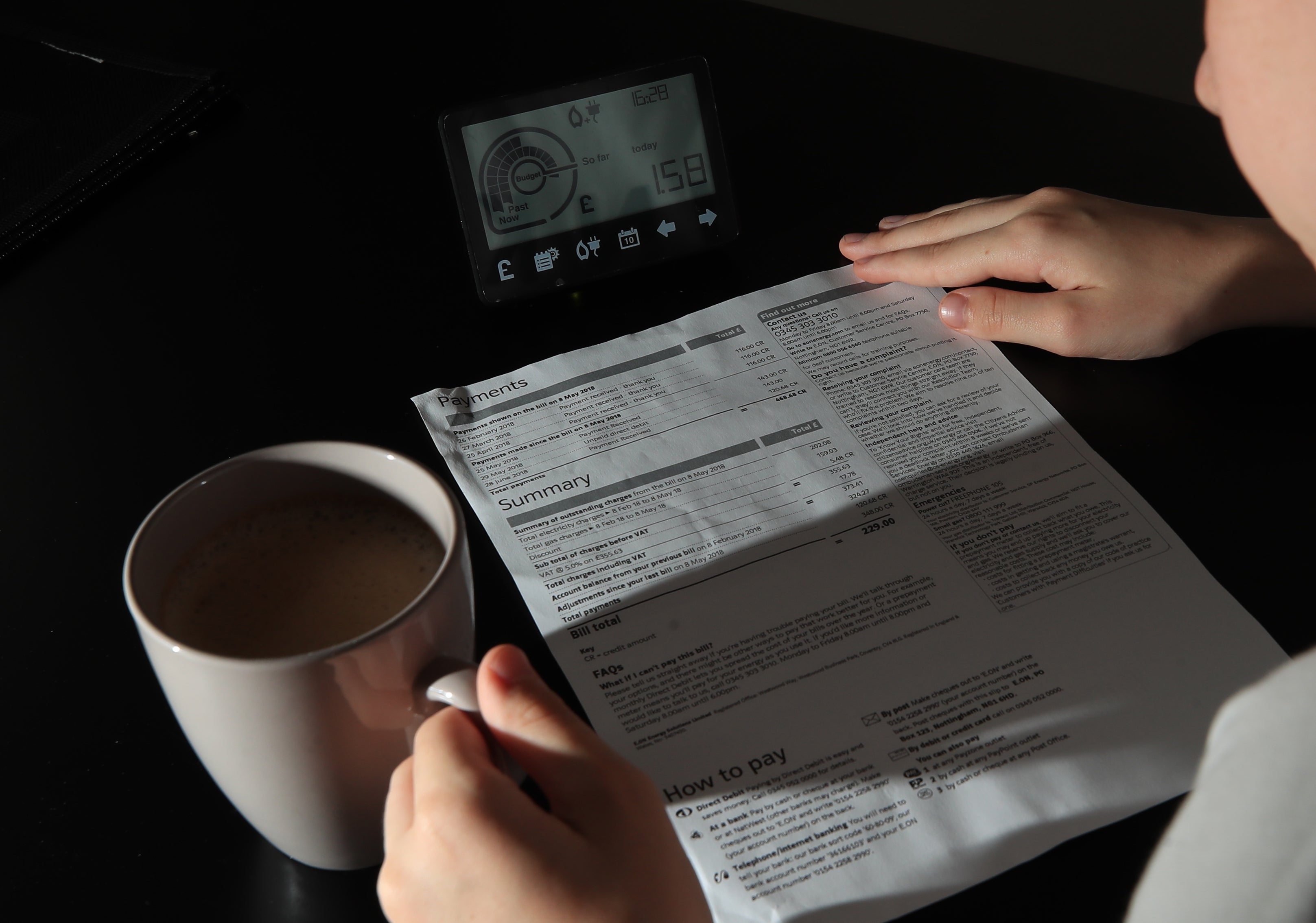

Biggest jump in energy bills in living memory comes into effect

The energy price cap for those on default tariffs who pay by direct debit is rising from £1,277 to £1,971 from 1 April

The biggest jump in domestic energy bills in living memory has come into effect as charities warn that 2.5 million more households are set to fall into “fuel stress” and supplier websites remained unresponsive to customers.

As a 54% increase to Ofgem’s price cap hit bills, the Resolution Foundation think tank said the number of English households in fuel stress – those spending at least 10% of their total budgets on energy bills – was set to double overnight from 2.5 to five million.

Resolution Foundation senior economist Jonathan Marshall said: “Today’s energy price cap rise will see the number of households experiencing fuel stress double to five million.

“Another increase in energy bills this autumn hastens the need for more immediate support, as well as a clear, long-term strategy for improving home insulation, ramping up renewable and nuclear electricity generation, and reforming energy markets so that families’ energy bills are less dependent on global gas prices.”

Citizens Advice said around five million people would be unable to pay their energy bills from April, even accounting for the support the Government has already announced.

It warned this number would almost triple to one in four people in the UK – more than 14 million – if the price cap rises again in October based on current predictions.

Concern about the pressures households are facing came as energy firms continued to struggle to allow customers to submit up-to-date meter readings to avoid paying the higher tariff on energy used before April 1.

Customers reported issues logging in to supplier websites including British Gas, EDF, E.On, SSE, So Energy and Octopus Energy from early on Thursday.

The energy price cap rise will be potentially ruinous for millions of people across the country

Energy UK, the trade body for the industry, urged people not to worry if they were unable to submit a meter reading ahead of Friday.

It said: “Most suppliers are offering alternative options such as submitting at a later date, and different methods to send meter readings such as text, social media and email.

“This demonstrates the scale of the problem and how worried people are about high prices, which is why we have been asking Government to intervene to provide further support to consumers.”

Citizens Advice chief executive Dame Clare Moriarty said: “The energy price cap rise will be potentially ruinous for millions of people across the country.

“The support announced so far from the Government simply isn’t enough for those who’ll be hit hardest. With the long-anticipated price rises now hitting, many more people will face the kind of heart-rending choices that our frontline advisers already see all too often.”

The energy price cap for those on default tariffs who pay by direct debit is rising by £693 from £1,277 to £1,971 from April 1.

Prepayment customers will see a bigger jump, with their price cap going up by £708, from £1,309 to £2,017.

The regulator was forced to hike the energy price cap to a record £1,971 for a typical household as gas prices soared to unprecedented highs.

Fuel poverty charity National Energy Action (NEA) warned the cost of heating an average home has now doubled in 18 months, leaving 6.5 million households unable to live in a warm, safe home across the UK.

An Ofgem spokeswoman said: “We know this rise will be extremely worrying for many people.

“The energy market has faced a huge challenge due to the unprecedented increase in global gas prices, a once in a 30-year event, and Ofgem’s role as energy regulator is to ensure that, under the price cap, energy companies can only charge a fair price based on the true cost of supplying electricity and gas.

“Ofgem is working to stabilise the market and over the longer term to diversify our sources of energy, which will help protect customers from similar price shocks in the future.”

Chancellor Rishi Sunak has previously pledged to “take the sting out” of the price rises, promising all 28 million households in Britain would get a £200 upfront rebate on their energy bills from October.

The Government will provide the cash for this, but it wants the money back so will hike bills by £40 per year over the next five years from 2023 to recoup it.

Goldman Sachs has already warned that prices in the gas market are likely to remain at twice their usual levels until 2025.

Higher energy prices are not the only way households are set to feel the pinch, with tax rises and reductions in state pandemic support increasing costs for businesses and, ultimately, leading to higher prices for customers.

The cost of buying a pub meal, soft drink or hotel stay could become more expensive from this month as VAT levels across the hospitality sector lift back to 20%, while the National Insurance tax rise will come into force on April 6.

Fuel prices have also reached record highs in recent weeks amid a rise in oil prices following Russia’s invasion of Ukraine.

Mr Sunak cut fuel duty by 5p in his spring statement last week, but retailers have been accused of failing to fully pass on the saving.

Bookmark popover

Removed from bookmarks