HMRC's customer relationship managers need to become tax cops

A National Audit Office report says the organisation is getting more of the super rich to pay more tax. But its enforcers need a rebrand to send a message to those tempted to try and get out of paying what they owe

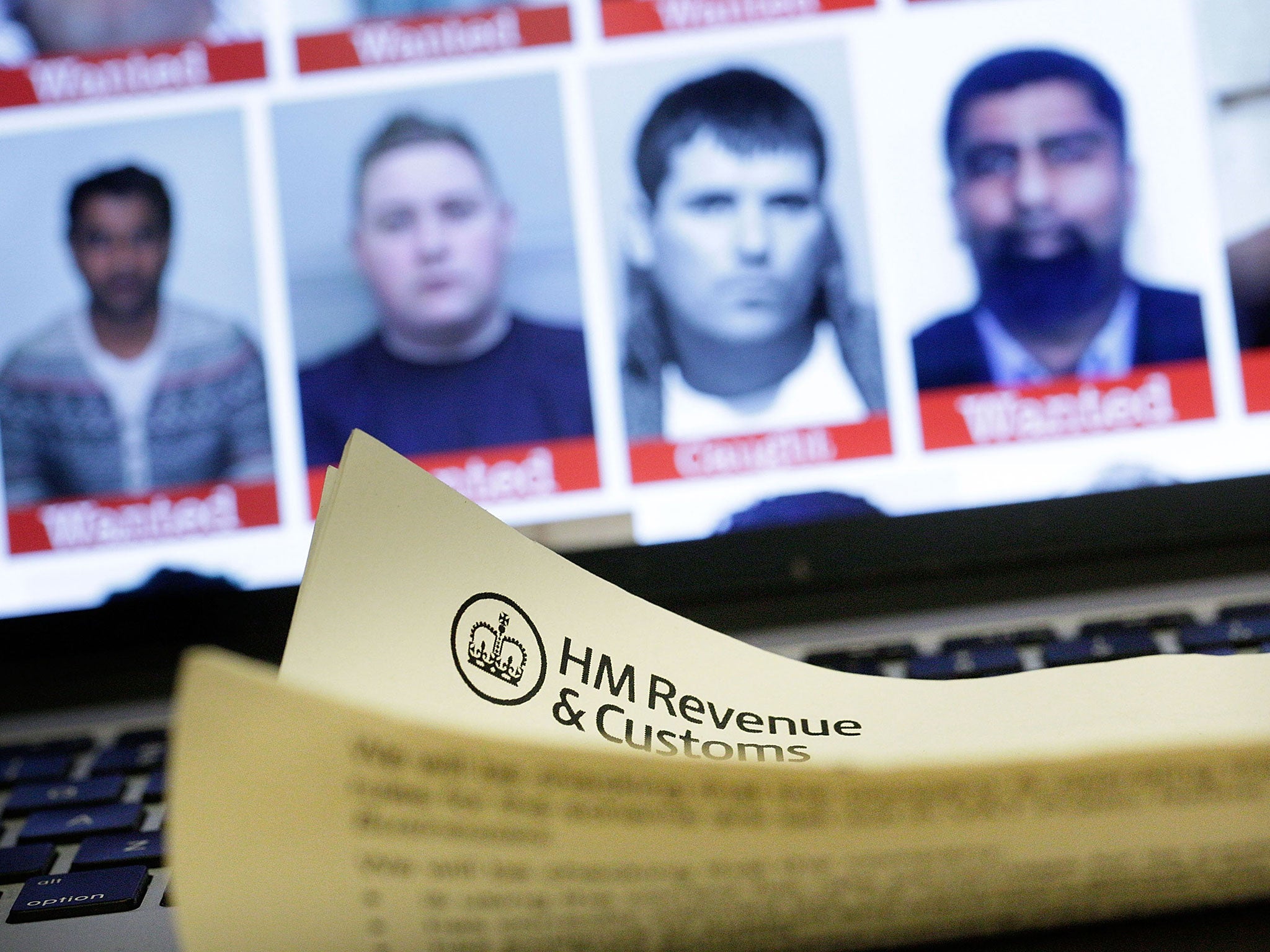

One in three of Britain’s high net worth individuals are under some form of investigation by HM Revenue & Customs, a report published by the National Audit Office has revealed, which perhaps shouldn’t come as such a surprise.

The report says that HMRC has identified 6,500 such people in Britain (each worth more than £20m) which sounds a little on the low side, but their affairs are so complex they can be hard to identify.

Those that have been amount to 0.02 per cent of tax payers. But their wealth is such that they contribute a much higher proportion of the overall tax take.

Or at least they should contribute a higher propotion of the overall tax take. Some 15 per cent of the 6,500 take part in some form of tax avoidance scheme and the fact that so many of them find themselves under investigation suggests that the criticisms frequently directed at the “feckless” poor are misdirected.

The inquiries into their affairs, which are being handled by a specialist unit set up to deal with them, could could yield nearly £2bn too, which demonstrates the need for HMRC be diligent in its work.

The unit, which is investigating the so called Panama Papers following the leak from law firm Mossack Fonseca, would surely argue that it is taking this to heart. It brought in £416m in 2015-2016, £29 for every £1 spent on half. Half came from work aimed at tackling avoidance schemes and the yield is considerably more than the - rather disappointing - internal target of £250m. It is more than double the £200m recovered in 2011-2012.

The fact that things are improving is very much to be welcomed, particularly from the perspective of the public finances, which are hardly flush with cash. But we do need to ask whether it is enough.

The report also says that just 72 cases of suspected fraud relating to high net worth individuals have been investigated and closed over a five year period.

Some 70 of those investigations were completed using civil powers, yielding £80m in penalties. Just two were passed to the Crown Prosecution Service, yielding a solitary conviction.

As of October a further 10 wealthy individuals are under investigation and HMRC is targeting more, as it should.

One criticism levelled against it by the NAO is that the HMRC has failed to evaluate its work and consider the approaches that work best.

A bout of naval gazing would certaintly be timely. There is a danger, however, that the HMRC could conclude that its focus should overwhelmingly be on yield at the expense of enforcement, which has been its preferred approach in the past.

The vast majority of Britons pay their tax. Prosecuting those that don’t is difficult and expensive, but there is a pressing need for it to be done if confidence in the system is to be maintained.

Given the solitary conviction secured in five years, there may very well be a perception among the super rich that they can get away with it with the help of the expensive accounts an lawyers that they can afford to employ. That needs to change.

The neccessary change might be encouraged by having the people that deal with them given a new name that better reflects a get tough approach. They currently bear the title “customer relationship manager” which is entirely too cuddly sounding. Tax cop might do better. Those employed in that role would surely have some fun telling their friends about their new title.

But that sort of thing rarely goes down well with officialdom. So I'd settle for something like tax compliance enforcement officer, which would be a good first step to come from the analysis the NAO is calling for.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks