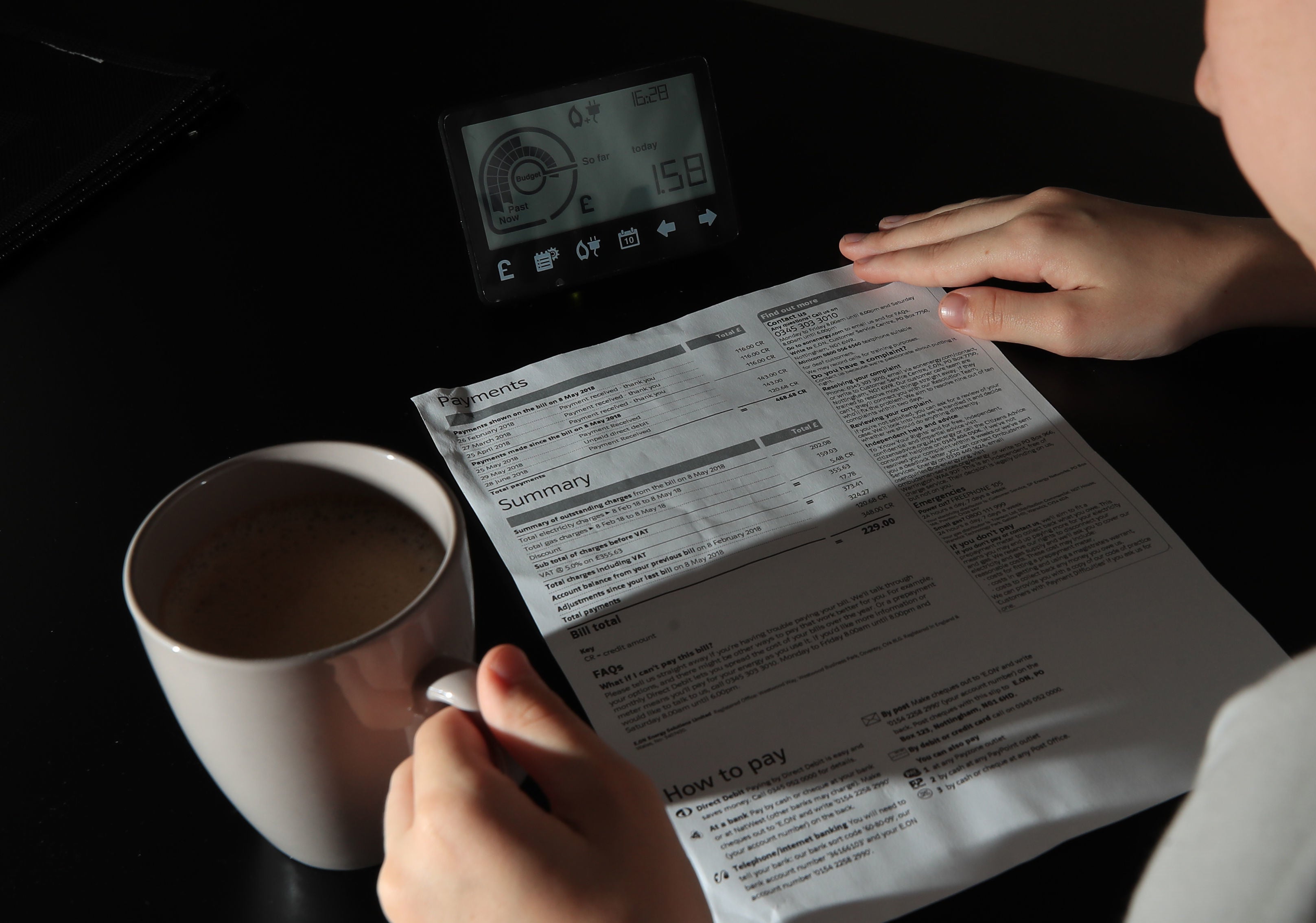

Living standards fall for record fourth quarter in a row as inflation outpaces wages

Inflation outpaces incomes in first three months of the year

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Living standards fell again at the start of the year, marking four consecutive quarters of declining disposable incomes for the first time since records began.

Soaring prices reduced the spending power of British households by 0.2 per cent on average between January and March, official figures show.

The Office for National Statistics reported that inflation was 1.7 per cent during the quarter, outpacing income growth by 1.5 per cent.

New data confirmed earlier estimates showing that economic growth slowed markedly in the first three months of the year.

Gross domestic product (GDP) - a measure of the size of the economy - increased 0.8 per cent, down from 1.3 per cent in the previous quarter. GDP was 0.7 per cent higher than in the final quarter of 2019, before the pandemic began.

Concerningly for chancellor Rishi Sunak, business investment fell 0.6 per cent and remains languishing 9.2 per cent below its pre-pandemic peak. Lack of investment suggests low ocnfidence in the economy's future and could hamper any recovery.

The figures do not take into account the last three months during which rising prices for essentials have developed into a crisis, pushing energy bills to around £2,000 for the average household.

Inflation is at its highest in four decades and the Bank of England Governor warned on Thursday of worse to come.

Andrew Bailey said price rises will hit Britain harder than any other major economy and that output is likely to weaken earlier and be more intense.

Martin Beck, at the EY Item Club, said: "The squeeze on household spending power has further to run, with the second quarter having seen both the energy price cap increase by more than 50 per cent and a rise in personal taxation, while a further large rise in the energy price cap looking likely in October.

"So, with savings rates already below 'normal' levels, hopes of avoiding a consumer recession rest on households who accumulated 'excess' savings during the pandemic spending a good amount of those funds."

ONS data also out on Thursday showed Britain's current account deficit - the difference between the value of the goods and services the UK imports and the goods and services it exports - widened to a record £51.7bn, or 8.3 per cent of gross domestic product.

This was the biggest shortfall since records began in 1955, according to the ONS.

But it issued a warning over the figures, saying there was an impact of changes in post-Brexit data collection on trade in goods imports and foreign direct investment, which it is investigating.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments