Hamish McRae: So, what on earth should investors do with their money?

Economic Life

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Second day thoughts on Budgets are usually better than initial ones, for the devil is usually in the detail. But this year it is different.

The Institute for Fiscal Studies has done its usual excellent forensic analysis of the numbers and highlighted the inconsistencies in the deficit reduction plans: the black hole. But we knew all that, just as we can be virtually certain that everything will be rewritten later in the year. Depending on the result of the election, either there will be the planned emergency Budget promised by the Tories or there will be a forced emergency Budget, probably triggered by a downgrading of British debt, imposed by the financial markets.

From a British political perspective the issue is the election and the post-election plans. But stand back from our plight for a moment, for most developed countries are in a fiscal mess. We all have to borrow hundreds of billions from the financial markets over the next few years; the UK merely has to borrow more than anyone else, bar the US. At the moment it is possible to borrow relatively cheaply for reasons associated with the financial market rescue. The central banks have pumped money into the system and that has lowered not only short-term rates but longer-term ones too.

But gradually normality will return. Indeed, we are just starting to see interest rate increases coming through, for example, from India and soon Brazil. As short-term rates rise, the "safe haven" status of longer-term government bonds will come under question. So from a financial perspective, the really interesting issue in the months ahead is not so much at what interest rate the UK can finance its deficit, but rather what will happen to government bonds as a whole?

We have already had a glimpse of the growing distrust in the markets of the deficits that countries are running. There is the obvious example of Greece, where the plight of one small member of the eurozone has driven the euro down to a 10-month low against the dollar. But the dollar is not in great shape, or at least it should not be, given the size of the US fiscal deficit and the dearth of savings to finance it. Were it not for the dollar's reserve status and the willingness of the Chinese authorities to finance the debt, there might well be a run on the dollar too. What on earth should savers do with their money? Equities? Property? Gold?

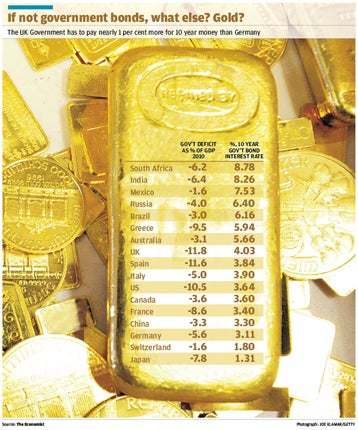

We will come to that in a moment. First, have a look at the table, which shows the yield on 10-year government bonds for a selection of countries in both the developed and emerging world. It also shows the projected deficits for the present year, expressed as a percentage of GDP, the idea being to pick out the relationship between government deficits and the rate that countries have to pay for their money. It is not a perfect relationship by any means, for while you might imagine that the larger the deficit the higher the interest rate, life is not as simple as that. Some countries do worse than they ought to, in the sense that they have to pay more for their money than you might expect, given the size of the deficit than has to be financed. Others do better.

Thus both the US and Japan seem to be able to borrow quite cheaply despite the deficits, Japan very cheaply indeed. Japan, however, has the advantage of large domestic savings, while the US has the dollar reserve role. On the other hand, Mexico and Brazil seem to be paying a larger penalty than you might expect given their reasonable fiscal performance. I suppose years of Latin American devaluations have led to a certain reluctance of investors to plunge in. Russia, too, suffers from its past attitudes to investors, while South Africa has had a particularly volatile currency.

Within the eurozone, the base line is set by Germany, with Italy paying 0.8 per cent more and Greece nearly 2 per cent more. The UK is now paying a premium of nearly 1 per cent over Germany at the moment. I am afraid that our credit is worse than that of Italy, and more surprisingly Spain, given the latter country's considerable problems. It will be interesting to see how the IMF bailout of Greece, which seems now to be likely to happen following the EU summit yesterday, actually cuts interest rates for the eurozone as a whole. Maybe it will, maybe it won't.

There is a further point to be made. By and large the interest rate on the debt of the developed countries is lower than that of the emerging ones. That raises an intriguing question: it is right for fast-growing countries, with budget deficits more or less under control, to be paying more for government borrowing than slower-growing and more heavily indebted developed countries?

I suppose that past experience of defaults, currency devaluations and the like inevitably colours investor attitudes but I should have thought that investors in, for example, Mexico or India, are getting good compensation for the risks they are being asked to carry, while those in Italy or Spain are not. As for the UK, I would not want to invest in gilts at the present price, for there does not seem to me to be sufficient will in our society to combat our financial problems. The British Government will have to borrow upwards of £600bn over the next five years. I would want a higher interest rate to cover the political risk.

But if you don't trust governments what else do you do? Well, shares worldwide have continued to recover, with the climb over the past 12 months being almost a straight line in the main developed world markets. That says something. Calculations as to "fair value", insofar as they mean anything, suggest that the present level of prices is about right. But equity investors have to confront the fact that the past decade has been a dreadful one for shares in the developed world, notwithstanding the recent recovery. So what else is there?

When people don't trust paper assets they turn to physical assets. The most obvious is property. But that in most markets, not all, has been very difficult in the past three years, though values are generally well above those of 10 years ago. The troubling conclusion that some investors have come to is that governments will debase the currency and so the only safe investments are in physical commodities, including oil – and that ultimate funk investment, gold.

Actually there are some reasons to suspect that the gold price is now inflated. It has been pushed up by central bank purchases in the emerging world and those purchases may now tail off. (Gordon Brown's sale of a large chunk of the British gold reserves does not look pretty daft, by the way, but you do have to allow for the interest received on the alternative assets that the gold was swapped for.) But the strong market not only for gold but for commodities as a whole is not just a response to the strong demand from the emerging world. It says something about trust and it is, or at least should be, a troubling message for the policymakers. Mind you, they deserve to be distrusted, don't they?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments