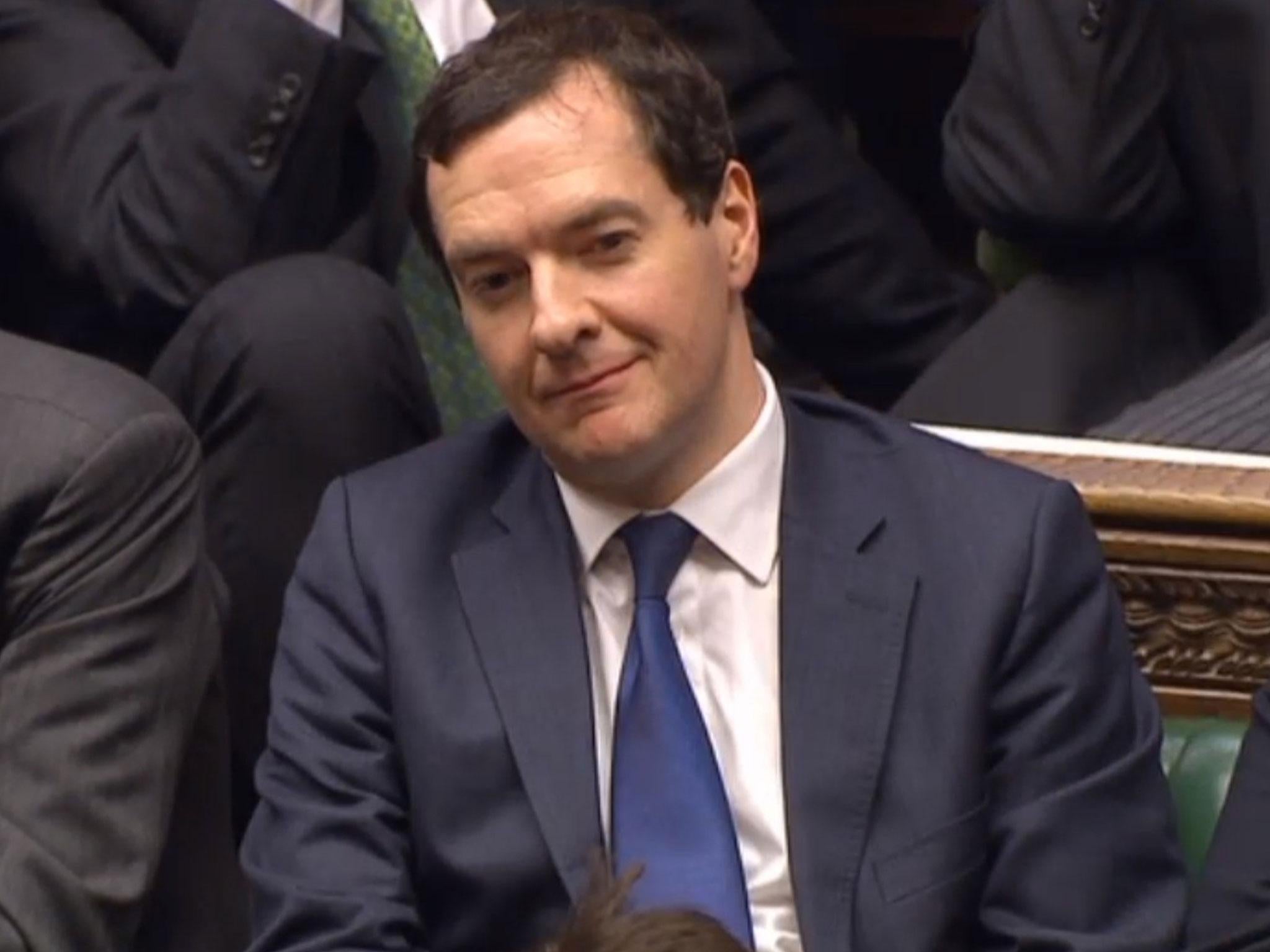

George Osborne's 2015 tax change 'helped 100 wealthy people save £1m each'

The timing of the former Chancellor's announcement enabled people to pay themselves larger dividends from their companies in the 2015-16 financial year to avoid a higher rate

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne’s decision to announce a tax change in July 2015 that would not take effect for another nine months enabled 100 wealthy individuals to save an average of £1m each, according to the Office for Budget Responsibility.

The former Chancellor announced in the Summer Budget in the wake of the 2015 general election that taxes on individual dividend income, generally paid by well-off people who own their own businesses, would rise from April 2016.

The prompted people to, entirely legally, pay themselves larger dividends from their companies in the 2015-16 financial year to avoid the higher rate.

HMRC initially expected a total of around £7.7bn of income to be brought forward in this way. But the tax office now estimates that, in fact, £10.7bn was bought forward, or “forestalled”.

Based on an estimate of what the timing and value of dividend income would have been in the absence of the tax change the OBR estimates that the decision to pre-announce the policy effectively cost the taxpayer around £800m in lost tax, with the benefit accruing to those who took the opportunity to shift their incomes.

It further estimates that around 14 per cent of that total gain went to just 100 individuals who withdrew around £30m each from their companies. That implies that each of those 100 individuals saved, on average, £1.12m.

This is something that they would probably not have been able to do if the Government had not left such a large time lag between the announcement of the tax and its implementation.

Carl Emmerson of the Institute for Fiscal Studies said that there are “sound public finance reasons” to get such tax changes in place as soon as possible to minimise the opportunity for such forestalling.

He suggested that it might have been better for Mr Osborne to have announced the measure in the 2015 Autumn Statement, rather than in the summer, to reduce the time available for private income shifting at the public sector's expense.

According to estimates from HMRC around two-thirds of the forestalling was done by additional rate taxpayers, meaning they have pre-tax incomes of more than £150,000 a year.

In Wednesday’s Budget the Chancellor, Philip Hammond, also pre-announced an increase in dividend taxes to take place in April 2018.

But Mr Emmerson noted that this new change is a reduction in the dividend income tax free allowance from £5,000 to £2,000 meaning that there is much less incentive for the wealthy to shift their incomes.

A previous example of income forestalling by wealthy individuals occurred after the previous Labour Chancellor, Alistair Darling, announced the introduction of a new 50p rate of income tax for those earning more than £150,000 in his 2009 Budget to take effect in the 2010-11 financial year.

Around £18bn was shifted between fiscal years, most of it in the form of dividends.

Mr Osborne, controversially, announced a cut in the rate to 45p in his March 2012 Budget, to take effect in April 2013, prompting yet more large-scale income shifting, with many wealthy individuals delaying receiving their incomes until the following tax year.

Labour at the time branded this a "tax cut for millionaires".

It emerged this week that Mr Osborne, who was sacked as Chancellor last year, will earn £650,000 a year for working four days a month at the giant global asset manager Black Rock.

Some have estimated that, including bonuses, Mr Osborne's total remuneration for this work could exceed £1m a year.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments