UK wage growth rises again in November as job creation picks up

They grew by 3.4 per cent in the three months to November, the strongest in a decade

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

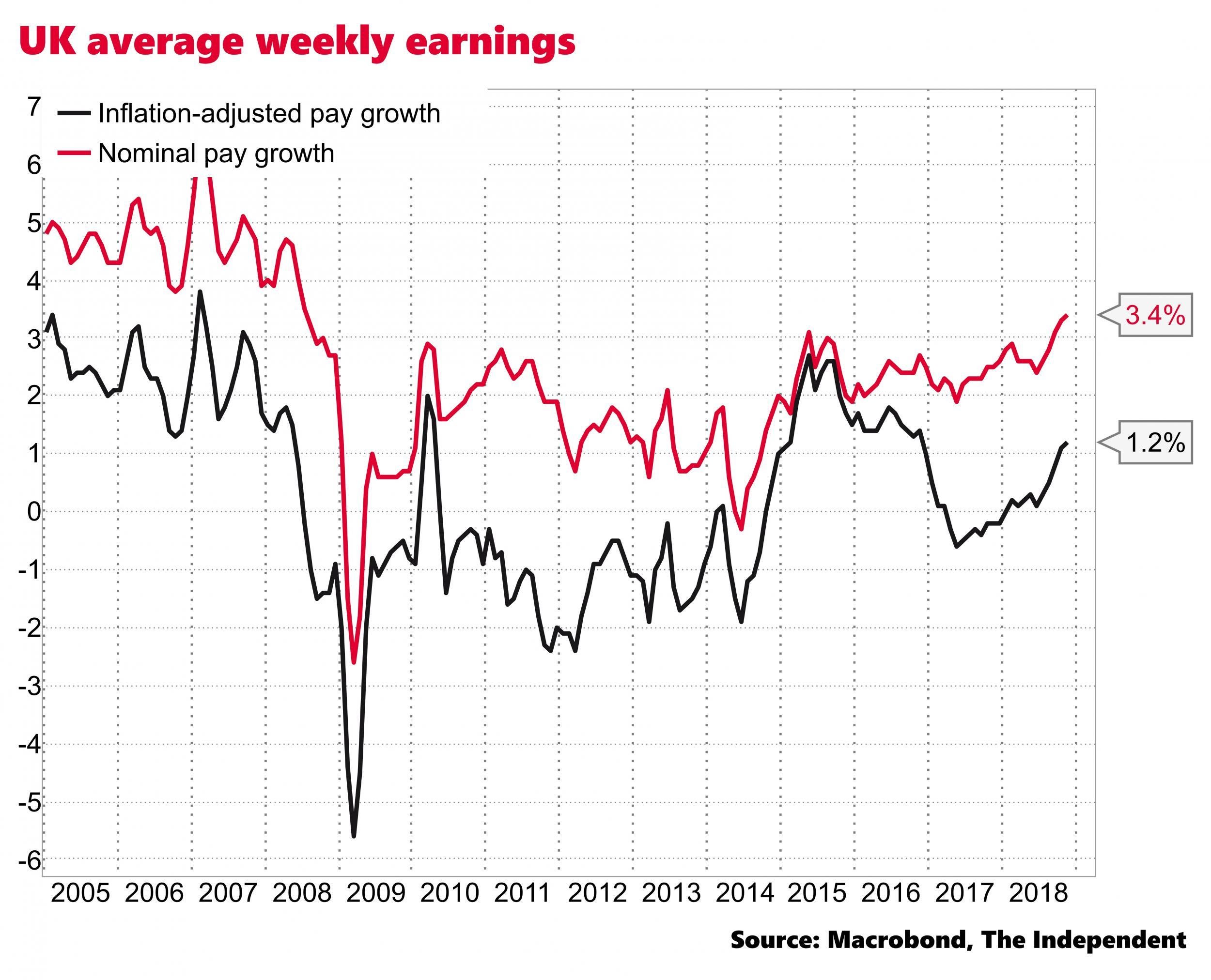

Your support makes all the difference.UK average wages grew by 3.4 per cent year-on-year in the three months to November, official data on Tuesday showed.

That was up from the 3.3 per cent rate in October and the strongest in a decade.

The Bank of England raised interest rates last year in anticipation of rising inflationary pressures in the economy, which it expects to be led by stronger pay growth.

Adjusted for consumer price inflation, which has been dropping since its peak in 2017, real wages were up 1.2 per cent in the quarter to November, the best performance in two years.

However the level of UK average weekly earnings adjusted for inflation is still below where it was in 2008.

And the nominal growth rate of pay remains lower than the 4 per cent annual average seen before the financial crisis.

Further the Bank’s Governor, Mark Carney, has warned that a no-deal Brexit is likely to inflict severe damage on real wages and living standards.

“The recent pick-up in salaries, coupled with the fall in inflation, will be welcomed by households, though the hangover of weak real wage growth over the past 18 months will continue to be felt on the high street for the time being,” said Tej Parikh of the Institute of Directors.

“The Bank of England will be little moved by today’s data. While the momentum behind wage growth may build support for interest rate hikes, Brexit remains the spanner in the works for the [Bank’s Monetary Policy Committee].”

The Office for National Statistics also reported on Tuesday that the numbers in employment in the UK grew by 141,000 in the three month period – the biggest rise since the three months to March.

And the employment rate reached a new record high of 75.8 per cent.

Picking up

The jobless rate was 4 per cent, down from 4.1 per cent in the three months to October, while the inactivity rate declined slightly to 21 per cent.

Separately, the ONS reported that public borrowing in December was £3bn, up £300m on the same month in 2017.

It was also higher than City of London analysts had been expected and leaves public borrowing on course to come in around £5bn ahead of the Office for Budget Responsibility’s (OBR) £25.5bn estimate for the 2018-19 financial year.

“The first estimates of monthly borrowing in 2018/19 so far have subsequently been lowered, mainly due to receipts being revised up so there is a good chance that public borrowing this year will match, or even beat, the OBR’s forecast in the end,” said Andrew Wishart of Capital Economics.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments