How the vulnerable lost their life savings while regulators stood by

Investigation: The City watchdog failed to act for more than two years against an alleged scam that took life-changing sums from elderly savers – one of whom had dementia – before disappearing without trace. Ben Chapman reports

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In one devastating moment, Jane Caldwell realised she had lost £200,000. The money had come in part from a life insurance payout that she had not touched since her partner’s death a decade before. She had set it aside for their disabled daughter’s future.

“As an older mother and with her father having passed away, I thought my daughter is probably going to need my help in the future which I won’t be around to do,” says Caldwell, who asked for her name to be changed so she would not be targeted by fraudsters.

In mid-2018, Caldwell, who is unable to work for health reasons, received a call from a man she understood to be from Nationwide, with which she had savings bonds. It was not from Nationwide at all – but the caller appeared to know all about her finances.

Caldwell was about to become one of a rapidly growing number of victims of investment scams who are finding little help from regulators, banks or the police when they lose life-changing sums of money.

The Financial Conduct Authority (FCA) knew about the scam six months before the call but failed to stop salespeople pursuing the vulnerable for almost two years, an investigation by The Independent has found.

Reports of investment fraud to police more than tripled between 2017 and 2020 and are on course to hit a record high this year. Victims reported almost 7,000 cases and £177m of losses in the first three months of the year alone, new figures from the National Fraud Intelligence Bureau show.

Since 2017, total reported losses to investment fraudsters have topped £2bn. The true figure is almost certainly higher, as many victims do not call the police.

“I’m dyslexic. I have a lot of trouble remembering things,” Caldwell says. But she remembers the sales call vividly.

“He gave advice on my bonds and said that switching would be the best thing for my daughter.”

He was persistent, recommending she invest her savings in a property company called Exmount Construction Limited, Caldwell says.

After a lot of persuasion, she walked into her Nationwide branch, approached the counter and, with the help of a cashier, transferred almost £200,000.

She says she did not know she was putting her savings into a high-risk investment and that the building society should have asked questions about such a large transfer. Nationwide says it complied with its legal obligations. Many months later, when her current partner questioned the transfer, Caldwell realised she had been scammed.

Exmount has since disappeared, its phone lines are dead and there is no evidence that any money was ever invested in property.

Long line of victims

The case adds to a series of issues that occurred under the watch of former FCA boss Andrew Bailey. Last year, a damning report was published into failures prior to the £237m collapse of another investment firm, London Capital & Finance.

It also has echoes of Blackmore Bond, which went into administration last year with £47m of savers’ cash. The FCA failed to act on repeated warnings, made directly to Bailey, that it had been a scam.

After Caldwell complained, the Financial Ombudsman Service told Nationwide to refund her money, but the building society has appealed against the decision. “As no error has been made by the society, we are not liable for her loss,” a spokesperson said.

Nationwide also turned down the complaint of a 79-year-old Exmount victim with dementia who transferred £50,000. The building society later refunded that victim’s money after being told to do so by the ombudsman.

A group of 15 more victims, many elderly or vulnerable, have come together to recover the £1m they put into Exmount. All of them parted with their money after the FCA had been warned. None wished to be named for fear they would be further targeted by scammers. The total number of victims is unknown.

Glossy brochures, a top barrister... and a gardener for a director

The Exmount case demonstrates the ease with which companies selling questionable investments can operate under regulators’ noses.

Exmount’s brochure and website were signed off by an FCA-approved person; its legal documents had the seal of approval of a top barrister, while an established accountancy firm acted as trustee.

A glossy brochure portrayed Exmount as a visionary property company, but beneath the slick marketing lay warning signs for those who knew where to look.

The company began life in 2013, registered at a non-descript semi-detached house in north London. The address, 2 Woodberry Grove, has become notorious as home – on paper – to more than 20,000 off-the-shelf firms.

All of them were initially registered in the name of an 86-year-old woman and some have been used to carry out scams.

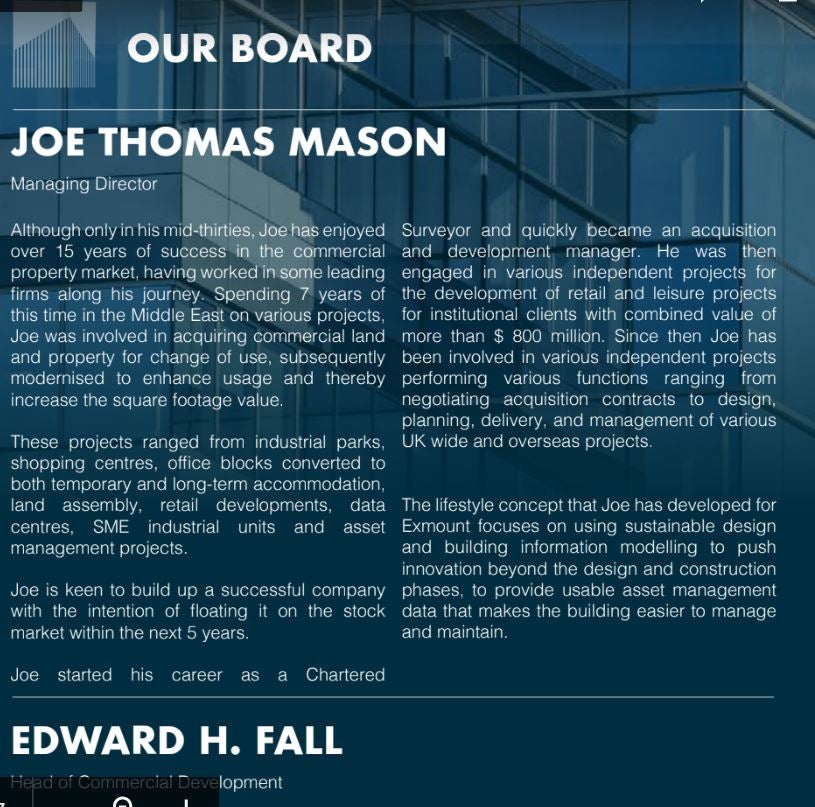

After four years lying dormant, Exmount was taken over by 38-year-old Joe Thomas Mason, who became Exmount’s only director in July 2017. Mason is a sole trader from Tilbury in Essex who lays driveways and fake lawns.

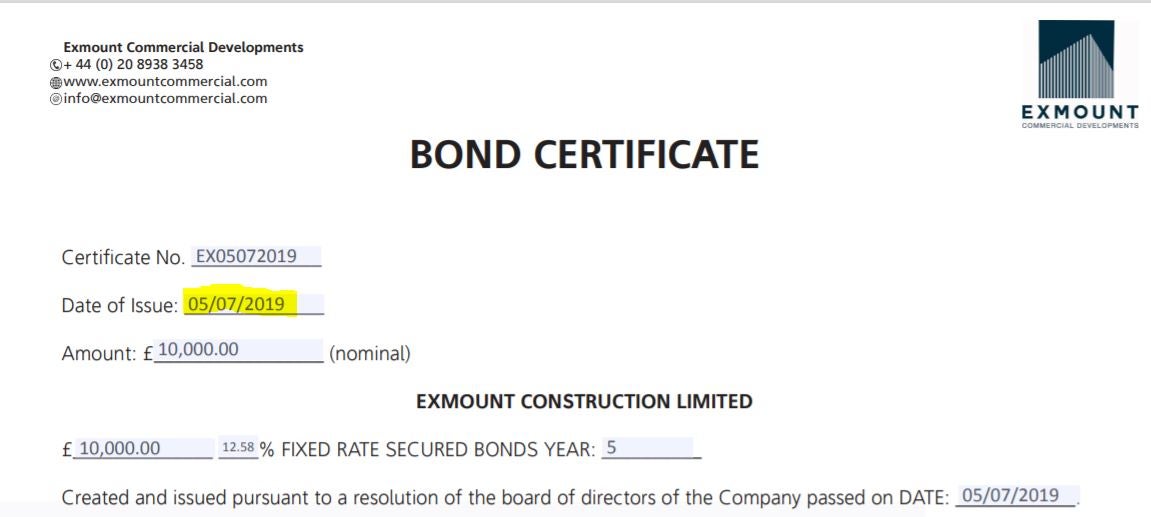

Within two months, Exmount had plans to raise £20m from the public with the promise of returns as high as 12.5 per cent. The company issued a brochure that falsely described Mason as a chartered surveyor who had worked on “retail and leisure projects for institutional clients with a combined value of more than $800m”.

It also claimed prominently on the front cover that Exmount had a “strategic partnership” with Century 21, a global estate agency business. Century 21 said it had never dealt with Exmount.

In September 2017, an FCA-approved person, Graham Read, signed off the brochures. That meant Read vouched for the fact that they were clear, fair and not misleading. Exmount investors put faith in a copy of a signed letter from Read to Exmount, confirming his approval.

However, Read claims he withdrew his approval in early 2018, before investors had parted with their money. He said he had come to believe that Mason was not in control of the company but was instead used as a frontman by “some dodgy people”.

He added: “The sooner this is cleared up, the better it is for everybody, because I just hate elderly people being ripped off.”

When contacted by The Independent, Exmount’s director, Mason, said he didn’t “know much about” the company and declined to comment further. Asked about Read’s comments and the misleading claims in the brochure, Mason did not respond.

‘Should never have been given to investors’

In August 2017, shortly after Mason had become director of Exmount, a solicitor called Taher Moosavi approached a senior London barrister, Clive Wolman, for a legal opinion on the investment structure.

Wolman, who is a former City editor of The Mail on Sunday and practices at the same Thomas More Chambers as former attorney general Geoffrey Cox, said he was regularly introduced to potential work by Moosavi.

Wolman spoke once over the phone with Mason and another man who introduced himself as Vijay Singh. Wolman conceded that he did not know if this was a real identity.

He was then instructed directly by Exmount and gave a legal opinion, stating that the investment structure was legally sound. He never gave any opinion on the investment itself and said he had not conducted due diligence on Mason or Singh, and did not have an obligation to.

“That piece of paper should never have been given to investors. Indeed, I made clear to them that it was not for investors. It was solely a legal opinion,” Wolman said.

Four months later, in January 2018, Trading Standards, City of London Police and the FCA jointly raided a rented office on Threadneedle Street in the City of London and discovered sales agents for a company called Asset Backed Management (ABM) selling Exmount’s bonds. Officers seized brochures making false claims.

The sales agents took commissions of between 27.5 and 40 per cent for each Exmount sale, paid for out of investors’ money.

ABM’s director and its major shareholder had both been involved in previous unregulated investments where elderly savers lost large sums.

The shareholder, Ricky Burgess, 31, had been banned from being a company director for 15 years in 2016 for his part in a company selling overpriced carbon credits and gems. He said he was an employee of ABM, not a director, so should not be held responsible if people lost money. He pointed out that the company’s marketing material was signed off by an FCA-approved person and therefore had no reason to doubt its contents.

Graham Read, who had signed off the brochures, said he was contacted by Trading Standards about the raid and immediately told the FCA he had withdrawn his approval. The FCA declined to confirm or deny this and could not point to any action it took at the time to stop Exmount or ABM operating.

Records collated by Exmount’s victims show that over the following 18 months, they made dozens of bank transfers to a series of accounts on the instruction of salespeople. Some victims made multiple transfers, all of which could have been prevented if swift action had been taken.

Consistent failure

In August 2020, two and a half years after the FCA had first been alerted to problems with Exmount, the regulator quietly updated Read’s status to say that he was no longer allowed to sign off financial promotions without prior approval from the FCA.

When approached by The Independent about Exmount, the FCA said it took “very seriously the information we receive about unethical business practices and scams” and that it aimed to take action against “firms that act as enablers”. However, the spokesperson added: “We can only take actions against misconduct in our remit.”

But Mark Taber, a consumer campaigner, said the regulator had consistently failed to use its powers to stop potential scams and bring prosecutions against people behind them.

“The FCA was clearly aware of Exmount and the boiler room, Asset Backed Management, selling its bonds in early 2018 before victims invested but took no effective action to protect or warn consumers.”

Taber called for a provision in the Online Safety Bill that would force tech companies like Google and Facebook to vet adverts for investments before they are published. Many victims are first targeted after responding to online ads.

Currently, loopholes in the rules and a patchwork of different enforcement agencies allow investment fraudsters to operate with little fear of being held accountable when money vanishes.

Last year, more than a year and a half after the £237m collapse of London Capital & Finance, the FCA launched a consultation asking for views on how it should stop what the watchdog’s chairman described as an “epidemic” of investment scams. For thousands of savers like Jane Caldwell, it has come years too late.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments