UK shops still running short on painkillers and crisps amid global supply crunch

Data also suggests consumers are now buying early ahead of Christmas to ensure they can get hold of goods

Shoppers may still struggle to get hold of crisps in UK supermarkets, according to official statistics.

Survey data, gathered by Kantar Public and shared with the Office for National Statistics, found some shops were still running low on crisp supplies.

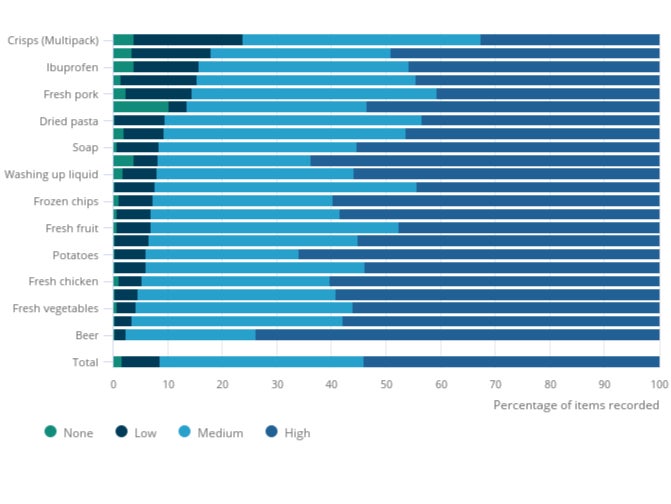

Yet while there were still considerable shortages of multipacks when the data was collected between 19 and 22 November, with 24 per cent of stores having few or none on offer, it has eased somewhat from the 30 per cent the previous week.

An IT glitch earlier this month that disrupted production at Walkers, the UK biggest crisps maker, led to a sharp fall in production levels. The manufacturer warned at the time that it could take weeks to get back to normal levels of output.

More troubling, however, is the ongoing shortage of over-the-counter painkillers - paracetamol and ibuprofen. Almost one in five stores had low or no stock of paracetamol between 19 and 22 November.

The figures, part of the ONS’ regular examination into how the economy has fared during the pandemic, help paint the picture of consumers’ experiences during the global supply chain crunch and the partial disintegration of EU-UK trade.

Reports of shortages are set against a backdrop of rising costs for consumers, with the Confederation of British Industry (CBI) recording the largest rise in selling prices since 1990 in the year to November.

The CBI said data from its members indicated that prices would continue their upward path next month, too, adding to pressure on Christmas shoppers’ wallets as inflation outstrips wage growth.

The data painted a relatively positive picture for retailers, suggesting that sales were relatively strong for the time of year. Some economists were wary about whether this would prove lasting, though and that the year-on-year measure was also affected by the Covid-19 restrictions last year.

“These positive signals, however, most likely reflect consumers bringing forward their Christmas shopping in the face of warnings over potential shortages, rather than a pick-up in underlying demand,” said Gabriella Dickens, senior UK economist at Pantheon Macroeconomics.

This may be borne out by the separate ONS/Kantar data which showed that more than one in 10 stores were out of fresh pork, frozen turkey and sparking water.

The ONS’ figures come after the Wine and Spirit Trade Association (WSTA) said its members had been reporting serious delays in importing products, of up to five times the normal timescale.

The industry is continuing to struggle against global economic disruption due to the pandemic, and heavy goods driver shortages.

In March this year, amid soaring levels of coronavirus cases, India, one of the world’s biggest suppliers of generic drugs, placed limits on exports. Many inputs for these drugs, often sourced in China, had also been in short supply for Indian importers, industry experts said.

Shortages from packaging through to raw materials and limits on freight capacity have all served to create a supply chain crunch for drugs.

The problem is not dissipating as quickly as some industry experts had originally hoped, however - with several global trade studies suggesting that shipping costs and other triggers of supply chain disruption will last well into next year.

Overall, for the range of items which were surveyed, around 10 per cent of stores were missing or low on these goods that is “broadly similar” to previous measurements, the ONS said, suggesting that general shortages had not got worse.

Still, this does not mean that the economy is avoiding price rises from shortages for a range of industry inputs. Inflation is set to peak at 5 per cent in April 2022, the Bank of England has warned.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks