Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In his “100 day action plan” Donald Trump referred to his overarching macroeconomic goals. This stated that he would grow the US economy by 4 per cent per year and create at least 25 million new jobs over a decade.

Trump himself has been boasting of his growth boosting and job boosting achievements in recent months.

But the reality is that it would be unwise to look for any evidence in the official US data that President Trump is delivering.

For all his bluster, he has not actually passed any budgets or tax reforms yet. He ostentatiously scrapped US participation in the Trans-Pacific Trade Partnership, but this was not yet up and running. No existing US trade deals have been re-negotiated in America's favour.

GDP growth or new jobs since Mr Trump was inaugurated on 20 January largely reflects the state of the economy he inherited from Barack Obama.

But those figures do suggest the scale of the challenge ahead of him if he is to make good on his promises.

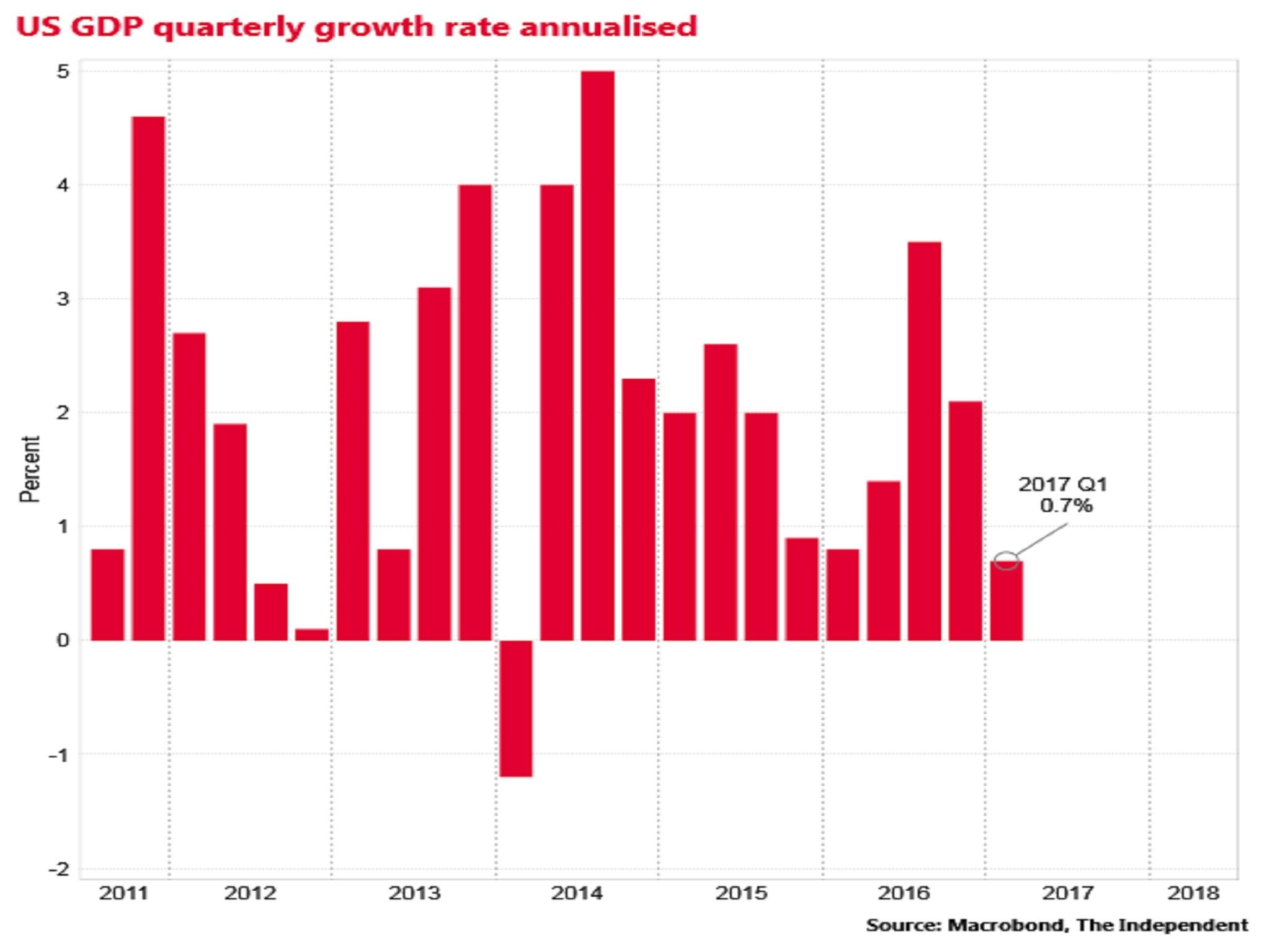

On Friday, the Bureau of Economic Analysis reported that US real GDP grew at an annualised rate of just 0.7 per cent in the final quarter of 2016, down from a 2.1 per cent rate in the third quarter.

Growth needs to rise...

Analysts caution against reading too much into one quarter's figures and suspect that growth will pick up over the rest of the year.

Nevertherless, total GDP growth in 2016 as a whole was 1.6 per cent and Mr Trump will need to more than double that rate and keep it there in order to deliver on his growth target.

The last time the US had consistent growth of above 4 per cent a year was in the late 1990s and many economists are sceptical of whether those days can return given structural drags on economic expansion, not least an ageing population.

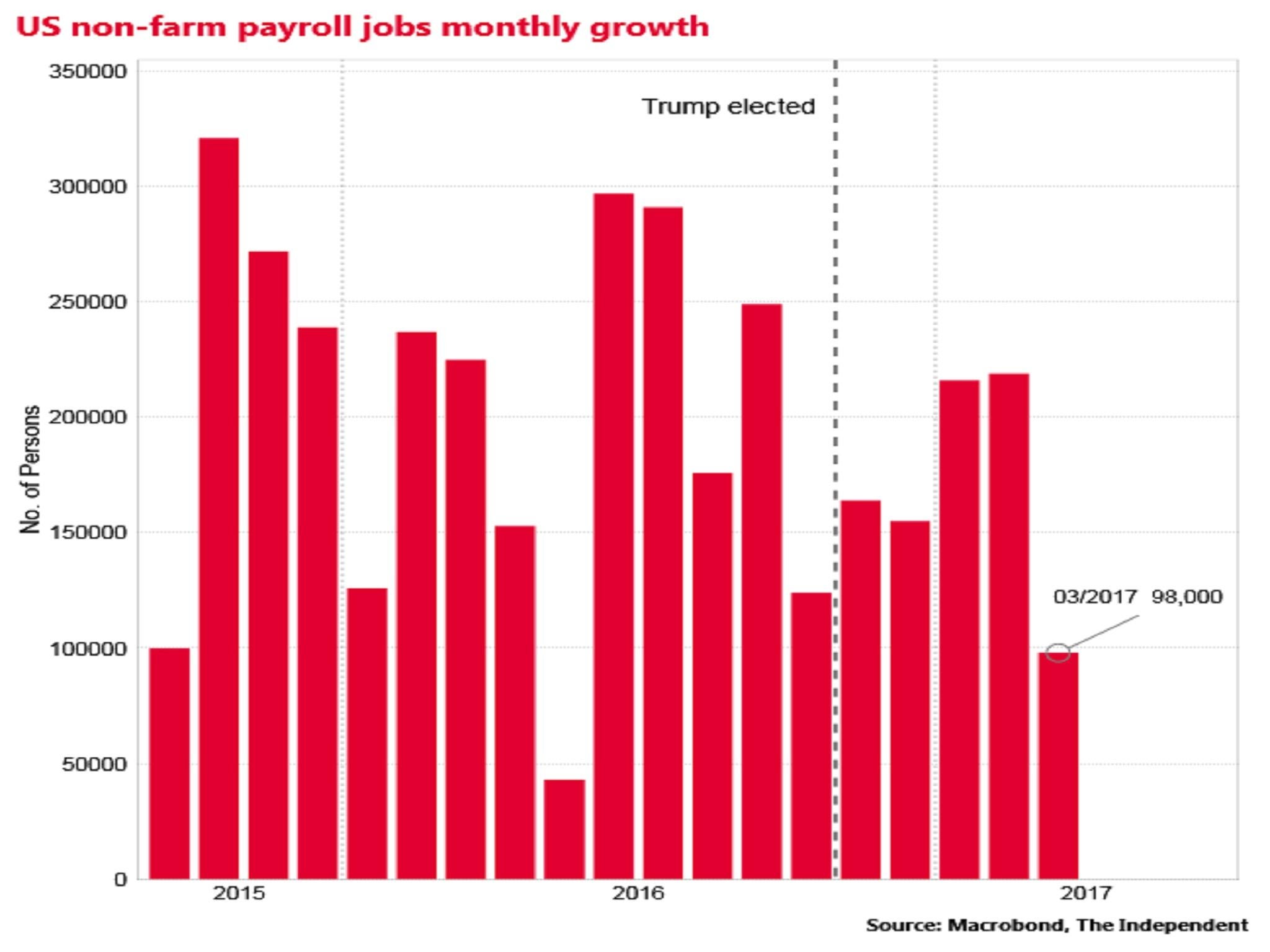

The most recent US jobs report from the US Bureau of Labour Statistics was on 7 April. This showed a very disappointing expansion of just 98,000 new non-farm jobs created in March. This was well down from job creation of 219,000 in February.

...so does job creation...

If Mr Trump is to meet his 25 million jobs pledge over 10 years the job creation rate would have to return to some 200,000 a month and stay there.

Again, economists are sceptical about how deliverable that is given the US unemployment rate is already just 4.7 per cent and widely estimated to have little remaining spare capacity.

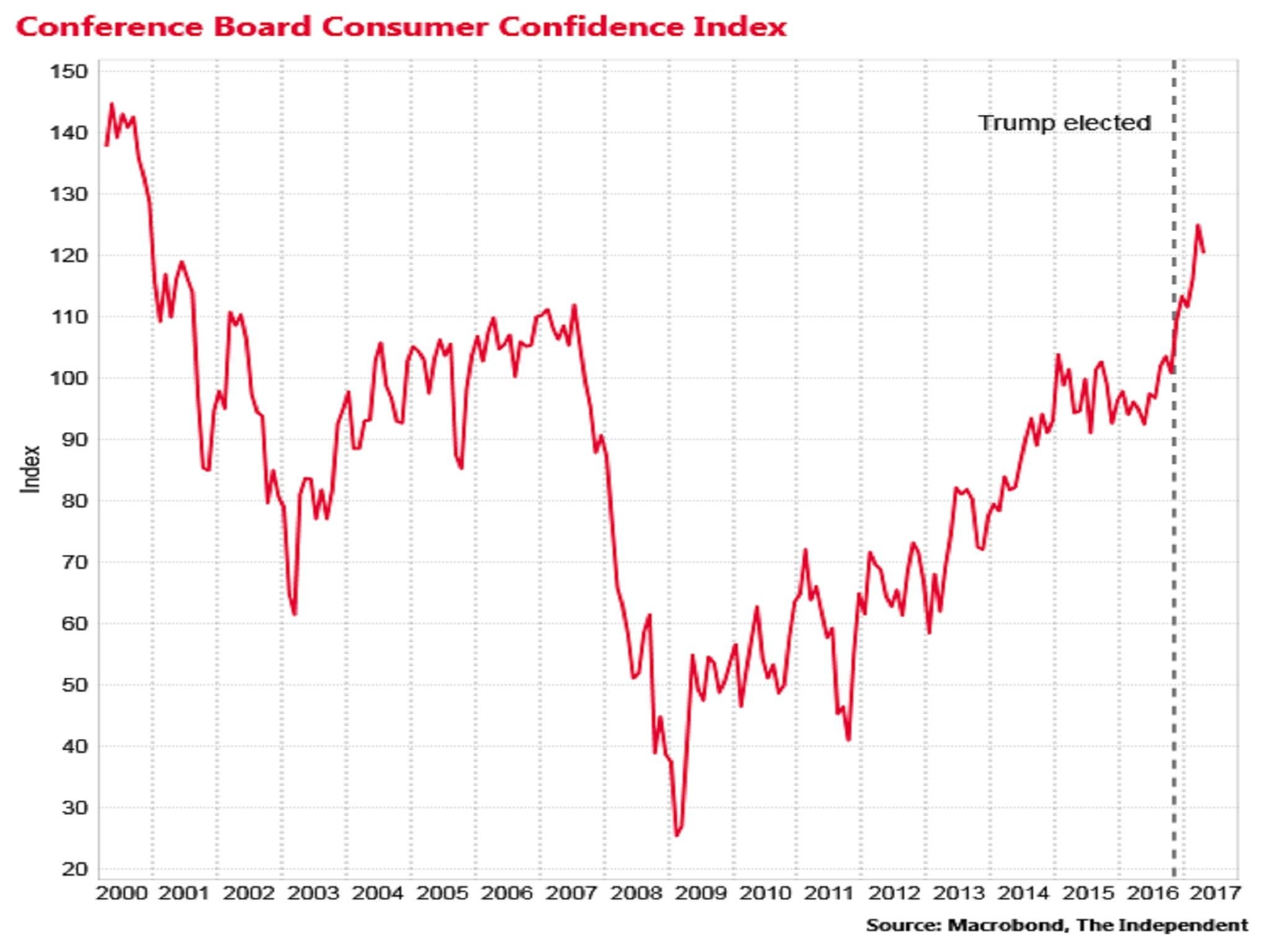

Where Mr Trump might legitimately claim to have made an economic impact already is through boosting public and financial market expectations of higher growth, which does matter economically since people often spend based on those expectations.

Consumer confidence hit its highest level since 2000 in March according to the Conference Board. It declined slightly in April, but remains at “strong” levels by historical standards according to the compilers.

...US consumers seem optimistic...

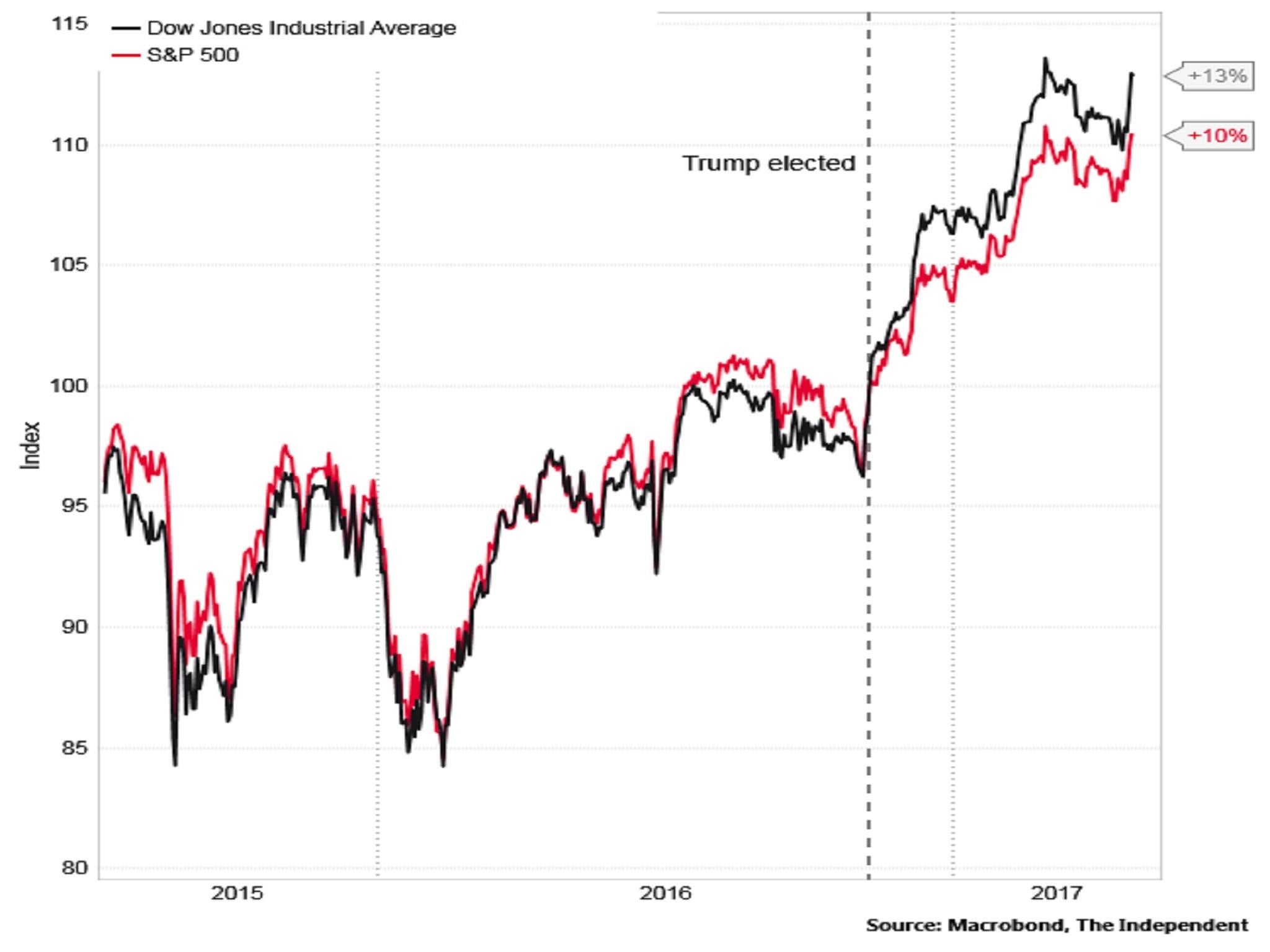

Since he won the election on 8 November, US stock markets have risen quite sharply. The S&P 500 index is up around 10 per cent and the Dow Jones Industrial Average is 13 per cent higher.

The latter passed through the symbolic 20,000 mark for the first time in its history in January.

Yet both indexes have been treading water since early March, reflecting creeping doubts among investors over whether Mr Trump will actually be able to deliver on key elements of his economic programme, particularly his promised massive personal income tax cuts and $1 trillion infrastructure (£770bn) spending package, given divisions in the Republican Party in Congress.

...investors are more wary...

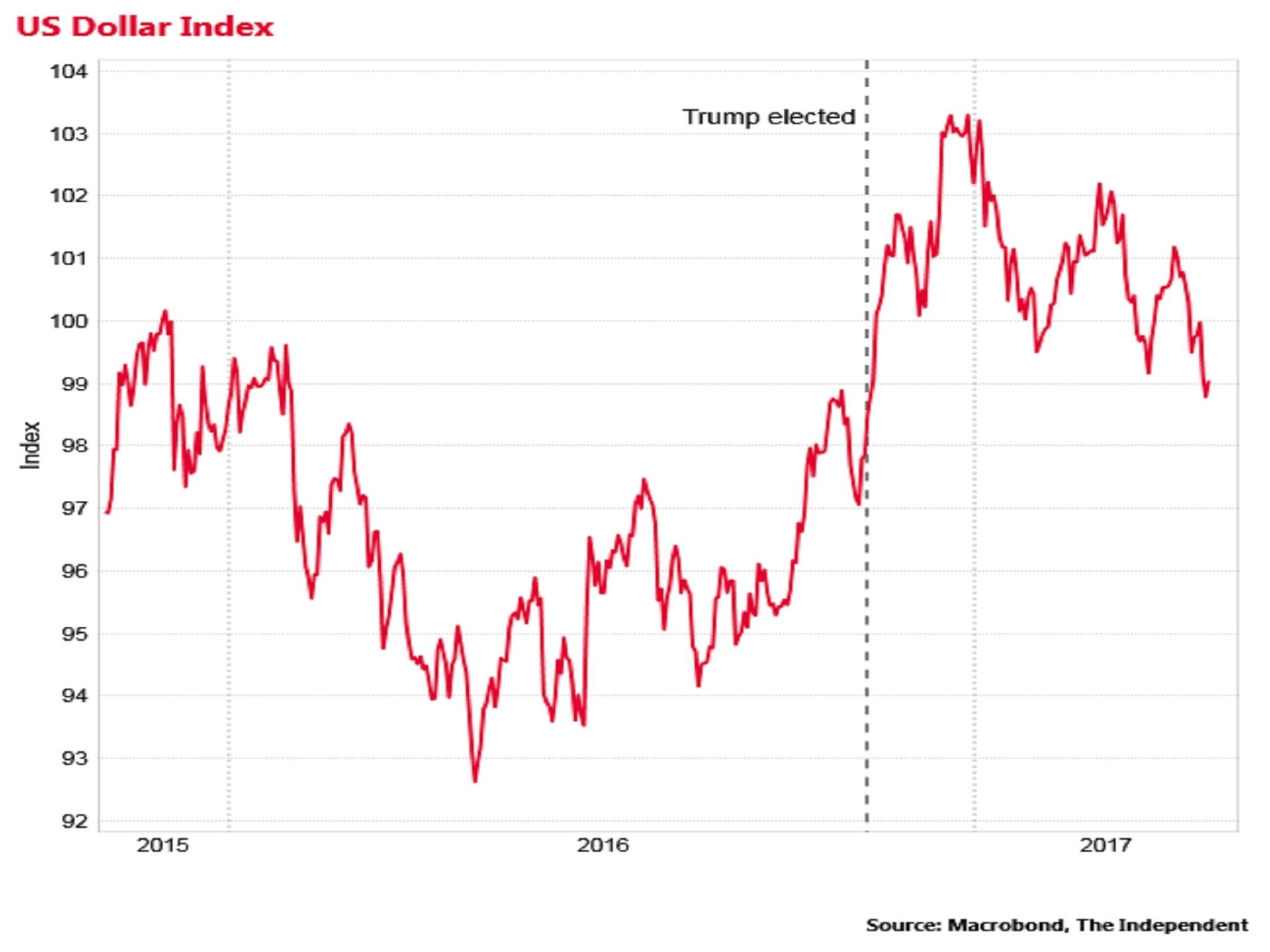

Mr Trump had a dramatic impact on the dollar when he was elected. The Dollar Index – which values the greenback against a host of other major currencies – shot up, reflecting a belief that Trump would boost growth and prompt the US central bank to increase interest rates faster than otherwise. This was dubbed the “Trumpflation” trade.

Yet the Dollar Index has been gliding down this year and is now roughly back to where it was at the time of last November's election.

...and the dollar has returned to earth

This also reflects waning market expectations of a near-term major Trump infrastructure stimulus package as well as ambiguous signals from Mr Trump and his senior economics team over whether or not they welcome a stronger dollar from a trade perspective.

So there we are.

Consumers seem to be pretty buoyant. Doubts among financial market traders and investors are growing. And all the hard economic data is really still to come.

It will take considerably longer than 100 days to determine whether or not Mr Trump is delivering on his claims that he will make the American economy (by his own lights) great again.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments