Why Japan's SoftBank is the best bet for British tech hope Improbable

The British might shake their fists at foreigners, but they're reluctant to buy home produced goods where that is an option and chary of investing in local start ups

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Once again a promising British technology company has had to source its growth capital from overseas.

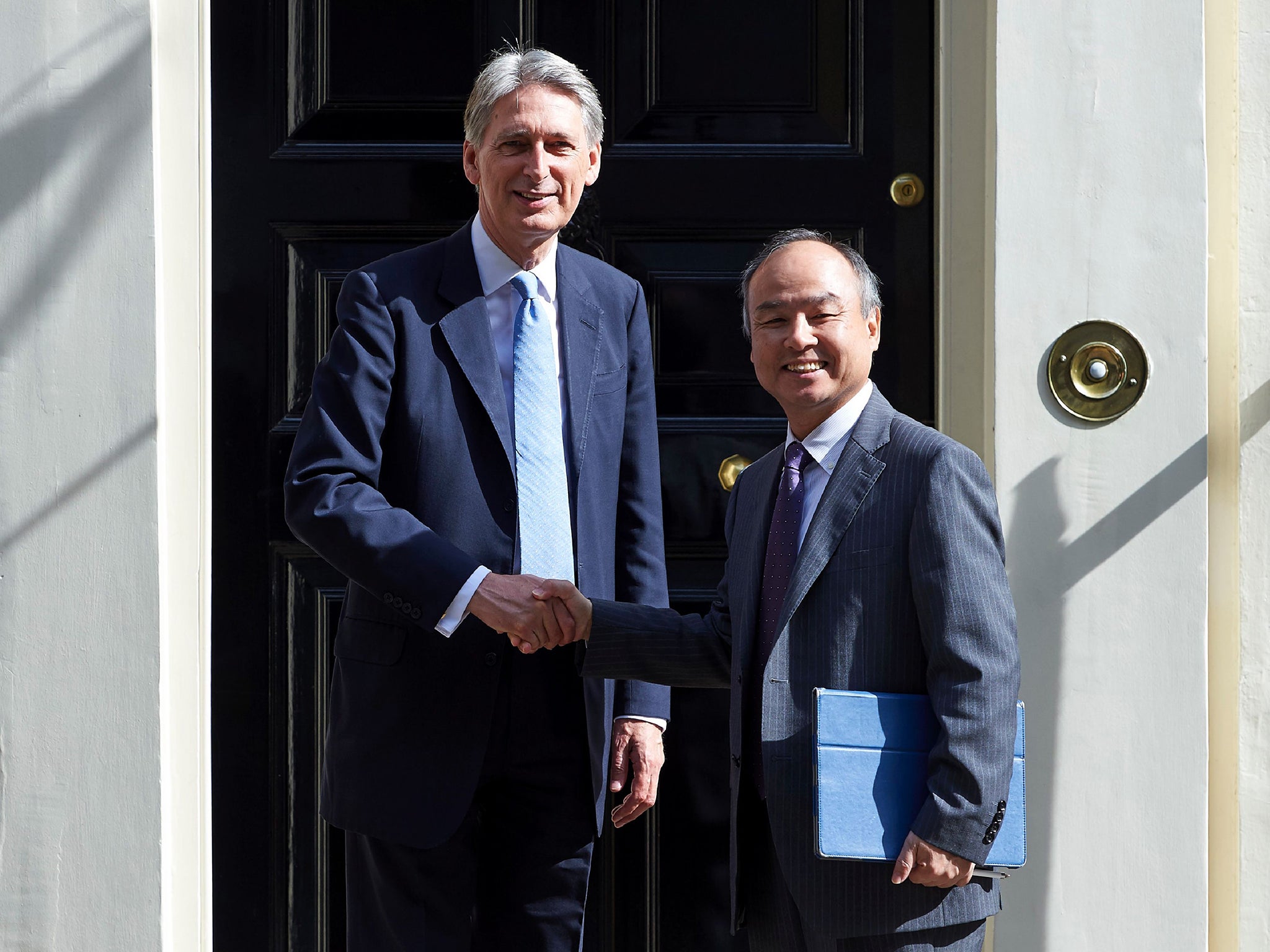

Virtual reality firm Improbable has raised $500m (£390m), in a funding round led by Japan’s SoftBank, which will take a non controlling stake in the business.

Its investment values the five-year-old company, set up by couple of former Cambridge University computer science students, at more than $1bn.

Not bad for a loss making venture. This is the sort of thing that you regularly see in California’s Silicon Valley, which boasts a small army of investors who are willing to take a punt on potential. On these shores, it’s a lot less common.

One of the other benefits of all that funding is that the Valley has been able to produce some big guns with sufficient resources to gobble up companies with potential like Improbable before they really get going, and then reap the benefit when they fly.

With SoftBank on board, however, the company, will be able to stay at home, and continue its development as an independent outfit.

Seeking to develop “virtual world and massive-scale simulation technology” primarily for games designers (but it could have other applications too) it will also be able to develop relationships with other SoftBank companies. That could come in very handy down the line.

It is the tech investment house’s second big British investment of late. Shortly after the Brexit vote crushed the value of the pound, it cooked up a far bigger deal, swooping to buy chip designer ARM Holdings, just about Britain’s only established technology star, in a £24bn deal.

To avoid ruffling any feathers locally, it made, at the time, a legally binding commitment to keep it in Cambridge and to hire lots of staff there.

People started to get a mite twitchy after SoftBank flipped a quarter of the company over to a fund backed by a variety of largely Middle Eastern Investors.

But apparently the commitment will remain in force even if SoftBank’s continuing majority ownership status changes.

And if that doesn’t work out as intended, well, Britain will have only itself to blame.

For ARM, Improbable, and many of their peers, whether in London (where Improbable has offices) or in the little cluster that makes its home in Cambridge’s Silicon Fen, SoftBank is probably their best option. It's proven willing to give the companies in which it invests a lot of love, and it doesn't interfere too much in their development if things go well.

While have a Business Angels Association here, and while the City has a venture capital industry, investors sometimes seem no less chary of putting their money into local ventures.

If there is going to be any future for the country's economy post-Brexit that really needs to change.

But how to make it happen? It’s a problem that has defeated successive Governments, when they’ve paid half a mind to it. Best just sit back and salute rising sun while it shines, then.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments