Hamish McRae: Retirement ages are out of date: we live longer, so we must work longer

Economic Life: One aim of this change is to nudge people into a new mind-set about the way they will think about their careers or, you might even say, their lives

So we are going to be nudged into working beyond the age of 65. When Otto von Bismarck introduced his famous Old Age and Disability Insurance Bill in 1889, which became the model for state-funded old-age pensions throughout the world, the average life expectancy of a Prussian male was 45. Initially the pension age was 70 (von Bismarck himself was 74 that year), though it was subsequently reduced to 65, the age that has become the global standard. Unsurprisingly, in 19th century Prussia, the maths of the scheme worked very well. A lot of people paid in but not very many collected at the end.

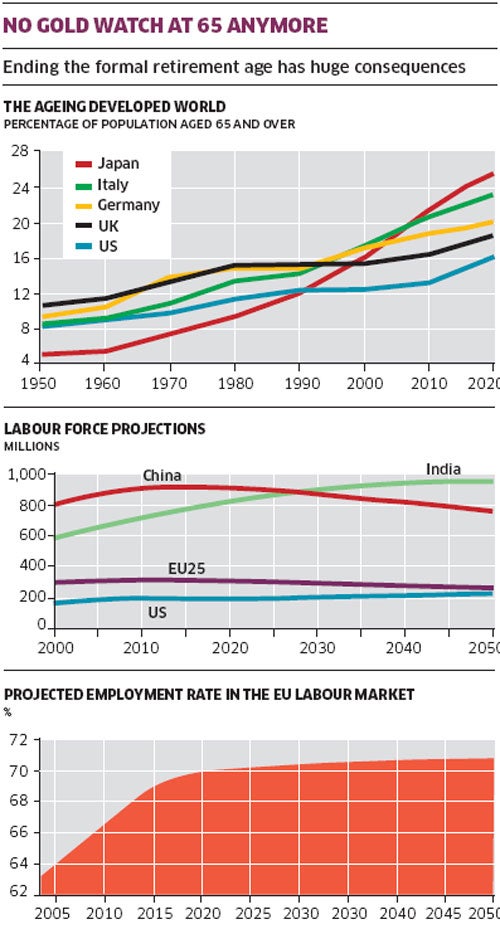

Two things since then have changed everything, one widely appreciated, the other less so. The first is that we are living longer. The ratio of older people to young varies from country to country, with it rising particularly swiftly in Japan and relatively slowly in the US, as the first graph shows. But all the lines are heading up. So a retirement age that was affordable has become a huge and growing burden but also, implicit in those rising lines, we are also healthier than we use to be at any particular age.

The second is that the nature of work has itself changed. Employment in agriculture, construction and manufacturing has fallen, while the vast range of service jobs has ballooned. This change in the jobs we do has itself had a number of effects.

It is an over-generalisation to say it is practicable for older people to carry on in these service jobs, whereas it was not so to go on working on a building site. But there is some truth in this. There are probably some jobs that people get better at with age. Watching David Cameron's visit to India I checked the age of his host, Manmohan Singh, the man who as finance minister pushed through the reforms that triggered India's economic renaissance. He is 77.

By changing the law on retirement, the Government has two broad objectives, relating to those to points noted above. One is to alter the mechanical impact that a fixed retirement age has on the size of the workforce and the size of the retired population. You can see in the second graph how the EU faces a shrinking workforce during the next 40 years, in contrast to the US workforce which is expected to grow, albeit slowly, and the continuing rise of the Indian workforce. If people are persuaded to stay at work even for a couple of years, that postpones the point at which the workforce starts to shrink.

There is another way of boosting the size of the workforce, which is to persuade people who are of working age to remain at work. Part of the Lisbon Agenda, the much-derided plan by the EU to make Europe the most dynamic knowledge-based economy in the world, was to increase participation rates. A projection of what was supposed to be achieved – increasing the participation rate from little over 60 per cent to something close to the US 70 per cent – is set out in the bottom graph. The idea, in a nutshell, was to get Italians to be more like Swedes – the former has a very low participation rate, the latter a very high one. In fact, that goal has not been reached, along with the other Lisbon objectives, but it seems a reasonable, indeed essential, one to retain.

The other aim of this UK initiative leads on from this. The aim is to nudge people into a new mind-set about the way they will think about their careers, you might even say their lives. Some jobs by their very nature are for young people. If you go into the Army, you know you will need a second career because there is a very good chance you will be retired in your 40s or early 50s, maybe sooner. If you are an athlete, the shift to another career comes much earlier still. So you plan with the aim of having more than one career. But for most occupations, and certainly all public-sector ones, there is the set retirement age at which people can collect their full pension – even if many workers, be they a police officer or an ambassador, go on to do something else.

There is a further twist. Will we go on having jobs? Well of course some of us will, but an increasing proportion of the workforce is likely to be self-employed. Technology alone makes that easier: if someone is online and can do their job online, who cares who actually employs them? Indeed, one way of slowing the loss of white-collar jobs offshore is to use self-employed part-timers in the UK.

If you are self-employed, the idea of a set retirement age is irrelevant. You chose your retirement age, or more accurately your workload, based on a whole string of other factors: whether you need the money, how much you have saved for your pension, current tax rates, your health, whether you still enjoy working, and so on. Indeed, one of the shifts that the ending of the 65 cut-off may encourage is for more people to set up their own businesses.

That leads to the final point: the law of unintended consequences. The fixed retirement age may be, in human history, a relatively recent concept, for it is after all only 120 years old. Nevertheless it has become embedded in our employment structures and extracting it without damaging the underlying employment patterns will be tricky. A number of difficulties loom.

One will be what happens in the run-up to the new legislation. Will employers choose to get rid of their would-be retirees early so that they have adjusted their workforce ahead of the deadline? What do you do about people whose performance has gradually fallen as a result of their age but where it is hard to pin this down? What do you do about the resentment of younger employees who rightly or wrongly feel their promotion is barred by these "bed-blockers"?

In a climate of low or falling unemployment all this should be manageable. During the boom one of the fascinating changes to employment patterns was that the two largest factors increasing the size of the workforce were immigration and older people staying in the workforce or returning to it. We created a lot of new jobs but they went to migrants and the old. You might say that what the Government is doing will merely reinforce an existing trend and if that is right, then expect it to prove a successful change.

But much labour legislation does have unintended consequences and it would be surprising if this one goes smoothly. The worst thing to happen would be for employers who were worried about being stuck with a dad's army of employees to cut back on employing the 50-something-year-olds looking for jobs. There may, given what is about to happen to public spending, be a lot of those around in the next couple of years.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments