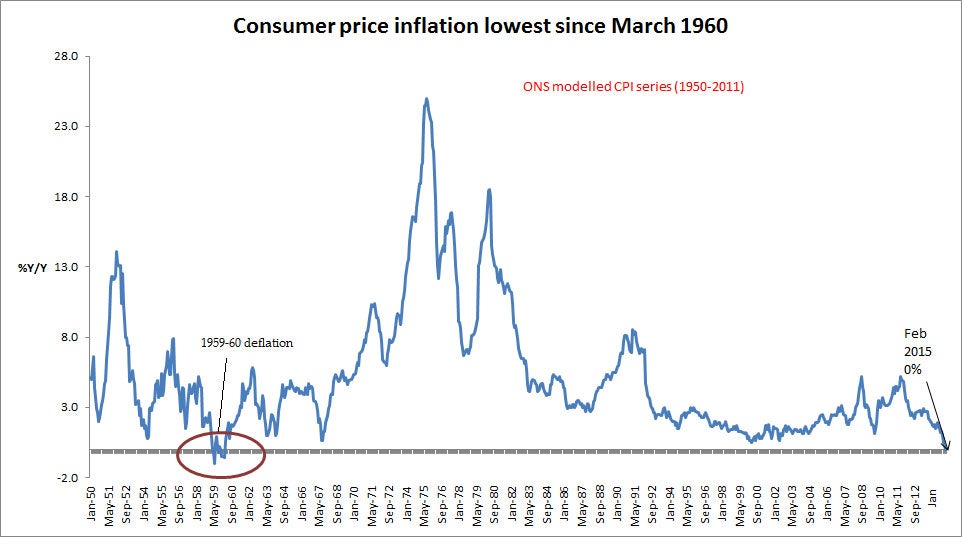

Inflation hits a record zero boosting household incomes

Lower prices for food and goods welcomed pre-election

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Consumer price inflation dropped to 0.0 per cent in February from an annual rate of 0.3 per cent in January, the Office for National Statistics said, delivering a pre-election windfall to millions of households.

It was the first time the consumer price index has shown no change to consumer prices year-on-year, according to the Office for National Statistics, which holds records dating back to 1989.

However, the ONS said inflation may have even been lower in 1960 based on unofficial estimates.

The slowdown stemmed from lower prices for food, furniture and recreational goods, like computers, books and games.

The news will be welcome news for consumers, especially as annual wage growth slipped to 1.8% per cent at the start of the year, and will likely be a major talking point ahead of the general election in May.

Some will fear, however, that the falls in inflation below the Bank of England's 2 per cent target could see the UK slip into a cycle of low price growth.

Last week the Bank's chief economist Andy Haldane said the central bank was as likely to need to cut rates as to raise them in the immediate future, though for now that view appears not to be shared by other policymakers.

Governor Mark Carney said earlier this month that cutting rates purely in response to falling oil prices would be “extremely foolish”, and most expect a rate rise in around a year's time.

Additional reporting by Reuters

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments