The US could raise rates in September. So will we be in for another recession?

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The big thing we have learnt from Janet Yellen, chair of the US Federal Reserve Board, from her testimony to Congress here in Washington this week is that the troubles of Greece and China will not delay the rise in US interest rates. I think we could have guessed that anyway: American monetary and fiscal policies may affect the world economy but they have always been determined by US conditions and perceived needs.

This does, however, have particular significance at the moment, for when the Fed starts to normalise the ultra-easy monetary conditions, it will signal the end of an extraordinary period in central banking history – a time when national monetary authorities have broken the normal rules that govern their behaviour in order to pump up the world economy.

So the first Fed increase in rates has real global significance. It has a direct impact on the UK as we are at a very similar stage of the interest rate cycle, and it will give us cover for our own first rate rise. In theory there is no need for us to wait, but in practice a US increase makes it more credible to do so. The conclusion of the markets is that we are going to follow the US pretty fast, something that is helping drive sterling up on the exchanges, particularly against the euro.

This leads to an immediate question and then to two larger and more substantive ones. The immediate question is when will the US move? The larger ones are the profile of the rate increases and the likely shape and duration of the rest of this growth phase in the US economy.

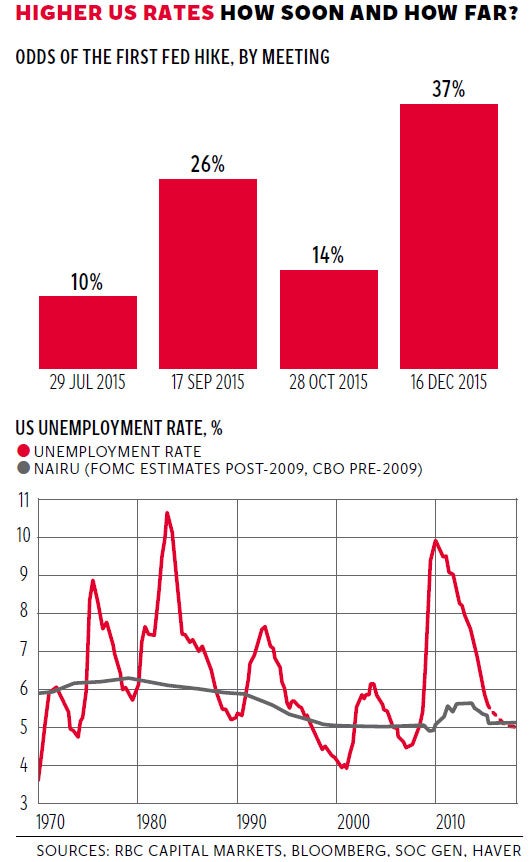

Ms Yellen has said on several occasions that she expects the first rise to come before the end of the year. The capital markets division at the Royal Bank of Canada (RBC) has come up with a handy chart of market expectations for the timing, shown on the left at the top. As you can see, September is only second favourite, with December ranked ahead. This is a calculation from market rates – not what people say, what they do – but actually to move in the earlier month might be safer for two reasons.

One is that by moving early, you may reduce the risk of sharper increases later. That was acknowledged in testimony by Ms Yellen. The other is that financial institutions make up their accounts at the calendar year-end, and so were there to be an adverse reaction to the rise in rates – it will be the first for five years – then that might distort the behaviour of the banks as they have to make sure that their accounts fit the various regulatory requirements.

RBC thinks September may be more likely than market rates suggest.

If that is right, there is a practical point for the UK. It would make the November meeting of the Monetary Policy Committee (which coincides with the quarterly Inflation Report) a more likely time for our first move.

Timing matters but what happens beyond this first increase, of course, matters more. Much will depend on the potential of the US economy to grow, and that in turn depends to quite a large extent on the labour market. Put crudely: at what point will labour shortages drive up wages and hence inflation more generally?

The key difficulty here is to know where is Nairu. If you are not familiar with this expression, it stands for non-accelerating inflation rate of unemployment. It means, in effect, the lowest level to which you can get unemployment down before pay increases start to push up the rate of inflation over and above what it would otherwise be.

The economics team at Société Générale’s New York base has done some thoughtful work on Fed policy in relation to labour market pressures, and the bottom graph comes from this. It is not a precise number and in any case it is always difficult to know where Nairu is until after the event.

It may well be that because of changes in the labour market as a result of weaker trade unions and changing demand for different skills, Nairu now is lower than it was 20 years ago. But as you can see from the graph, for most of the past 45 years American unemployment has been well above this level. Now it is pretty close to the 5 per cent level that the Fed estimates is the bottom end of the Nairu range. In previous cycles unemployment has bottomed out on average 0.8 per cent below Nairu, suggesting that at the bottom of this cycle it will be around 4.2 per cent.

Now maybe the US economy can run at this level of unemployment, or even below, without the labour market bumping up wage costs. Reasons could include the slack from discouraged workers: if there were more demand for labour, people not now looking for work might be sucked back into jobs. If that were right, then the pressure to increase rates next year and beyond would be lower. Anecdotally, however, there are reports of labour shortages already and there is upward pressure on wages in some important industries, including automobiles.

Société Générale thinks that the Fed would want a lot more evidence before it could lower its Nairu estimate further, and that would seem right. But if the evidence comes through, then the increases in this interest rate cycle could be slower and less marked than in previous ones.

This leads to the second big question: the shape and duration of the growth phase. Put crudely, when is the next recession coming?

Of course you cannot answer this, but what I think you can do is to look at constraints on growth. The most important of these is the supply of labour, but the greater the scope for higher productivity, the less the pressure on the labour market. Indeed, is it possible that as a result of social and economic changes, the US could get its unemployment down below 4 per cent without increasing inflation?

One big (and pleasant) surprise has been the way in which ultra-easy monetary policy has not led to an increase in current inflation, though it has inflated asset prices. But here’s the prize: the lower the US can get unemployment without causing inflation, the longer the boom can last.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments