Netflix plays down rivals' competitive threat after bumper quarter. The script will be different behind the scenes

The entertainment streaming industry is about to enter a new phase

“We’re excited to compete,” declared Netflix in response to the rivals preparing to take it on.

Translation: Oh crap, oh crap, oh crap.

The streaming kingpin has a squadron of tanks moving on to its lawn. Disney, Apple, Warner, insert name of giant media company wanting to join the streaming party. In between are niche players, like ITV and the the BBC with their feisty little cut price Brit Box.

But don’t you worry your sweet little heads, said Netflix while unveiling its latest quarterly update. “We don’t anticipate that these new entrants will materially affect our growth.”

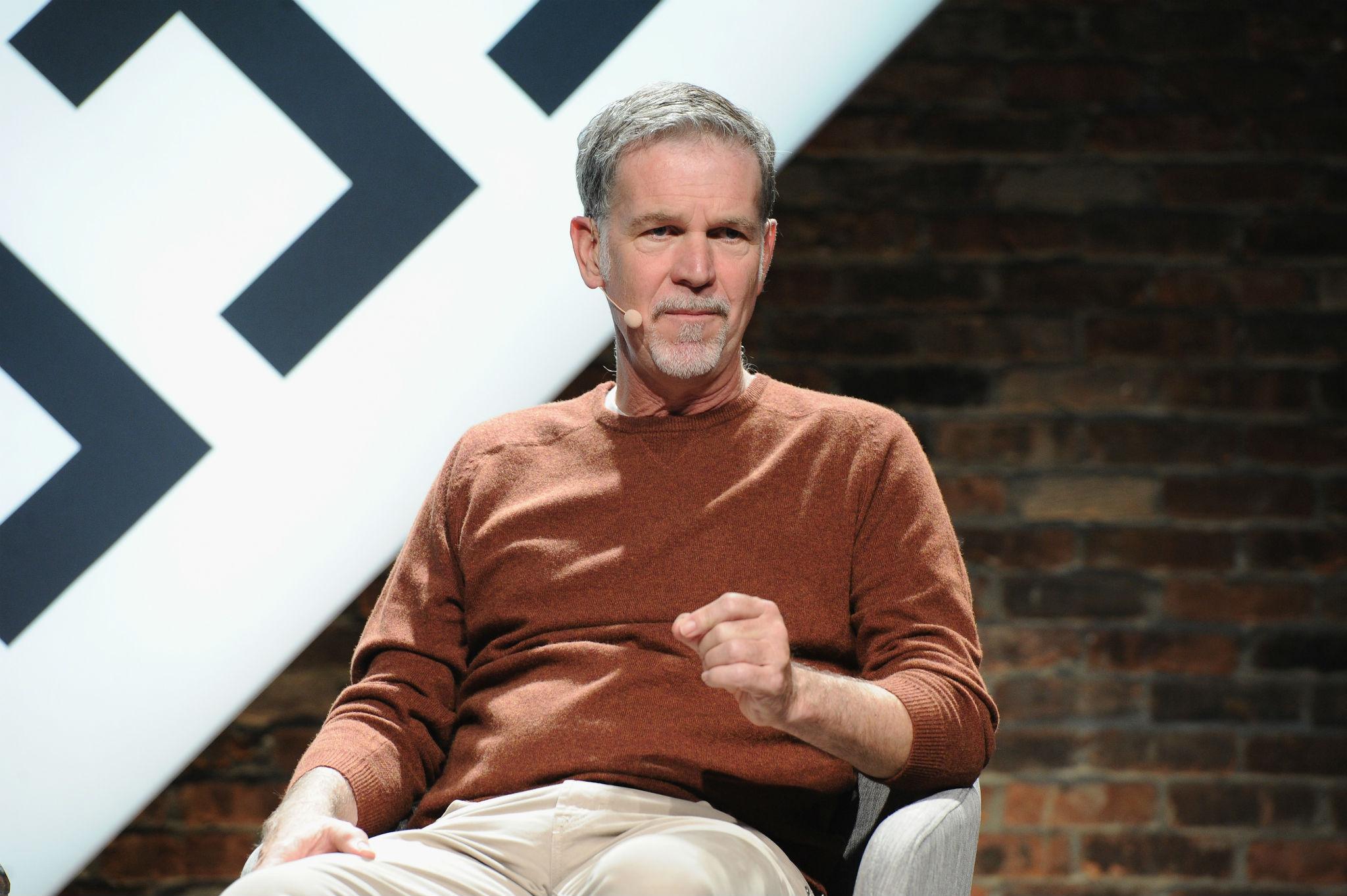

Co founder and CEO Reed Hastings’ reasoning seems to be that if he acts chilled then his shareholders will too.

For the most part it seems to have worked.

Wall Street was a little restive over the outlook for subscriber growth in the wake of the price rises the company has pushed through in some markets (including its US home). But Netflix had a very good quarter, topping expectations and welcoming 9.6m new customers. The birthday cake was brought home and while next week's party might not be quite as fancy as some of the guests had hoped it’ll still be a blast.

You investors, you have nothing to worry about because “the transition from linear to on demand entertainment is so massive and because of the differing nature of our content offering”.

There’s nothing like some good old fashioned corporate gobbledygook to reassure people that everything’s just fine ’n’ dandy .

Behind the scenes I imagine it’s a different story. If you’re a long term holder of the stock you’d certainly hope so.

Netflix has been living on easy street for a remarkably long time, and my how it has capitalised on that. But its surprisingly slow to join in the fun rivals have now woken up and they have the capacity to make it sweat. Disney, Apple and Amazon (which is beefing up its Prime offer) boast a combined market value of in excess of $2tn (£1.5tn). That’s a lot of clout.

Disney, in particular, also has content and recently bought out the AT&T owned Warner’s minority stake in Hulu, a US based streaming service perhaps best known for the Handmaid’s Tale.

The others can pay for it, and Amazon has done for its hugely expensive Lord of the Rings prequel.

Part of the reason for those Netflix price rises is to fund more of its own shows and films.

It’s heaven for creators and consumers could be left starry eyed. Look at all that lovely choice.

Trouble is, how much choice will they be willing to pay for? The research ITV commissioned before moving ahead with BritBox is interesting. The growth in households with multiple streaming services is outpacing the growth in those with one in Britain.

But there are limits, and there is such a thing as churn, as Netflix’s numbers demonstrate.

Behind the scenes Hastings and the other suits will be biting their nails. Their business is just starting to get interesting. Quick, someone commission a script.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks