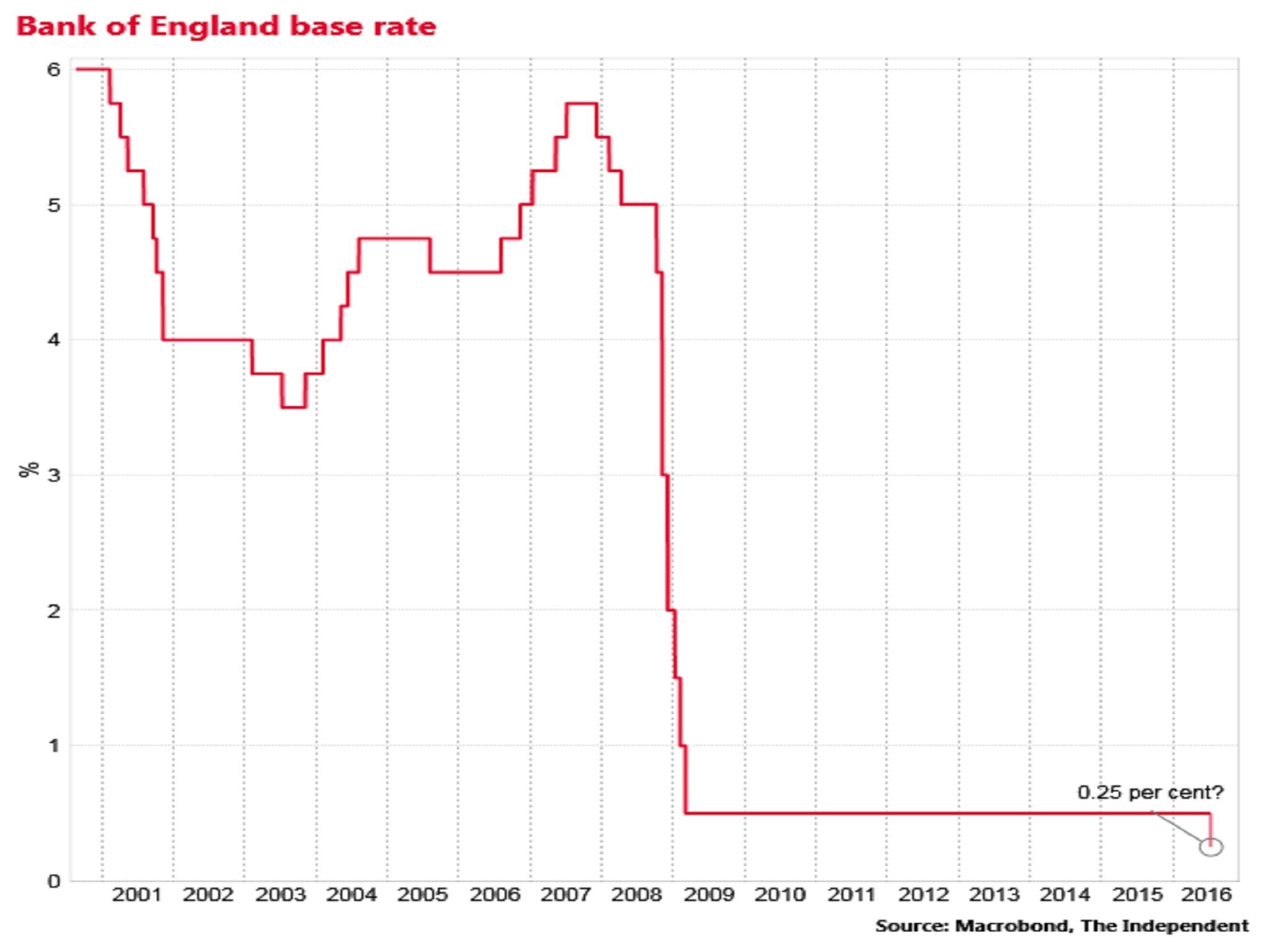

Economists think Mark Carney and the Monetary Policy Committee will cut rates from their current historic floor of 0.5 per cent to just 0.25 per cent tomorrow. But what will such a reduction mean for UK borrowers, savers, workers and families?

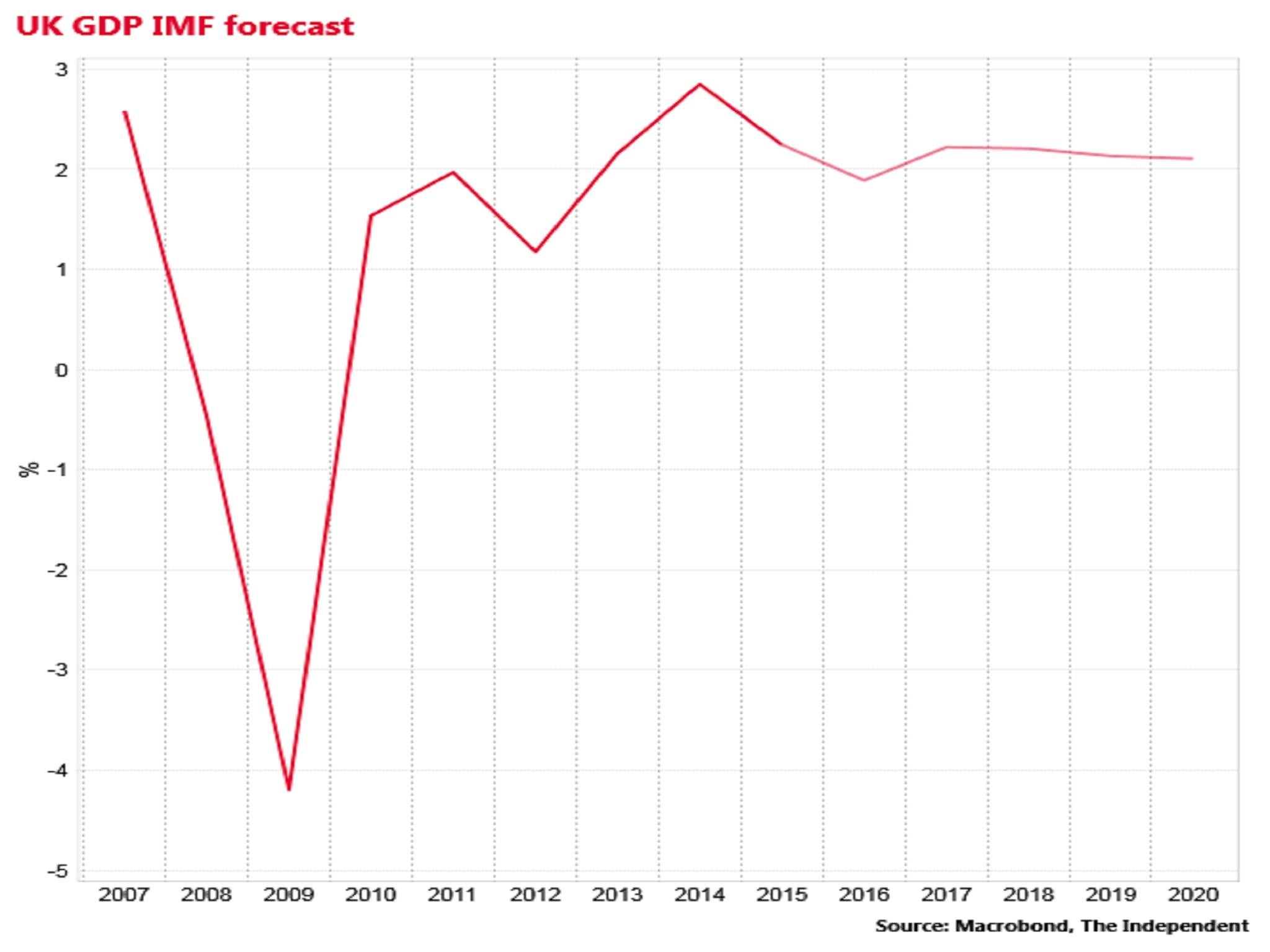

The Bank of England is widely expected to reduce its base rate tomorrow for the first time since the global financial crisis in order to help the UK economy cope with the negative impact of the shock Brexit vote.

Economists think Mark Carney and the Monetary Policy Committee will cut rates from their current all-time low of 0.5 per cent to just 0.25 per cent.

But what will such a reduction mean for UK borrowers, savers, workers and families?

Lower mortgage rates?

Traditionally, cuts in interest rates by the Bank of England were associated with lower monthly mortgage repayments by families as private banks passed on the cut in their funding costs to their borrowers.

Mortgage borrowers certainly received a major financial windfall after the Bank rapidly slashed rates from 5 per cent in October 2008 to 0.5 per cent in March 2009 during the last recession.

So will the same happen tomorrow if the Bank cuts rates again?

People who have “tracker” mortgages – where the interest rate automatically goes up and down with the Bank rate - will benefit. Someone with a 25 year £250,000 repayment tracker mortgage paying 2 per cent interest would see their monthly £1,100 repayment fall by around £30 if rates went down by 0.25 per cent.

Yet the numbers of people taking out trackers or variable rate mortgages has dwindled in recent years, with many more opting for fixed rate products.

In 2015 fixed rate mortgages made up almost 90 per cent of new loans. Those borrowers will not feel any immediate benefit tomorrow.

However, they will benefit financially in the coming months and years when they re-mortgage (assuming rates have not bounced back by then).

“The transmission of interest rate cuts to disposable incomes will be much more lagged than it was in 2007-09” says Simon French of Panmure Gordon.

Lower returns on cash savings?

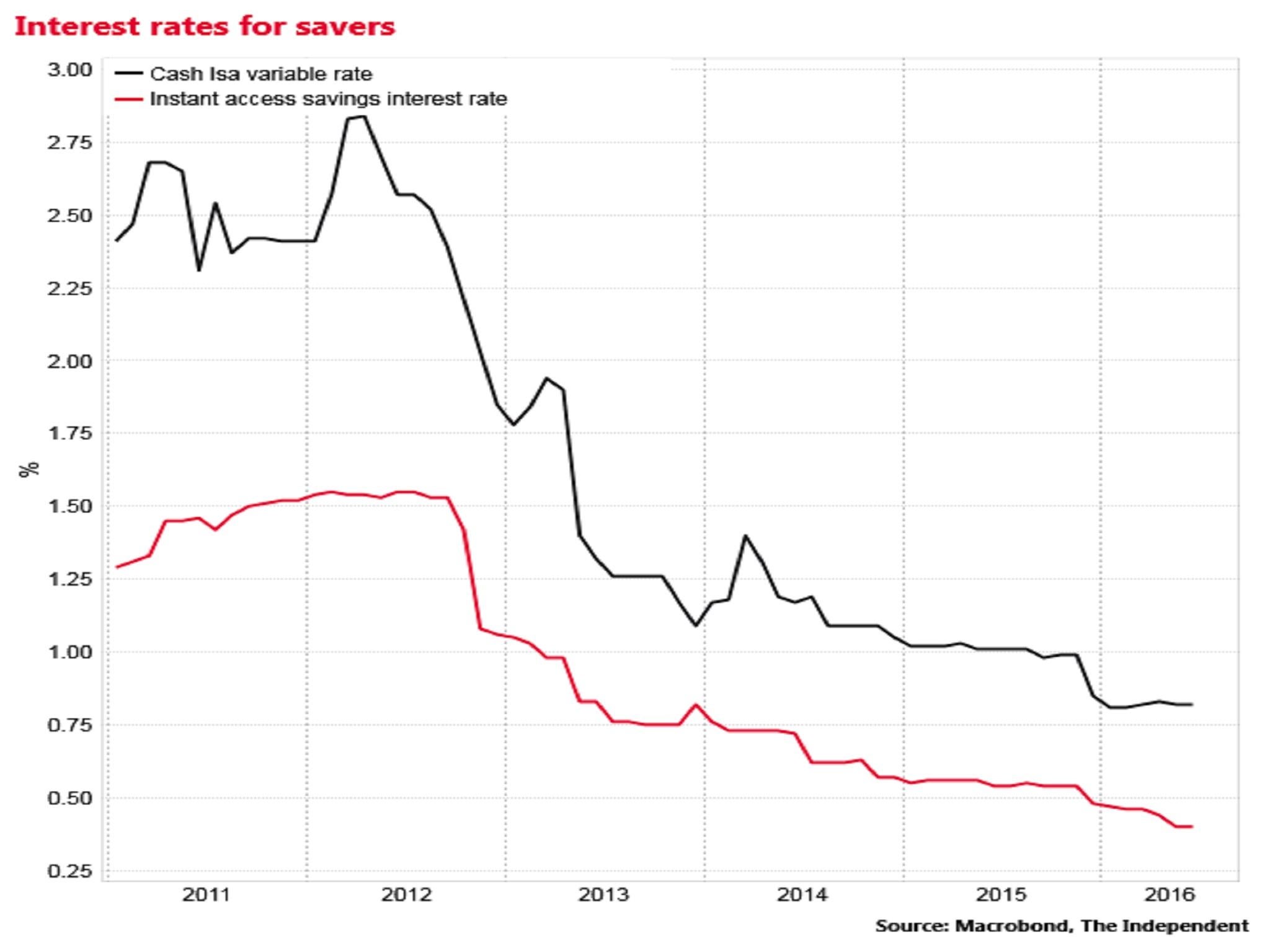

The amount private banks pay to cash savers has fallen in step with the official base rate, meaning a great many savers have been getting very meagre returns for the best part of seven years.

Average interest rates on instant access savings accounts are currently just 0.4 per cent. Cash ISAs pay out just 0.82 per cent.

If the Bank of England cuts rates again that may be passed on to savers, meaning further pain.

But with interest rates already so low banks may hesitate to pass on the cut to savers and instead choose to absorb the hit themselves in the form of lower profits.

More expensive holidays?

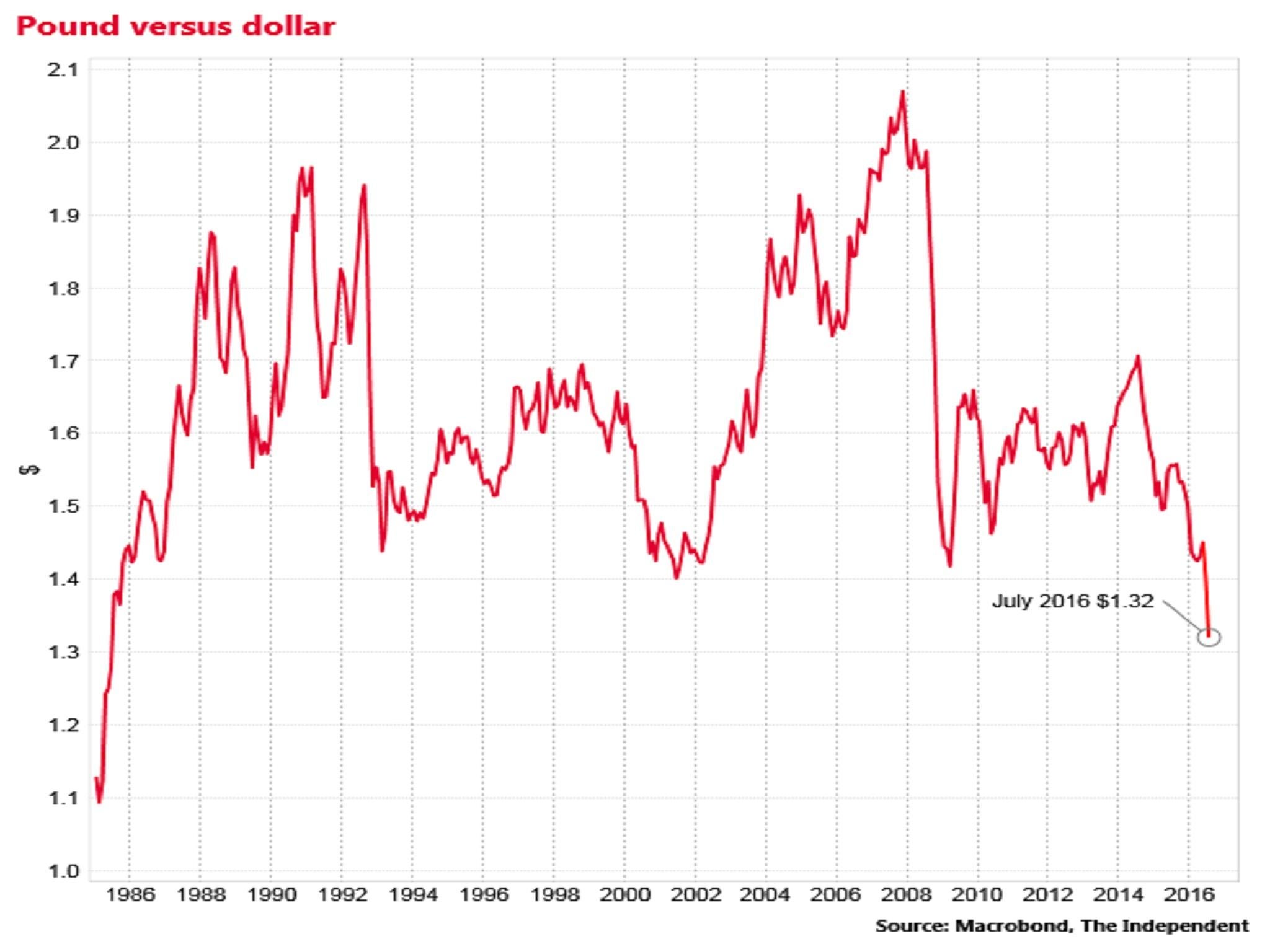

Interest rate cuts are often associated with falls in the exchange rate, meaning a weaker pound and therefore more expensive holidays for Britons travelling abroad.

Yet this is a complex transmission process and the impact on sterling is not always so straightforward.

Foreign exchange market traders seek to price in events before they happen.

A Bank rate cut has been widely expected since Mark Carney said monetary easing was likely in the week after the referendum result and the pound has been marked down heavily against the dollar and euro.

So a major movement in the pound tomorrow is unlikely (unless, of course, the decision goes in the way the markets do not expect and rates are not cut).

“When the actual rate cut takes place we wouldn’t be surprised if you didn’t see any changes in market rates because it’s already been priced in” says Kallum Pickering of Berenberg.

But he adds that Bank of England stimulus could raise expectations for GDP growth and even though interest rates are lower the price of sterling could actually rise.

“Raised expectations of growth would raise demand for investment in the UK and you’d have to buy sterling in order to do that” he said.

Support for stocks and shares and house prices?

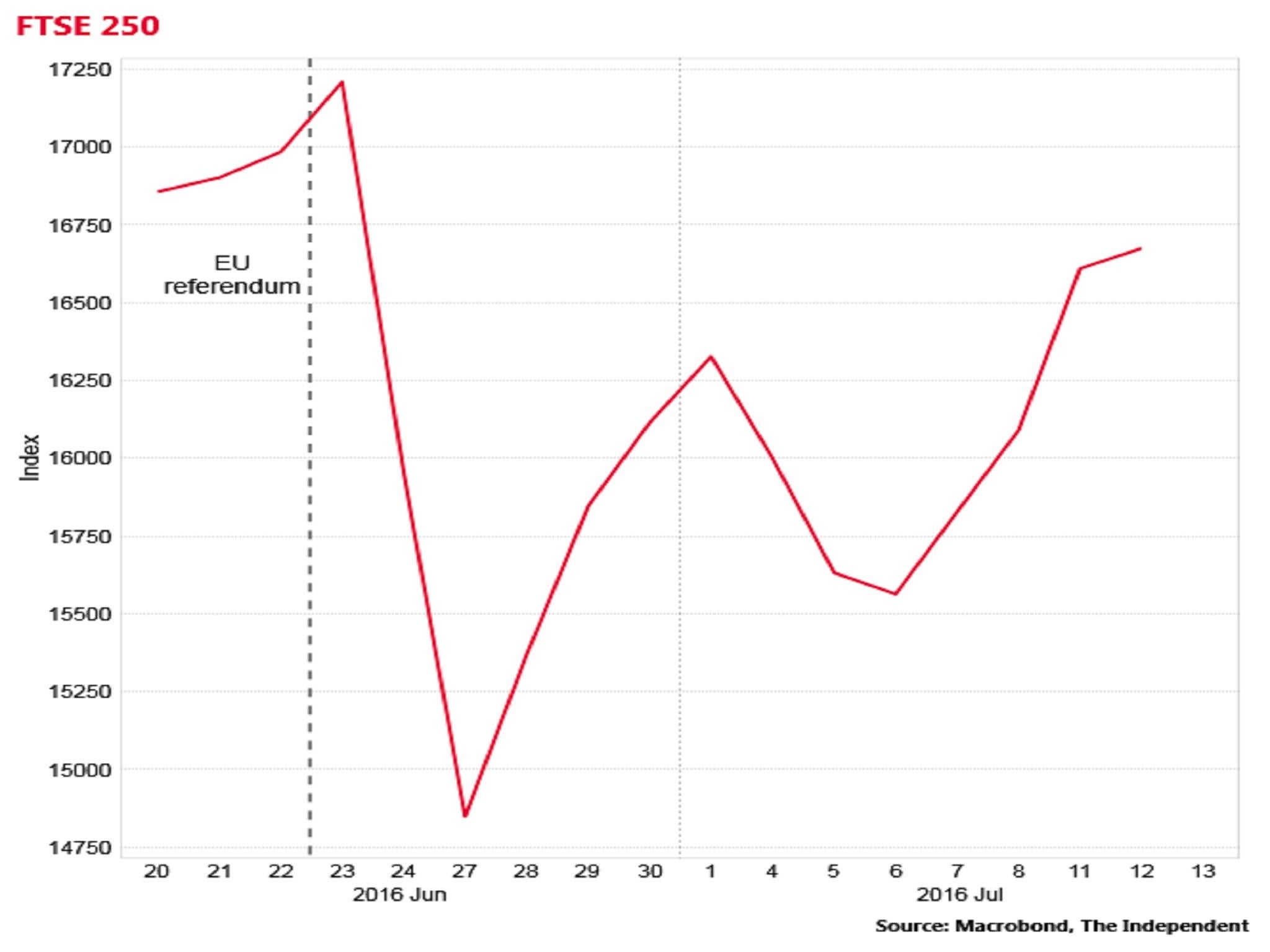

For various reasons, rate cuts tend to boost asset prices, such as shares, bonds and also house prices.

But as with the exchange rate, markets will have largely priced in tomorrow’s expected rate cuts, meaning that there is unlikely to be a significant movement in share prices tomorrow.

“I think an awful lot of what we have seen in the FTSE recovery [in recent days] has been the anticipation of QE [Quantitative Easing] and base rate reductions” said Mr French. “I think you’ll see markets hold a lot of the gains they’ve had.”

This asset price appreciation could help prop up consumer spending through “wealth effects” but economists are wary about forecasting whether that will offset the negative impact of Brexit on consumer confidence.

A healthier economy?

The basic economic logic of rate cuts by a central bank is to boost demand in an economy by encouraging businesses to invest and consumers to borrow and spend.

This support to demand should lift GDP, employment and general living standards.

So will another rate cut by the Bank of England deliver all these things?

Economists are sceptical about how much an interest rate cut can deliver in the current environment.

The price of credit for firms is already low. It may fall slightly again, but if businesses are scared to invest in the wake of the Brexit vote it is not clear that cheaper loans from banks will induce them to do so.

"In terms of its macroeconomic impact, we would see the move as largely futile, though it may calm markets somewhat" say Fathom Consulting.

Some economists see the primary contribution of the Bank as helping to cushion the post-Brexit shock to the supply of lending from banks.

“If over the next 12 months lending conditions for the real economy remain unchanged compared to those pre-Brexit that would be a big success for the Bank of England” says Mr Pickering.

“The counterfactual would be less lending to the real economy, probably higher mortgage rates, less consumer credit.”

Analysts also stress that there are limits to what the Bank of England can achieve alone to improve the UK outlook.

“Monetary policy can’t offset political uncertainty and that’s the real thing which is hitting confidence”, says Mr Pickering.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks