Hamish McRae: Oil's power to shock the world economy has not gone away

Economic Life: Opec has promised to increase production to offset any reduction in output from Libya. Yet the oil price has risen by more than $20 a barrel

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It gets worse. At some stage – and let us all hope soon – Libya will be back to some sort of calm and a new regime installed. Meanwhile the world has to cope with the reality that a civil war in a middling-sized oil producer – it pumps a little more than the UK – has had an immediate and potentially devastating impact on the oil price and potentially on the world economy. What is happening is primarily a human story and a deeply distressing one. But it is also an economic story, so some words about that.

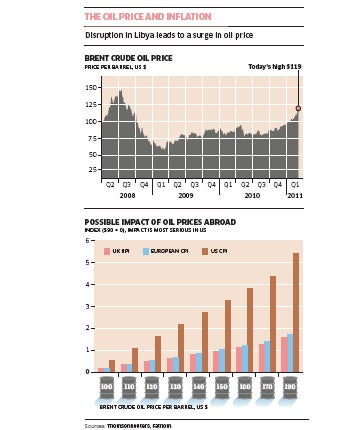

You can see what has happened to the oil price in the top graph: a surge from the levels during the early period of the recession, but still a long way from the previous peak. But the surge is troubling for obvious reasons. For a start, the price was rising even ahead of recent events. Note, too, that this is a relatively small shock to supply. Opec has assured the markets that other members will increase production to offset any reduction from Libya. And yet the oil price has risen by more that $20 a barrel. This matters tremendously because oil is still the principal source of the world's primary energy source, larger than gas or coal and far larger than the renewable options. It is also an important chemical feedstock, so it is not just energy prices that are pushed up: a large range of other prices are affected too.

So what will be the inflation effect? It is difficult to calculate because you have to allow for secondary effects as well as the initial one, so any estimates should be treated cautiously but I have been intrigued by some calculations by Fathom Consulting shown in the bar charts. Along the bottom axis is the price of oil, working from a base of $90 a barrel, in $10 increments. On the vertical axis is the rise in the inflation in the UK, measured by the RPI, in Europe and in the US. As youcan see we are all affected but the US is affected much more seriously than the UK and continental Europe.

There are two reasons for this. One is the higher oil use in the US. Americans consume 25 barrels of oil per head each year, compared with 10 per head in Europe. That is because they have a less efficient vehicle fleet, travel longer distances and truck goods longer distances, rely more on oil-fired power stations and generally have higher energy use.

The other reason is that the impact on inflation here is masked by taxation. Because Britons and Europeans pay such high fuel taxation the incremental increase in the price of oil has less impact on the indices. You still have to pay more if, say, an extra 50 pence a gallon is put on petrol, but you notice it less if the price is rising from £5 a gallon to £5.50 than you do if the price is rising from £1.50 to £2.00. As you can see, were oil to go back to $150 a barrel and stay there, that would add more than 3 percentage points to US inflation but only 1 point to inflation here.

Nevertheless, even a 1 point rise would come straight off living standards. Money you spend on filling the car is money not spent on goods in the shops. And the squeeze comes at a bad time, for as the Governor of the Bank of England pointed out recently, Britons face the sharpest decline in real disposable income since the 1920s. Yesterday's survey of retailers from the CBI showed that price pressures were at a 20-year high. So the timing is bad, very bad, and of course not just for us but for the whole of the world.

The poorer the country the greater the suffering, because a higher oil price affects fertiliser and other agricultural input prices and food accounts for a much higher proportion of income the further you go down the wealth scale. In the longer run higher oil prices may have a helpful impact on our willingness to use less of the stuff but in the short they are completely negative.

So what happens now? I think the question really is whether this is just Libya, or whether unrest spreads to places such as Algeria and the Gulf. You begin to try to think through worst case scenarios, the various "what if?" questions.

It then becomes a matter of maths. On the supply side there is a bit of spare capacity at the moment, with the rest of Opec supposedly being to increase production by up to 5 million barrels a day. But if there were to be disruption in Algeria as well as Libya just a bit of that spare headroom would be used up. And were there to be difficulties on either side of the Gulf – remember Iran is on the other side – then things begin to head towards the horror end of the spectrum. There have been various guesstimates thrown around of oil going to $180 or $220 a barrel.

I have been trying to think through the consequences of that sort of extreme outcome. At some level we would cope, of course, for we would conserve like mad. Other fuels would substitute in many activities, most notably power generation. But for land transport there really are few alternatives – a lot of rail transport around the world is diesel powered. And for air and sea transport there are effectively no substitutes at all.

So there would be a lot of disruption and the longer that lasted, the greater the danger of a double dip not just to the developed economies but to the rest of the world. (Remember, the emerging world taken as a whole did not go into recession at all.) But – and this is the more encouraging news – the underlying price of oil, even assuming somewhat lower production from North Africa, is probably somewhere around $100. It may be a bit more, perhaps a bit less, but it is surely not $200 a barrel.

In short, yes, we may have a spike in the price that tops the previous one. Yes, the longer-term supply and demand equation points to somewhat higher prices generally. Yes, it is very worrying that this relatively small disruption to global supplies should have had such a dramatic impact on oil prices. Yes, that is bad for inflation. And yes, this hits the entire world at a particularly unfortunate time, with the poorest suffering most.

But we have lived with very expensive oil before and I guess we will have to learn to live with it again. In the very long term, given the fundamental need to try to feed the world's growing population and keep our planet inhabitable for the next generation and the ones beyond, that may be no bad thing.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments