Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

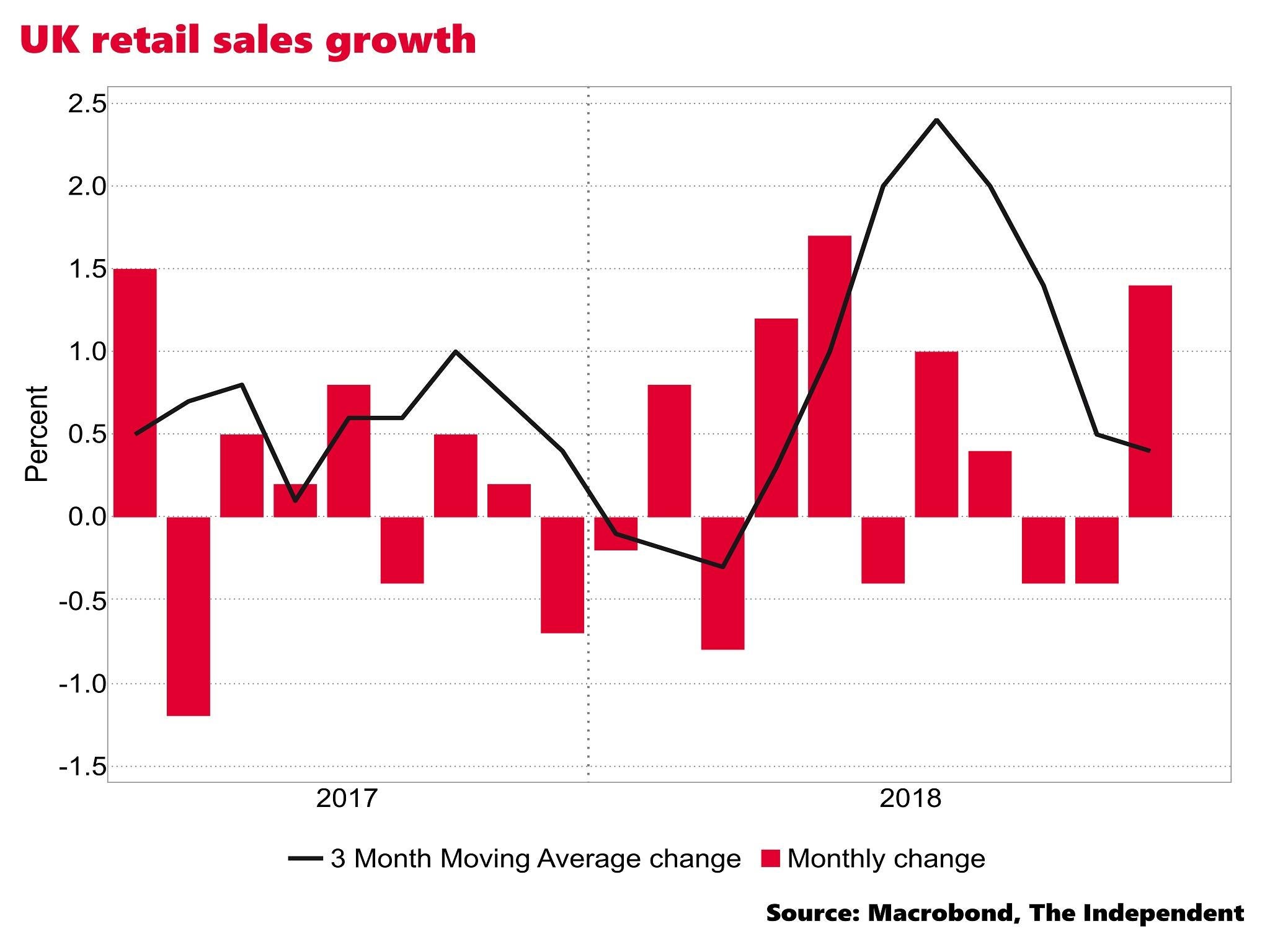

Your support makes all the difference.UK retail sales picked up by more than expected in November due to Black Friday discounting – but trading is still slow ahead of Brexit.

Sales volumes were up 1.4 per cent from October, well ahead of City analysts’ prediction of 0.3 per cent, the Office for National Statistics reported.

However, over the three months to the end of October, sales grew only 0.4 per cent from the previous quarter – a sign of faltering consumer confidence ahead of the UK’s exit from the European Union.

Retail sales account for around 20 per cent of UK GDP and are seen as an important barometer of conditions in the overall economy.

And more up-to-date business surveys have indicated that GDP growth could slip to just 0.1 per cent in the final quarter.

Samuel Tombs, of economic consultancy Pantheon, predicted: “Most of the pick-up in total [retail] sales will be revised away in time, when the seasonal adjustment process updates for the new pattern on spending generated by Black Friday.”

However, other analysts were more optimistic.

“With inflation continuing to fall back and pay growth on the up, there should be scope for consumer spending growth to gather some momentum,” said Thomas Pugh of Capital Economics.

Many retailers have reported a disappointing Black Friday, including the online fashion retailer Asos.

Slowing down

And consumer confidence measures have been weakening in recent months.

The ONS reported that the biggest increase in sales volumes in November came from non-food stores, where there was a 0.9 per cent rise.

Food stores saw zero growth in the month and department store sales fell.

Internet sales as a proportion of all retailing hit 21.5 per cent, the first time it has exceeded a fifth of the market.

Analysts’ attentions will now turn to Christmas trading data to gauge the strength of the consumer and to judge the implications for the overall momentum of the economy.

Separately on Thursday, the CBI reported the results of its latest distributive trades survey for December, another marker of consumer spending health.

The results showed the retail sales balance of the biggest companies dropped to -13 from +19 in November, the lowest reading since October 2017.

Anna Leach of the CBI said: “It’s clear the sector continues to feel the impact from pressures on household incomes and digital disruption. Brexit uncertainty may also be affecting consumer sentiment and spending.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments